Open Password – Mittwoch,

den 1. Juli 2020

# 780

Wirecard – Wirecard Fraud – Blame Game – Information Game – Joachim Bartels – BIIA – EY – DAX – Moody – Financial Times – BaFin – Whistleblower – Esma – Abraham Lincoln – Dun & Bradstreet – Live Meetings – Virtual Meetings – Chris Kuehl – Armada Corporate Intelligence – BIIA – NFDI4Health – Juliane Fluck – ZB MED – Iris Pigeot – Leibniz-Institut für Präventionsforschung und Epidemiologie – Google – Licencing Content – Kantar – Link AI – Salesforce – Salesforce Anywhere – Protiviti – Navigating Business Resilience – Refinitiv – Digital Investor – Catlight Health – Working Well for Higher Education – Outsell

Wann fliegen wir wieder?

Nicht vor 2021, und vielleicht

nicht einmal dann

By Chris Kuehl, Armada Corporate Intelligence

Once upon a time we listed the various Armada speaking engagements scheduled by groups and businesses all over the country (US). For the most obvious reasons these talks were suspended but we thought this would be a temporary phenomenon.

Today we are not so sure. The talks hat had been planned in march, April and May were cancelled and these cancellations have now extended through June, July and August with several planned for later in the year soon to follow. It is beginning to look likely that „live“ meetings and conferences will not take place until well into 2021 and perhaps not even then.

I have my own personal laments as far as this is concerned as I truly enjoyed the opportunity to meet people and engage with them but there are much deeper concerns. There is no real substitute for these meetings and gatherings. A webinar can only do so much as far as imparting information. The greatest value from these talks came from the questions asked by attendees and the casual conversations over meals and breaks. The real purpose of these meetings is networking and that dosn´t take place virtually. The lack of an opportunity to get with and talk with one´s peers robbed of a vital asset.

It is sincerely hoped that these gatherings resume sooner than later.

Quelle: BIIA

The Wirecard Fraud

The Blame Game about

the Missing EURO 1.9 billion in Cash

Did the Information Sector Fail?

By Joachim Bartels, BIIA – International Partner of Open Password

BIIA reported the events leading up to the insolvency. Since the announcement by EY, that it could not provide an unqualified audit opinion, investors were led to believe that the Wirecard investment was of investment grade and a safe investment. Investors rely on reliable information, thus the first question one may ask: Did the information sector fail?

Insolvency filing: Wirecard filed for insolvency on June 26th, 2020, at Munich Local Court due to the threat of insolvency and over-indebtedness. The fintech company was one of the darlings of the investment community listed on the German DAX 30 index.

The DAX – also known as the Deutscher Aktien Index – is a stock index which represents 30 of the largest and most liquid German companies that trade on the Frankfurt Exchange.

Role of the information sector: Failure to predict default?

On Aug. 29 2019 Moody’s assigned German payment processor Wirecard AG a first-time Baa3 long-term issuer rating, with a stable outlook.

The rating took into account the company’s strong position in the European and Asian markets, its strong financial profile with very high margins and good liquidity profile. The rating also factors in the threat of competition from new entrants, the risk of regulatory and technological changes and pricing pressure as payment processing continues to become more of a commodity. Wirecard is smaller in scale compared to U.S.-based competitors, however, the company has a well-diversified business profile in terms of products, geographies and customers, the agency noted.

Moody’s downgraded Wirecard’s rating to ‘Junk’ on June 19th, 2020, after the EY announcement.

Rating agencies and credit information companies rely on audited financial statements. Investigations by the media, such as the investigation by the FT, or innuendo circulated by short sellers, have to be ignored unless they are supported by facts.

The auditor: EY certified Wirecard accounts for more than a decade.

According to the FT, EY failed for more than three years to request crucial account information from Asian banks where Wirecard claimed to it had more than EURO 1,9bn in cash. The accounting firm relied on documents provided by third parties. This is a serious laps in not adhering to audit standards, which is tantamount to negligence. Obtaining independent conformation of bank balances is a standard audit requirement one learns at audit school (FT quote).

The regulator: BaFin (Bundesanstalt fűr Finanzdienstleistungsaufsicht).

BaFin operates in the public interest. Its primary objective is to ensure the proper functioning, stability and integrity of the German financial system. Bank customers, insurance policyholders and investors ought to be able to trust the financial system.

Apart from the auditor, the German regulator BaFin has now moved into the spotlight concerning its supervision of Wirecard. BaFin appeared to have protected the company from attacks by short sellers when in February 2019 it imposed a two-month short-selling ban on Wirecard shares. In April of 2019 it filed a criminal complaint against two FT journalists who reported on whistleblower allegations of accounting fraud in Wirecard’s Singapore office.

The EU is now prompting its financial regulator Esma to investigate BaFin for a possible ‘breach of Union law’.

Summary: As the old adage goes: ‘It usually takes two to tango’. In the case of Wirecard it appears to be three: The culprit committing fraud, the auditor who failed to detect it and the regulator shooting the messengers who raised the alarm.

Facts are important, but when there are signals that facts are misrepresented and falsified, they cannot be ignored. That is the job of the regulator. Even if anomalies are detected by comparing financial ratios and industry trends, the credit rating and information businesses are hardly in a position to query a company’s results when audited by a certified public accountant.

Our predecessors in credit reporting used to have it easier: Abraham Lincoln*, while working as a correspondent for Dun & Bradstreet, expressed his opinion about the character of a business owner in a post scriptum: “Behind the counter is a rat hole and it is worth looking into.” In the case of Wirecard the FT shouted ‘rat hole’ and was sued. The regulator ignored the warning.

NFDI4Health

Aufbau einer Forschungsdateninfrastruktur

für personenbezogene Gesundheitsdaten

Ein multidisziplinäres Team aus Wissenschaftlerinnen und Wissenschaftlern baut in Deutschland eine Forschungsdateninfrastruktur für personenbezogene Gesundheitsdaten auf: NFDI4Health. Über die Förderung hat die Gemeinsame Wissenschaftskonferenz (GWK) in Bonn entschieden. Das Projekt wird von Bund und Ländern finanziert. www.nfdi4health.de

Dazu Prof. Dr. Juliane Fluck, Sprecherin der NFDI4Health und Programmbereichsleiterin „Wissensmanagement“ bei ZB MED – Informationszentrum Lebenswissenschaften: „Unsere Mission ist die Wertsteigerung der Forschung in den Bereichen Epidemiologie, Gesundheitswesen und klinische Studien. Dazu wollen wir hochwertige Daten nach den FAIR-Prinzipien international zugänglich machen. Wir bieten eine vollständige Abdeckung großer epidemiologischer Studien, der Public-Health-Forschung und von Prüfärzten und -ärztinnen initiierter klinischer Studien in Deutschland sowie die gemeinsame Entwicklung von NFDI4Health mit der Nutzergemeinde.“

„Die Erfassung und Analyse personenbezogener Daten zu Gesundheits- sowie Krankheitsstatus und wichtiger Einflussfaktoren darauf sind eine wesentliche Komponente zur Entwicklung neuer Therapien, übergreifender Versorgungsansätze und präventiver Maßnahmen eines modernen Gesundheitswesens“, ergänzt Prof. Dr. Iris Pigeot, Direktorin des Leibniz-Instituts für Präventionsforschung und Epidemiologie – BIPS und stellvertretende Sprecherin von NFDI4Health. „Die fortschreitende Digitalisierung führt zu einem bedeutenden Wachstum des hierfür nutzbaren Datenbestands, aber auch zu einem erhöhten Bedarf an beschreibenden Daten. Die personenbezogenen Gesundheits- und Krankendaten bieten eine hervorragende Ressource, verlangen jedoch auch einen besonderen Schutz. Sicherheit und Nutzbarkeit zu vereinen, darauf zielt NFDI4Health!“

Die NFDI soll die Datenbanken von Wissenschaft und Forschung systematisch erschließen, nachhaltig sichern und zugänglich machen und (inter-)national vernetzen.

Die darin eingebetteten Ziele von NFDI4Health sind:

1. Auffindbarkeit von und Zugang zu strukturierten Gesundheitsdaten ermöglichen.

2. Föderalen Rahmen für Datenhaltungsorganisationen erhalten.

3. Austausch und Verknüpfung von personenbezogenen Daten unter Wahrung des

Datenschutzes ermöglichen.

4. Automatisierte Dienste (z.B. Suche, Analysetools) etablieren.

5. Interoperabilität und Wiederverwendbarkeit der Daten etablieren und verbessern.

6. Anwendungsfallorientierte Zusammenarbeit zwischen Forschungsgemeinschaften fördern.

7. Geschäftsmodelle für Nachhaltigkeit erarbeiten.

NFDI4Health setzt sich aus einem interdisziplinären Team von 18 Partnern zusammen. 46 Institutionen aus dem Gesundheitsbereich haben ihre Beteiligung zugesichert, darunter große Fachgesellschaften und epidemiologische Kohorten.

Google will für qualitativ

hochwertige Inhalte zahlen

Google announced it will begin paying news publishers for “high-quality content” with the launch of a “new news experience” later this year. The move marks a major departure for Google, which has until now steadfastly refused to compensate news publishers for content. As news organizations’ digital advertising revenues have plunged, critics in the media, and even many politicians, have been pressuring Google to pay to license content.

Dun & Bradstreet mit Angebot an die Börse.

Dun & Bradstreet Holdings, Inc. announced the launch of its initial public offering of 65,750,000 shares of its common stock at an anticipated initial public offering price between $19.00 and $21.00 per share pursuant to a registration statement on Form S-1 previously filed with the United States Securities and Exchange Commission. Dun & Bradstreet intends to grant the underwriters a 30-day option to purchase up to an additional 9,862,500 shares of common stock.

Kantar sagt „kreative Effizienz“ bei Werbematerialien voraus.

Kantar, the data, insights and consulting company, announced the launch of Link AI, a fully automated, AI-powered machine to predict creative effectiveness. Trained on Kantar’s creative effectiveness Link database, Link AI evaluates high volumes of digital video and TV ads with precision in 15 minutes or less. Link AI delivers increased creative power and productivity at scale.

Umfassende Kommunikationslösung via App.

Salesforce is introducing Salesforce Anywhere, embedding collaboration capabilities directly within Salesforce. The Salesforce Anywhere app helps every Salesforce user collaborate with teams, stay productive in their workflow, and keep up to date on their customers from anywhere with chat, alerts, comments and video embedded directly into the Salesforce experience.

Protiviti mit Navigating Business Resilience Tool.

Protiviti has launched a Navigating Business Resilience tool to help companies take a rapid approach to addressing the challenges they are facing due to COVID-19 related disruptions, workplace re-entry and business transformation. The complimentary assessment tool helps business leaders quickly identify and prioritize their organization’s unique pain points, threats and vulnerabilities across their core functions, and then creates an agile operating model.

Mit Refinitivs „Digital Investor“ kürzere „Time to Market“.

Refinitiv continues its commitment to the Wealth Management industry with the launch of Refinitiv Digital Investor. This highly flexible solution empowers firms with faster time to market for digital properties, while providing their investors with a seamless digital experience including account information, workflow tools, analytics, news, and insights related to their holdings.

Corona-Management für Studentenpopulationen.

Castlight Health, Inc. announced the launch of Working Well for Higher Education, a solution that helps academic institutions manage safe campus re-entry in the wake of the COVID-19 pandemic. The solution helps securely track the health of the total campus population to provide a guided user experience through symptom self-assessment, with integrated lab testing, contact tracing support, and seamless access to care guidance and behavioral health support.

Quelle: Outsell

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

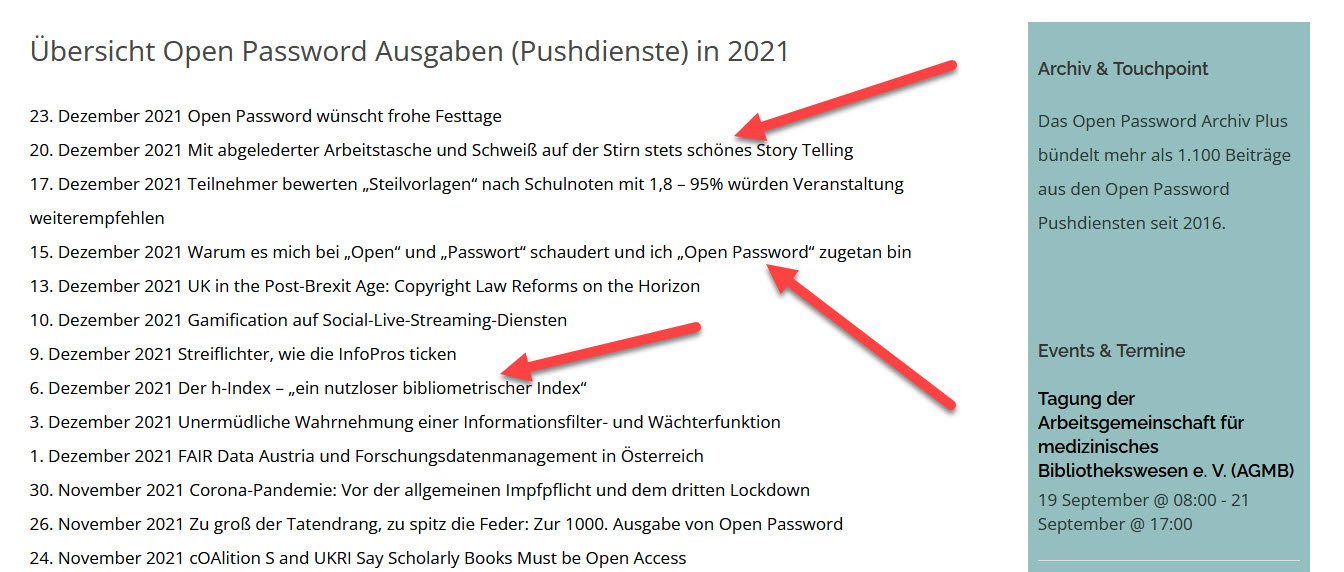

Neue Ausgaben von Open Password erscheinen viermal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe