Open Password – Dienstag,

den 3. Juli 2018

# 393

Peter Müller-Bader – GBI-Genios – Willi Bredemeier – Sabine Graumann – Nina Schul – ZB MED – Julia Klöckner – EmiMin – Data Librarian – Forschungsdatenmanagement – Gabriele Herrmann-Krotz – Springer Nature – Jo McShea – Outsell – Holtzbrinck – BC Partners – IPO Withdrawal – Brexit – Informa – Wolter Kluwer – Academic Publishing – Elsevier – Open Access – DEAL – Couperin – Libraries – Clarivate

Briefe

Wir halten Peter Müller-Bader

weiter in Ehren!

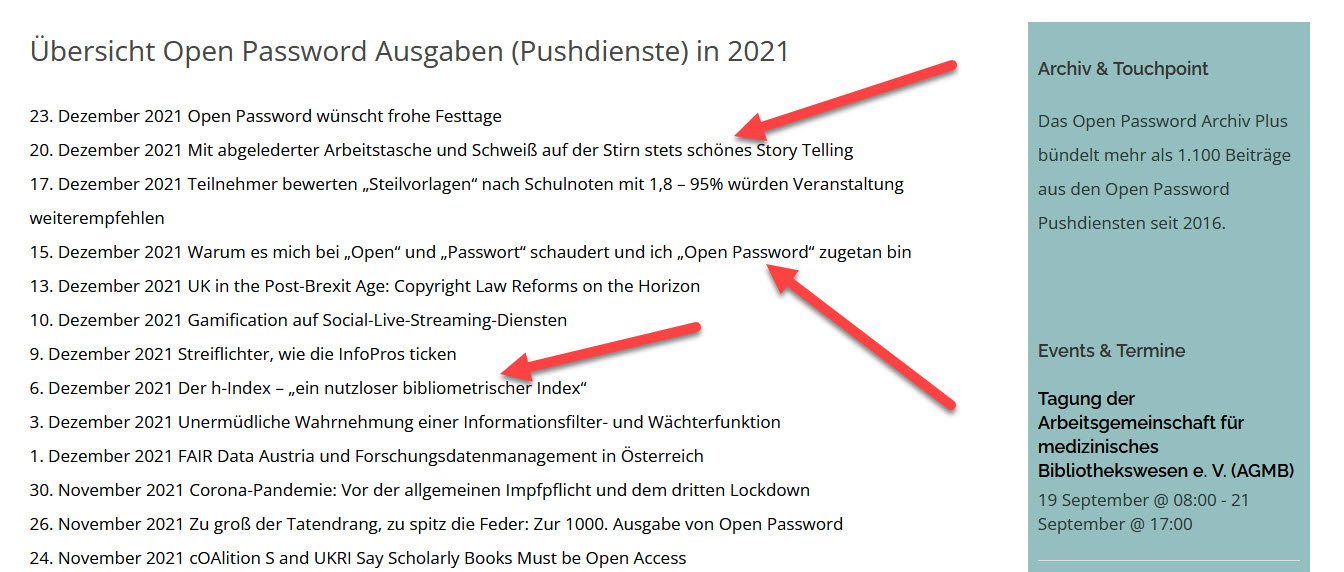

Zu: 40 Jahre GBI-Genios: A Touch of German Dream is Going On – Von Willi Bredemeier – Ein Gedicht zum 40. Geburtstag der GBI – Von Sabine Graumann – In den Beiträgen waren auch auf Leistungen des Unternehmensgründers und Branchenpioniers Peter Müller-Bader und auf seinen schweren Unfall vor zwei Jahrzehnten eingegangen worden.

Lieber Herr Bredemeier,

wir wollten uns bei Ihnen sehr über die letzte Push Dienst Meldung zur 40- jährigen Jubiläumsfeier von GBI-Genios und für den Abdruck des Gedichts von Sabine Graumann bedanken. Uns hat das Denken an Peter sehr berührt. Dass die Erinnerung an Peter aufrechterhalten wird, freut uns als seine Familie sehr, und ihn selbst sicher auch! Sein Nachbar in Barchi, Erwin, hat ihm den vollständigen Artikel vorgelesen und er hat sehr aufmerksam zugehört.

Peter lebt seit fast 2 Jahren größtenteils in Barchi und wir werden den ganzen August mit ihm dort sein.

Ich hoffe, dass es Ihnen gut geht.

Einen schönen Tag und herzliche Grüße aus meinem sich gerade zu Ende neigenden Auslandsjahr in Israel, Nina Schul (Tochter von Peter Müller-Bader, Red.)

Auch von meiner Mutter und meiner Schwester soll ich Sie herzlich grüßen.

ZB MED

Als Data Labrarian

Übernahme des Forschungsdaten-managements

Bundesministerin Julia Klöckner hat in Berlin den Förderbescheid für das Projekt „Emissionsminderung Nutztierhaltung – Einzelmaßnahmen“ (EmiMin) überreicht. Das Projekt EmiMin erforscht Maßnahmen zur Emissionsminderung in Tierställen und ist ein Verbundvorhaben mit sechs Partnern. ZB MED übernimmt darin als Data Librarian das Forschungsdatenmanagement.

Bundesministerin Julia Klöckner und die kaufmännische Leiterin der ZB MED,

Gabriele Herrmann-Krotz.

Die Hauptaufgabe von ZB MED im Projekt liegt im Forschungsdatenmanagement. Im ersten Schritt erarbeitet es mit den Forschenden einen Datenmanagementplan, der dynamisch fortgeschrieben wird. Dazu nutzt ZB MED das DFG-geförderte Tool Research Data Management Organizer (RDMO). Eines der Projektziele ist die Anpassung von RDMO an die Bedingungen der Agrarwissenschaften. Im nächsten Schritt wird erarbeitet, welche Daten – im Wesentlichen Messdaten aus den Ställen – im ZB-MED-Fachrepositorium Lebenswissenschaften publiziert und dauerhaft archiviert werden.

International Corner

Springer Nature

IPO Withdrawal Gambles on Improvement

in Academic Publishing’s Market Appeal

By Jo McShea, VP & Lead Analyst, Outsell, London

Last minute announcement from Springer Nature owners Holtzbrinck and BC Partners saw its IPO withdrawn less than 24 hours before shares were due to start trading.

____________________________________________________________________

Important Details. ____________________________________________________________________

Springer Nature’s statement focused on “market conditions” as the key reason behind its IPO withdrawal, saying that it “and its shareholders will continue to closely evaluate the market environment in general and opportunities regarding an IPO of Springer Nature in the future”. Weaker demand for shares than expected resulted in Springer Nature taking nine days for orders for placing all shares. Guidance released to investors stated an expectation that issue price would come in at the bottom of a €10.50—€14.50 range, valuing the company at approximately €3.2 billion. Then Springer Nature withdrew its stock market flotation.

“Market Conditions” is not just the usual “tired and emotional” euphemism here. a number of European IPOs have seen poor performance in 2018 and investors had concerns that the shares might trade badly following the float. Whilst 2017 saw the highest number of IPOs completed worldwide since 2007 and expectations were also high for 2018, late cycle markets can be unpredictable and global geo-political instability, rising interest rates, and ongoing uncertainty around Brexit are impacting the markets.

Fundamentally, however, the expected valuation was less than Springer Nature’s owners, Holtzbrinck and BC Partners were prepared to accept, and investors were not prepared to pay more — hence the withdrawal. At the bottom of the valuation range, Springer Nature compares poorly with other market leaders, and Outsell understands that it was looking to achieve a multiple higher than its closest rivals. The expected issue price gave Springer Nature a value of around 9x 2017 core earnings. RELX, in comparison, has Enterprise Value to EBITDA of around 16x, whilst Informa is at 13x and Wolters Kluwer at 12x. An issue of accounting relating to adjustments Springer Nature makes to its EBITDA also caused concern amongst investors who worried that Springer Nature had an inflated EBITDA. The level of debt the company would have after the listing is also an issue. It would have been high at around 3.5x EBITDA, but it could be closer to 4.5X EBITDA, given the accounting adjustments. RELX debt, in comparison, is just over 2x EBITDA, with Informa and Wolters Kluwer both just over 2.5x EBITDA.

Investors will also have found the core debt-reduction rationale behind the Springer Nature IPO less attractive than one focused on driving the business forward — and the fact that the smaller-than-expected predicted valuation meant that Springer Nature wouldn’t currently qualify for inclusion in Germany’s mid-cap stock index will have reduced its appeal, too.

____________________________________________________________________

Why This Matters. ____________________________________________________________________

The IPO withdrawal indicates that Springer Nature and its owners think that investors will have a better perception of academic publishing market at some point in the future. Traditionally, academic publishing is a safe bet — not hugely exciting growth-wise for investors but reliable and predictable. The fact that demand was weak here indicates a level of investor uncertainty about the sector as a whole otherwise the Springer Nature IPO would have been easier to row home. It’s the number-two market player behind Elsevier, the owner of high quality/high impact brands, and the market leader in terms of Open Access journals publications. It is reasonably diverse geographically, continuing to expand its product offerings for authors and researchers, and understands the importance of technology in delivering future opportunities — all of which are key growth drivers in this sector.

Withdrawing from the IPO this week makes sense in the context of the expected valuation. In Outsell’s opinion, however, it’s a gamble to assume that the academic publishing market will become more attractive to investors in the short term. Signals continue to point to significant potential for change to the traditional business model for commercial publishers in this sector. That goes for both continuing Open Access momentum, and the ongoing high profile Big Deal negotiations in which Springer Nature is widely involved. Of those, project DEAL in Germany is the most high profile, but Springer Nature’s negotiations with Couperin in France represents a recent addition to the list, amongst others. The effect is impacting perception of the largest commercial publishers in the broader marketplace — fairly or unfairly, depending on one’s perspective. At the same time, there are major, on-going structural discussions that could fundamentally impact their businesses (and the academic research sector as a whole) around data access and discoverability, research integrity and reproducibility, the speed of the research cycle, peer review, reputation, and recognition.

Speedier resolution to Big Deal negotiations (particularly Project DEAL) that both addresses library budget issues and represents fair value to the publishers for their services could tip the interest back in academic publishing’s favour relatively quickly, but these other issues are here for the long term.

This may feel like a story-of-the-week type thing, but for Springer Nature specifically an IPO withdrawal is not uncommon and, when an expected valuation is less than desired, it makes strong financial sense for all concerned. However, the fact remains that, whilst Holtzbrinck is clearly committed to Springer Nature’s long-term future, BC Partners will still need to exit at some point to get a return on its investment. If Springer Nature is to float in the future, it must take action for an improved result. Options include a return to the German market, perhaps within the year, assuming that the owners are satisfied that the market has improved sufficiently by then. Another alternative is to move the IPO to the New York market where conditions are currently friendlier.

Outsell’s concern is that neither of those options address the more fundamental issues regarding Springer Nature’s performance. Whilst Springer Nature holds its own in terms of underlying growth compared to key rivals (2.5% underlying growth between 2016 and 2017 compared to 2% for Elsevier and Informa’s Academic Division), EBITDA is growing more slowly (up 0.4% between 2016 and 2017 compared to Informa at 0.7% and Elsevier at 3%). These results must improve above market norms, if it is to increase its chances of the market comparing it favorably to RELX by investors — particularly as RELX also has the benefit of having only around 33% of its business in the (currently unappealing) academic publishing sector. It also, of course, has less debt. Reducing the level of debt within the business is the other key issue here as it is obviously larger than investors are comfortable with. Aside from the IPO approach, bringing in other PE or trade investors is a possibility.

On balance, we think this is primarily a financial event — but one that could have broader repercussions, too. A concern we have is that this weeks’ events could prove to be the bellwether to a prolonged period of investor ennui in the academic publishing sector. Equally, the scale of the combination of challenges for Springer Nature is daunting — cost-cutting to reduce massive debt whilst also investing to improve growth at a time when the broader academic publishing market also faces challenges. Springer Nature requires strong, focused leadership that targets improved attractiveness around its growth and profitability. However, it also requires a more strategic future-proofing of the business, like Elsevier or Clarivate around data-driven, technology-enabled, interoperable solutions targeting author, researcher, and other professional workflows in increasingly open ways.

Anzeige

FAQ + Hilfe