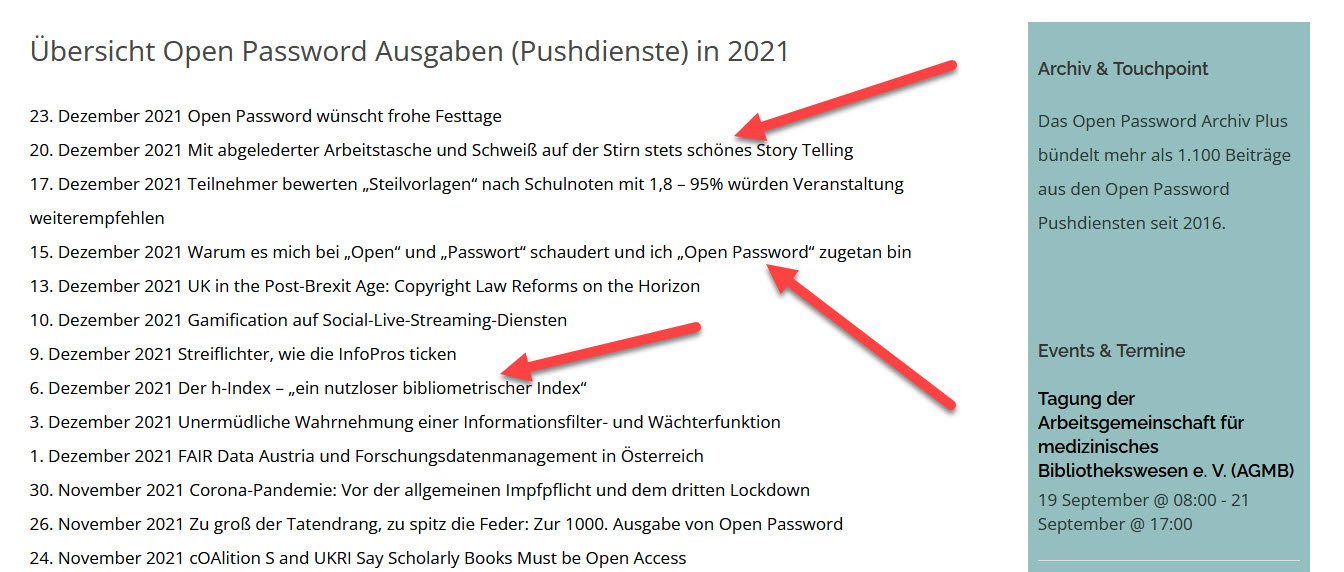

Open Password – Montag, 13. Dezember 2021

# 1010

Informa – Informa Intelligence – Academica Market – B2B Markets – Pharma – Tom White – Tom White – Alliance News – Divestment – Financial Intelligence – Maritime Intelligence – STN – FIZ Karlsruhe – CAS – STNext – STN IP Protection Suite – Sabine Brünger-Weilandt – Manuel Guzman – De Gruyter – Bibliotheks- und Informationswissenschaften – Archiv für Geschichte des Buchwesens – Kritik der Informationsgesellschaft – Buchrevolution in Rom

Outsell – UK Copyright – Hugh Logue – Post-Brexit – AI – Content Producers – EU Law – Computer-generated Content – Text and Data Mining – Office for AI – EU Copyright Directive – European Parliament – Copyright Exhaustion Rules – Uncertainty – UK Consumers – UK Consultation on Copyright and AI – United States Copyright Office – Complicated Regulations – AI-Investments

Informa

Planning to sell Informa IntelligenceConcentrating on Academic Market and B2B Markets, not Pharma und Financials – By Tom White

STN-Service

Transfer of full commercial and legal responsibility to CAS – By Sabine Brünger-Weilandt and Manuel Guzman

III.

de Gruyter

Neue Titel aus den Bibliotheks- und Informationswissenschaften – Archiv für Geschichte des Buchwesens, Fragilität des Zugangs, Die Buchrevolution in Rom

IV

Titel

UK Copyright: Law Reforms on the Horizon – By Hugh Logue, Outsell

Informa

Planning to sell Informa Intelligence

Concentrating on Academic Market and B2B Markets, not Pharma und Financials

By Tom White, thomaslwaite@alliancenews.com

(Alliance News) – Informa PLC said it plans to sell the businesses within its Informa Intelligence division and return GBP1 billion to shareholders via a special dividend and share buyback programme once the process is complete.

Ahead of a capital markets day in London, the business publisher and events organiser said it wants to focus on two markets where it believes it has leading positions – Academic Market and B2B Markets.

„As part of this investment and growth strategy we are starting a process to divest our portfolio of high-quality, high-performing brands in Informa Intelligence, thereby unlocking value and providing the funds to further strengthen our position in our two growth markets,“ said Chief Executive Stephen Carter.

Informa Intelligence divides its brands into the categories Pharma, Financial Intelligence, and Maritime Intelligence. The latter includes 300-year-old Lloyd’s List.

Once proceeds from the disposals are received, Informa said it will return GBP1 billion to shareholders via a special dividend and a share buyback programme. At the same time, it plans to resume ordinary dividends with a 2022 interim payout. The company will adopt an initial payout ratio of one-third of annual adjusted earnings.

Informa said that, even with its planned returns, it still will have the funding required to invest up to GBP150 million in incremental capital and net operating spending through its 2021 to 2024 strategic plan, which it calls ‚growth acceleration plan II‘. The Gap II plan calls for returning revenue to 2019 levels, adjusted for disposals, by 2024.

In 2020, revenue dropped to GBP1.66 billion from GBP2.89 billion in 2019, as physical events were cancelled due to the Covid-19 pandemic.

Informa shares were up 5.4% at 505.40 pence, the second best FTSE 100 performer Tuesday afternoon in London.

STN-Service

Transfer of full commercial

and legal responsibility to CAS

Dear Valued STN User,

During the past 38 years it has been our goal and privilege to support the advancement of scientific discovery and innovation by providing you with the STN service as a best-in-class technology solution offering online access to the most comprehensive collection of scientific, technical, and patent information. As your partner in innovation, we remain committed to serving your growing needs in the IP search market and are excited to share that we are evolving our partnership with CAS. To ensure continued delivery of an exceptional customer experience, we will be implementing some operational changes throughout 2022 including the transfer of full commercial and legal responsibility to CAS.

Our evolving partnership will benefit you and your team by enabling:

- The acceleration of innovation and development to deliver continued enhancements to high quality patent information and search capabilities available in STNext. Our STNext solution provides you with a more efficient path to your discoveries and sparking new ideas.

- Opportunity to access expanded support and solutions via the STN IP Protection Suite.

- A fully integrated and efficient customer experience with a single primary point of contact.

- Continued access to the most complete collections of global disclosed patent and non-patent content in a highly secure search environment.

- Streamlined customer service to support existing users and onboard new users within your organization, including training and search services. Over time this will include Helpdesk support in multiple time zones and languages.

As a result of this upcoming change, you will see minor impacts including:

- Assignment or transition of your STN agreement to CAS.

- Invoicing will come from CAS and may result in changes in the treatment of your VAT taxation.

- Log-in IDs will be serviced out of Columbus, Ohio, USA; therefore, all transcripts, queries, and results will reflect an Eastern Standard Time (EST) timestamp.

FIZ Karlsruhe will remain a vital partner of CAS to further develop the STN business. Your sales representative will be in contact with you in the coming weeks to provide you with more details of our partnership, as well as the benefits and changes to you and your team. If you have any questions in the interim, please contact your sales representative, the

FIZ Karlsruhe Helpdesk by phone (+49 7247 808 555) or email (helpdesk@fiz-karlsruhe.de), or the CAS Customer Center by phone (+1 614.447.3731) or email (help@cas.org).

Our FIZ team looks forward to continuing their service to you while working in collaboration with CAS to better meet your growing needs. We thank you for your continued partnership throughout your innovation journey.

Sincerely,

Sabine Brünger-Weilandt Manuel Guzman

President & CEO President

FIZ Karlsruhe – Leibniz Institut für CAS

Informationsinfrastruktur GmbH

De Gruyter

Neue Titel aus den Bibliotheks-

und Informationswissenschaften

Archiv für Geschichte des Buchwesens,

Fragilität des Zugangs,

die Buchrevolution in Rom

Archiv für Geschichte des Buchwesens

Band 76, 2021

Die Fragilität des Zugangs

Eine Kritik der Informationsgesellschaft

Schüller-Zwierlein, André

Lernwelt Wissenschaftliche Bibliothek

Pädagogische und raumtheoretische Facetten

Eigenbrodt, Olaf

Müllers Großes Deutsches Ortsbuch 2021

Clarice Lispector – Weltliteratur?

Übersetzungs- und Rezeptionsdynamiken im 20. und 21. Jahrhundert

Meyer-Krentler, Leonie

Die arabischen Evangelien der Typographia Medicea

Buchdruck, Buchhandel und Buchillustration in Rom um 1600

Reimann, Caren

Outsell´s Contribution for December

UK Copyright: Law Reforms on the Horizon

By Hugh Logue – Director & Lead Analyst

Hugh Logue

Post-Brexit, the UK is seeking to reform its intellectual property laws to keep pace with the fast-changing demands of AI and to increase competition for book consumers. However, UK-based publishers and content producers could face significant disruption.

_____________________________________________________

What to Know and Why It Matters

_____________________________________________________

The UK is considering significant changes to its copyright laws now that it is no longer tied to EU law. The British government is consulting on whether computer-generated content should continue to be protected by copyright and, if so, by what means. The UK is one of only a few countries that provides copyright protection for computer-generated works without a human author; these are currently protected for 50 years from the date the work is made.

It is also considering changes to laws concerning licensing or exceptions to copyright for text and data mining, which is often leveraged in the development of AI tools. This has become a hotly contested area, as AI systems increasingly need access to large

proprietary datasets to function properly. Many of these datasets were originally created to be used as reference materials by humans, not for use by AI systems.

A new “Office for AI” will develop the government’s position on governing and regulating AI in early 2022. The UK Government launched the Office for AI to commercialize ideas and shape government AI investment and regulation. The UK is set to diverge from EU laws despite playing a key role in the drafting of the EU Copyright Directive, which was adopted by the European Parliament in April 2019 but will not now be implemented in the UK.

Separately, copyright law reforms are also under consideration that could have serious implications for publishers and booksellers. When the UK was a member of the EU, books sold outside the EU could not be reimported and sold in the domestic market. The UK Intellectual Property Office is considering changing the “copyright exhaustion” rules, which govern when the control of rightsholders over the distribution of their property expires. Reforms could potentially lead to cheaper international editions of books, undercutting domestic editions.

_____________________________________________________

Analyst Rating: Negative

_____________________________________________________

The rules that govern copyright are the backbone of the publishing and information

industry, and any changes present risks to providers in this market. In Outsell’s view,

the UK moving away from the EU and international copyright norms creates uncertainty and presents more challenges than opportunities to publishers and content creators operating in the UK. These changes are also partly politically driven, which could create further uncertainty if a new government is elected in future.

_____________________________________________________

Winners and Losers

_____________________________________________________

AI-generated content is becoming increasingly common, and providers in this market

have invested heavily in systems to automate some types of content. Losing copyright protection for AI-created content would likely drive a loss in investment in automated content creation technology because the value of the content would no longer be protected.

Separately, publishers selling in the UK will resist changes that could lead to

international editions flooding the domestic market, particularly in areas such as school textbooks, where international editions are significantly cheaper. Ultimately, this could drive publishers to no longer issue rights for their books in emerging economies, which would be a loss for both publishers and consumers in those countries.

In the short term, the winners could be UK consumers, who might benefit from cheaper books. There could also be opportunities for international booksellers to import foreign editions and undercut domestic editions. It could also benefit content aggregators and businesses that scrape online content, as these firms could be free to use AI-generated content in whatever way they wanted. However, this would be short-lived, as publishers and content creators will soon find workarounds, and companies may pull products altogether.

_____________________________________________________

What’s Next

_____________________________________________________

The UK consultation on copyright and AI closes on 7 January 2022, after which the

government will assess whether changes to current legislation are necessary. The drive to reform copyright law is not limited to the UK: the United States Copyright Office is also undertaking a public study at the request of Congress to evaluate current copyright protections for publishers.

_____________________________________________________

Essential Actions

_____________________________________________________

The UK government is attempting to balance the need to support innovation — by

removing copyright hurdles for those training new AI systems — with the needs of

rightsholders who have invested heavily in automating content creation. There is also

resistance in government to regulations that reduce competition and limit choice for

consumers, and some view current copyright exhaustion rights as protectionist. These objectives could lead to complicated regulations, and information and software

providers need to act now to prevent their businesses from being negatively affected.

With this in mind, Outsell recommends the following actions.

✔ Hold Off Big Investments in AI Content Generation

Providers operating in the UK that are considering making investments in AI-generated content, such as automated journalism, need to wait until there is greater certainty about AI copyright law. If publishers will no longer own the copyright over a fully automated produced work, then there may be nothing stopping others from copying this content; there may also be no ownership rights for licensing the content to others. This could make any investment in automated content worthless in the UK.

✔ Shape the Debate

Industry leaders need to participate in the ongoing consultation and lobby the UK

government to ensure that their businesses don’t become collateral damage to

regulation changes. Business leaders in our industry need to be alert to the risk of the UK government going too far, especially if this drives the US and other nations to mirror the measures. Providers must make their voices heard to ensure that the debate is not framed by those who fear AI or those championing consumers by enabling international book editions to be sold in the domestic market.

Outsell (London) is the international partner of Open Password.

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

Neue Ausgaben von Open Password erscheinen dreimal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe