Open Password – Montag,

den 22. Juni 2020

# 774

Outsell – COVID-19 – Ned May – Data, Information, and Analytics Industry – Forecast – Contraction – Cataclysmic Decline – Event Industry – In-person Learning – Recovery – Print to Digital – Workflow-enabled Digital Platforms – Work from Home – Open Access – Peer Review – Spending Decisions – Human Interaction – Zoom – Distance Learning –

GBI-Genios – Steilvorlagen für den Unternehmenserfolg – Präsenzveranstaltung – Streaming – Ralf Hennemann – Willi Bredemeier – Creditreform Bonitätsauskünfte – TIB – „Bibliothek des Jahres“ – Sören Auer – Bibliotheksverband – Telekom-Stiftung

The Outsell Contribution of June

What’s Next? The Industry Impact of COVID-19

The Forecast and the Duration of the Crisis

By Ned May

__________________________________________________________________________________

What to Know and Why It Matters

_________________________________________________________________________________

Given the breadth of the global response to the pandemic’s impact, understanding if and when conditions will return to “normal” involves a complicated mix of variables. Company leaders need to carefully consider legal, financial, and even cultural risks in bringing staff and customers together, balancing these risks against what may or may not be actual gains. Careful consideration is now being given to whether pre-pandemic offices need to be completely refilled and what other face-to-face interactions might be moved permanently to digital. Our analysis stems from multiple surveys of CEOs and sales leaders and our ongoing dialog with the market.

___________________________________________________________________________

The Extent of Change

___________________________________________________________________________

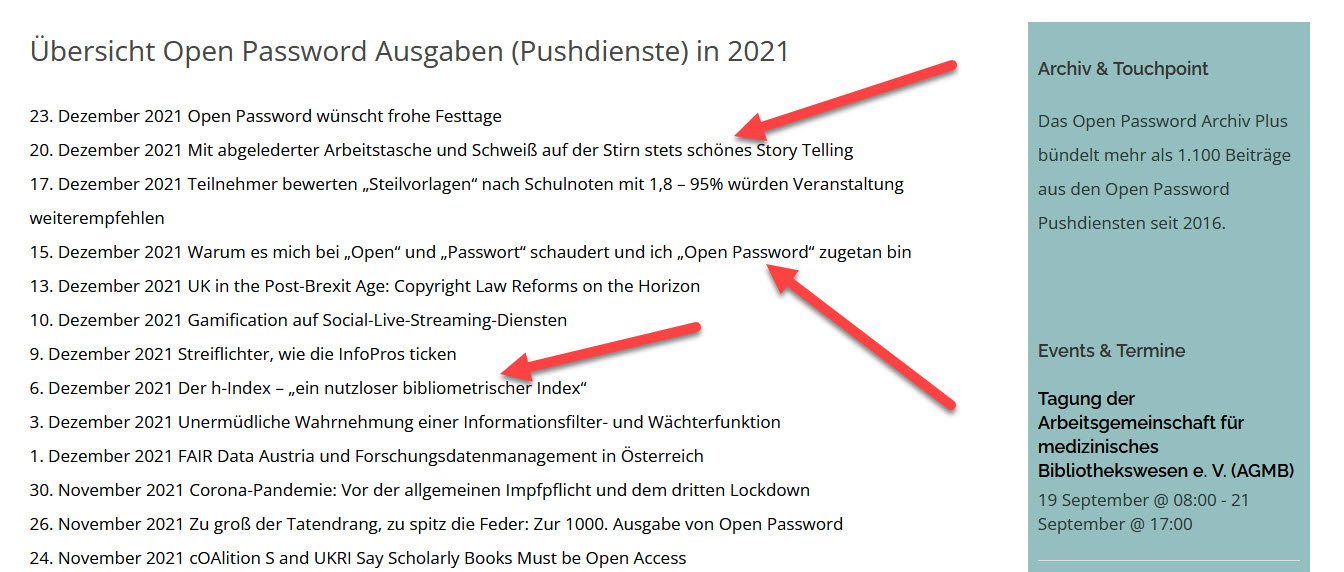

Outsell has tracked the data, information, and analytics industry since the turn of the century, and one thing has remained true: Industry growth largely mirrors global GDP (Figure 1). This is true in good times and bad, though when dramatic changes occur, such as global contractions, the impact often translates into a roughly six-month lag and hits the industry harder than overall GDP. This equates to a more severe decline coupled with a slower recovery. Looking at data from 2008-2009 bears this out, and we now see similar projections in our industry for the current crisis. It also played out in the dot.com bust of 2001 (not shown here). Looking out to 2020 and beyond, Outsell forecasts the overall industry to decline by nearly 8% in 2020. Recovery will be slow in 2021, forecast to grow 3.5%, assuming that a solution to the health crisis is in place by the middle of next year. Even so, spending levels will not fully recover to last year’s level until 2021. If we face an escalation of the pandemic later this fall, we believe 2021 will be flat at best.

Figure 1: Global GDP Vs. Information Industry (% Growth)

Source: Outsell analysis

It’s Minor on the Surface… While the contraction is significant, it is important to point out that it appears like a blip on the surface, with all but the very weakest of enterprises having the wherewithal to withstand a one-time 10% decline in their revenues. Most leaders told us that they have made painful cuts, they may acquire smaller companies, and our industry will simply limp along.

…Yet Dig Deeper, and It Is at Times Profound. Which brings us to the contradiction today. If the general news and internal company debates regarding the pandemic’s impact seem wildly divergent, it is for good reason. The impact has not only been uneven, it has been in opposing directions. For many — nearly three-quarters (74%) of respondents to our recent annual CEO sentiment poll — the impact has been dramatically negative. This group is expecting 2020 sales to end the year, on average, 22% below their pre-pandemic forecasts.

Go a bit deeper into this data, and some providers are facing a cataclysmic decline. The market segments they are operating within just suffered the equivalent of a large-scale meteor strike. Take revenues across events and in-person learning. These fell off a virtual (pun intended) cliff. For these providers, important questions remain regarding their survival: Will their world ever return to normal once the dust settles and the sun shines again? Can they adapt in time? Fortunately, we see most firms acting with the urgency required, and we expect success, though perhaps with tempered dreams.

For others, the impact has been positive: 14% anticipate sales exceeding plan by an average of 18% as they ride the right side of change. And a full quarter of respondents (23%) don’t anticipate much impact this year, if any. For these, it is as if not much of anything changed.

Figure 2: 2020 Outlook Against Sales Plan

Source: Outsell analysis

The reasons for this divergence are twofold. First, there has been a rapid acceleration of structural changes underway, in particular, the migration from print to digital. Firms that are positioned on the right side of this cutover are doing extremely well, while those that aren’t are struggling. Second, many businesses in our industry have steadier subscription-based revenue streams. So, while 2020 might hold steady for them, 2021 and the pace of recovery remain important wild cards.

__________________________________________________________________________________

Is It Permanent or Near-Term?

__________________________________________________________________________________

Underneath these differences lies a critical question regarding how long the changes brought about by the pandemic will last. Deciphering the length of the pandemic’s impact is a difficult task, if not an impossible one. Not the least of our problems is that there is, at best, a weak global system for gathering the critical health and response data to determine the virus’s trending impact on our health and the global economy. (More on this later when we get to opportunities.)

At best, we can separate the projected outcomes into a series of scenarios and do our best to play each one out. To do so, we have divided the drivers into those that are permanent (structural) and those we see as only near-term (cyclical). That said, whether these are “good” or “bad” depends more on where a vendor is positioned than the change underway.

The Case for Lasting Change. Outsell foresees several areas where the pandemic’s impact is unlikely to recede:

- Print to Digital Won’t Return Except in Pockets: This is a long steady march, and the inability to sit in a physical office, classroom, or courthouse just rapidly accelerated the ongoing change. Print is largely about to go the way of the horse and buggy for all but a few formats, such as books.

- New Platforms Will Permanently Displace Tired Processes: The movement to workflow-enabled digital platforms is equally accelerating at pace. Old processes that could limp along thanks to drive-by office visits and tiresome planning meetings that filled large conference rooms are no longer feasible in the physical-free world.

- Benefits Realized Without the Anticipated Cost: The most obvious example of this is the work from home switch. Companies once feared this approach yet now realize that they’ve maintained productivity with happier personnel. One in five (22%) CEOs recently indicated that the move to WFH will be permanent for some in their firms. Many we speak with are reconsidering their office spaces.

- Open Access Accelerates and Doesn’t Look Back: One of the more indirect outcomes of the pandemic is the continued acceleration of open access. Yet, while the effect is indirect, the outcome is undoubtedly a permanent change. The need for better data and insight and faster analysis has broken down previously standing constraints around peer review that many thought would never be overcome. With that final falling domino, there is little to constrain open access from transforming the STM industry and beyond. As this becomes more evident, we have seen more and more commercial publishers get on board.

- Tough Decisions Get Made: Even less specific to the pandemic is the inevitable outcome of any downturn where spending decisions get made that are arguably long overdue. For instance, take the areas of legal information where overlapping coverage makes the presence of the major offerings from leading providers largely redundant. Given spending constraints today, if a firm can get by with just one of these, it will, and once cut, it is unlikely that the spending will ever be restored given other headwinds on the profession.

Lesen Sie in der abschließenden Folge: The Case for Temporary Change – The Most Probable Outcome – Essential Actions

Save the date

Steilvorlagen powered by GBI-Genios

Aus dem aktuellen Newsletter von GBI-Genios:

GBI-Genios ist Partner und Veranstalter der „Steilvorlagen für den Unternehmenserfolg 2020“, die am 14. Oktober im MARITIM Hotel Frankfurt von 10-14 Uhr stattfinden wird. Das traditionelle GENIOS Datenbankfrühstück bietet den Rahmen für die Veranstaltung, die auch in diesem Jahr mit Referenten unter anderem von Roland Berger und Janssen-Cilag hochkarätig besetzt sein wird.

Merken Sie sich den Termin vor! Sollte aufgrund aktueller Erfordernisse keine Präsenzveranstaltung möglich sein: Die Veranstaltung wird in jedem Fall auch via Live-Stream als Web-Konferenz stattfinden.

In einem Interview blickt unser Marketing- und Vertriebsleiter Ralf Hennemann gemeinsam mit Willi Bredemeier zurück auf die bisherige Entwicklung der „Steilvorlagen“ und des „Datenbankfrühstücks“ und gibt auch schon einen ersten Ausblick darauf, was Sie im Oktober erwartet.

Lesen Sie das Interview im Open Password-Newsletter – www.password-online.de vom 15. Juni

GBI-Genios

Creditreform Bonitätsauskünfte

wesentlich erweitert

Die Creditreform Bonitätsauskünfte für Deutschland und Österreich liegen ab sofort in einem aktualisierten Layout vor.

Die umfangreichen Wirtschaftsauskünfte wurden in diesem Zuge um die folgenden Informationen erweitert (soweit jeweils vorhanden):

- Informationen zu Produkten, Marken, Vertriebswegen und Zertifizierungen

- Zusatzinformation zu Banken und Organschaft

- ein Anfragezähler zu den erteilten Auskünften über das beauskunftete Unternehmen in den letzten zwölf Monaten

- eine Zuordnung des ermittelten Creditreform-Bonitätsindexes zu den Bewertungsklassen verschiedener Finanzdienstleister.

TIB „Bibliothek des Jahres

Sören Auer: Der @bibverband und die @telekomstiftung haben uns ausgezeichnet: Die TIB ist „Bibliothek des Jahres 2020“. Danke!!!

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

Neue Ausgaben von Open Password erscheinen viermal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe