Open Password – Montag den 17. Mai 2021

# 923

Outsell – Roboter – Investment Reports – Wall Street – Will Jan – Research Analysts – COVID-19 – Institutional Asset Managers – Human Intermediation – Bloomberg – Refinitiv – S&P Global – FactSet – Thomson Reuters – Financial Times – Dow Jones – Credit Rating Agencies – Cost-Cutting – Financial Research Professional – Gaming – Gamer – Verband der deutschen Games-Branche – GfK – Felix Falk – Dun & Bradstreet – Twitter – Billboard – The Billboard Hot Trending – Springer Nature – Nature Africa – London Book Fair – Microsoft Research – Microsoft Aademic – WHO – Federal Republic of Germany – Hearst Magazine – iCrossing – HearstMade – Shutterstock – The Newsroom – Royal Society – Open Access – Outsell

I.

Cover Story: Roboter Writing Investment Reports – The Jury is Still Out

on Morningstar’s Automated Fund Research

Jeder dritte Gamer ist mindestens 50 – Corona-Lockdown sorgt für weiteren Schub

3.

Internationale Nachrichten

Outsell´s May Contribution

Roboter Writing Investment Reports

The Jury is Still Out

on Morningstar’s Automated Fund Research

— And Wall Street Is Presiding

By Will Jan, VP & Lead Analyst

Will Jan

Even if Wall Street shrugs off Morningstar’s attempt at automating fund research, the information giant’s bold move is destined to alter the role of financial research analysts and the financial community’s trust in robot-generated content.

__________________________________________________________________________________

What to Know and Why It Matters

__________________________________________________________________________________

Morningstar has been using robots to create analyst ratings on thousands of small funds. Now, the financial information provider is scaling up its robotic content authoring to create actual fund research. To be specific, Morningstar is now using robots to write investment reports to help investors manage thousands of exchange traded funds (ETFs) and mutual funds for savings and retirement.

The COVID-19 pandemic was a key catalyst for Morningstar’s investment in automated fund research. The market volatility over the last year has created greater expectations on financial analysts to cut through the noise in search of true investment and trading signals, which has required the analysis of information at unprecedented levels. Robotic fund research would effectively free up these human analysts to conduct actual analysis rather than spending most of their time collecting facts and data.

Morningstar’s robotic ratings were able to assign gold, silver, bronze, neutral, or negative scores to funds, while the robotic research authoring can now piece together relevant facts — news, financials, and social commentaries on financial holdings — all updated monthly. Together, the automated ratings and content enable equity analysts and portfolio managers to make more strategic decisions around buying, selling, or holding their financial assets.

__________________________________________________________________________________

Analyst Rating: Neutral

__________________________________________________________________________________

While the idea of a “Narrative Science” approach to enabling financial research sounds sexy, institutional asset managers are likely to remain in a wait-and-see position. There is too much to lose from their trading and investment decisions if the fund research they use is inaccurate or incorrectly assembled. This risk of loss is even greater among algorithmic investors that count on machine-driven trades.

There are two types of financial research consumption: that done via machine and that performed by humans.

For the latter, Morningstar’s robotic fund research will likely be more viable because human analysts will read a created piece and serve as mediators: They will act as the final screeners, deciding whether the content is relevant, pieced together correctly, and appropriate for making decisions.

With machine consumption, the created piece is extracted, processed, and decisions executed from it automatically by the likes of quant-driven hedge funds. Here, trusting robot-generated content to enable automated decision execution is simply too risky in terms of monetary impact. Research content for machine consumption still relies on some form of human intermediation (e.g., the opportunity for a portfolio manager or an equity analyst to double-check a source before a decision is made). Expecting Morningstar’s automated fund research to be an instant hit in financial services may be premature.

__________________________________________________________________________________

Winners and Losers

__________________________________________________________________________________

Automated fund research is a disruptive move by Morningstar that is certain to ruffle the feathers of many members of a large ecosystem of financial research providers. While it is still too early to determine the winners and losers of robotic content creation in financial services, Morningstar is sending a clear signal to financial desktop research providers like Bloomberg LP, Refinitiv, S&P Global, and FactSet Research Systems that its robots will outperform their (human) analyst commentaries and research assessments in terms of speed, consistency, and breadth of fund coverage.

If robotic algorithms do mature to the point of enabling fund research accuracy, Refinitiv’s strong machine learning developments, combined with its position in maintaining control over Reuters’ specific content input to its research platform, would likely give the provider an edge on becoming the winner in automated fund research in the institutional space. A provider like FactSet that lacks core AI capabilities may find itself at the bottom of the competitive stack-up.

Similarly, the technology behind Morningstar’s robotic authors will also challenge financial news providers like Thomson Reuters, Financial Times, and Dow Jones in the context of relevant content identification, extraction, and aggregation (beyond automated earnings reports). The success of this technology will be a critical milestone in unstructured data analytics, which means that if Morningstar gets this technology right, it could put itself ahead in aspects of news sentiment analysis.

In the case that the robotic algorithms do play well in evolving unstructured data analytics, Dow Jones may emerge as the winner, given its well-taxonomized news and content covering companies, individuals, and entities, which it is already leveraging to power risk and compliance assessments. Automated investment research would become a natural pivot for Dow Jones to leverage the same content to enable trading and investment recommendations at greater capacity. The Financial Times, which lacks the platform play that Dow Jones and Thomson Reuters possess, may become the laggard in this race.

As for credit rating agencies (CRAs) like Moody’s and Fitch, automated fund ratings do not necessarily translate to effective bond ratings. Even if Morningstar were to somehow perfect its automated rating algorithm to serve the fixed-income community, Morningstar’s credit rating business remains an unaccredited CRA, so bond traders must still default to Fitch, Moody’s, or S&P. Unless Morningstar becomes accredited, its advancements in robotic ratings will unlikely impact the CRAs.

__________________________________________________________________________________

What’s Next

__________________________________________________________________________________

Wall Street will likely see Morningstar’s automated fund research as a marketing gimmick to attract retail investors, who may see more research content as a major perk. Main Street may trust machine-weaved content more readily, seeing it as a quick means to obtain market or competitive intelligence.

In the meantime, financial information and research providers will likely stick with supplying their institutional investors with primary data and content for their own analyses, at least until these robots can be fully trusted to offer intelligence that drives multi-billion-dollar transactions. There is also a liability perspective to this development: If a trader or investor makes a poor decision based on bad research, and the research was written by a robot, the maker of the robot could very well be blamed.

Retail investors and traders will likely adopt automated research given that it is a step up from what they have had access to before. Institutional investors and traders deploying fundamental research may give automated fund research a shot, yet the financial research desktop providers that serve them would be unlikely to entertain this given the potential liability about users’ decisions. Institutional investors and traders deploying quant research will be unlikely to even consider automated fund research as the basis of their analysis lies in raw data feeds and bulleted facts that are analyzed by their own algorithmic platforms.

__________________________________________________________________________________

Essential Actions

__________________________________________________________________________________

Morningstar has applied automated content creation to the industry with the most skeptics — those with the most to lose on behalf of their client investors. Unless the technology has demonstrated significant success in terms of content accuracy, Wall Street will likely leave automated content creation in the hands of Main Street. Data and information providers can take the following actions to monetize the automated content movement.

- View Automated Research as a Cost-Cutting Measure

For financial research content providers, automated authoring means quicker reporting and intelligence sent more quickly out the door. For example, a Wall Street journalist could simply type in short bulleted facts and leave the robots to weave them quickly into a coherent article. If this is done well, the technology could also save on editorial review time, thus further accelerating financial news delivery.

- Brace for the Changing Role of the Financial Research Professional

Automated research is taking over a significant portion of the remit of professional researchers, including equity analysts, fixed-income analysts, and portfolio managers. Firms employing these professionals must see this as an opportunity to move them into more strategic roles that are less about arduous data and fact searching and more about valuable analysis.

Outsell ist der internationale Partner von Open Password.

6 von 10 Deutschen spielen Games

Jeder dritte Gamer ist mindestens 50

Corona-Lockdown sorgt für weiteren Schub

(game) Über die Hälfte der Deutschen spielen Computer- und Videospiele. Insgesamt greifen 58 Prozent im Alter zwischen 6 und 69 Jahren zu Konsole, PC oder Smartphone, um in digitale Welten einzutauchen. Allein im Corona-Jahr 2020 haben dabei rund 5 Prozent mehr Menschen in Deutschland Computer- und Videospiele neu für sich entdeckt. Das gab der game – Verband der deutschen Games-Branche auf Basis von Daten der Marktforschungsunternehmen GfK bekannt.

Gespielt wird in allen Altersklassen und von allen Geschlechtern gleichermaßen. Die größte Gruppe an Gamern ist jedoch die der 50- bis 59-Jährigen. Hier spielt aktuell rund jeder Fünfte Computer- und Videospiele. Zusammen mit den Spielerinnen und Spielern der Altersklasse 60- bis 69-Jahre machen die sogenannten „Silver Gamer“ rund ein Drittel der gesamten Spielerschaft in Deutschland aus. Das Durchschnittsalter der Spielenden in Deutschland liegt allerdings bei 37,4 Jahren.

Dazu game-Geschäftsführer Felix Falk. „Insbesondere während der Lockdown-Phasen waren Games für Millionen Menschen großartige Unterhaltung, eine willkommene Ablenkung und auch eine Möglichkeit, mit Familie und Freunden Spaß zu haben und in Kontakt zu bleiben. Damit haben Computer- und Videospiele einen wichtigen gesellschaftlichen Beitrag geleistet und gleichzeitig viele Millionen Menschen zusätzlich für sich begeistern können.“

Internationale Nachrichten

Dun & Bradstreet Reports First Quarter 2021 Financial Results

Dun & Bradstreet Holdings, Inc. announced unaudited financial results for the first quarter ended March 31, 2021. GAAP Revenue for the first quarter of 2021 was $504.5 million, an increase of 27.5% as reported and 26.6% on a constant currency basis compared to the first quarter of 2020; which includes the net impact of lower deferred revenue purchase accounting adjustments of $17.2 million.

Twitter, Billboard Partner On Real-Time Trending Music Chart

Twitter and Billboard are partnering to create The Billboard Hot Trending, a real-time Billboard Chart powered by the social media giant to showcase the songs being talked about most on the platform and tracking music trends. Advertisers will be able to connect to The Billboard Hot Trending through “innovative ad formats that will live on Twitter and across Billboard.”

Nature Africa Launched to Showcase Science Across the African Continent and Beyond

A new online magazine that reports on scientific research and issues of science policy across the African continent has been launched by Springer Nature. Nature Africa will cover the highest impact research taking place across the continent and communicate this to scientists and decision-makers in and outside Africa.

The London Book Fair Announces Format for 2021 Online Event

The Online Book Fair by LBF will run a series of events over three weeks in June, offering varied content for different audiences throughout the month. The programme will shine a spotlight on key areas of the fair, creating the opportunity for a larger global audience than ever before to come together in a flexible way to network, learn and share ideas.

Next Steps for Microsoft Academic – Expanding into New Horizons

Microsoft Research will continue to support the automated AI agents powering Microsoft Academic services through the end of calendar year 2021. During this time, it encourages existing Microsoft Academic users to begin transitioning to other equivalent services.

WHO, Germany Launch New Global Hub for Pandemic and Epidemic Intelligence

The World Health Organization (WHO) and the Federal Republic of Germany will establish a new global hub for pandemic and epidemic intelligence, data, surveillance and analytics innovation. The Hub will lead innovations in data analytics across the largest network of global data.

Hearst Magazines Offering Buyouts

Hearst Magazines is offering voluntary buyouts to all its sales and marketing staff. The voluntary offer is expected to go to some 600 of the 2,200 staff in the magazine division, the digital ad agency iCrossing and the branded content group called HearstMade. Town & Country UK magazine will cease publication.

Shutterstock, Inc. announced the launch of The Newsroom, a resource for global breaking news, exclusives, and archival content that will transcend traditional newsrooms. Through this offering, Shutterstock’s team works directly with news teams to package key trending stories, archival and UGC content, to help clients tell the story behind the story.

The Royal Society sets out how it will transition its primary research journals to open access. Following a review by its Council, the Royal Society has committed to ‘flipping’ the journals Biology Letters, Interface, Proceedings A, and Proceedings B to a fully open access model when 75% of articles are being published open access.

Source: Outsell

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

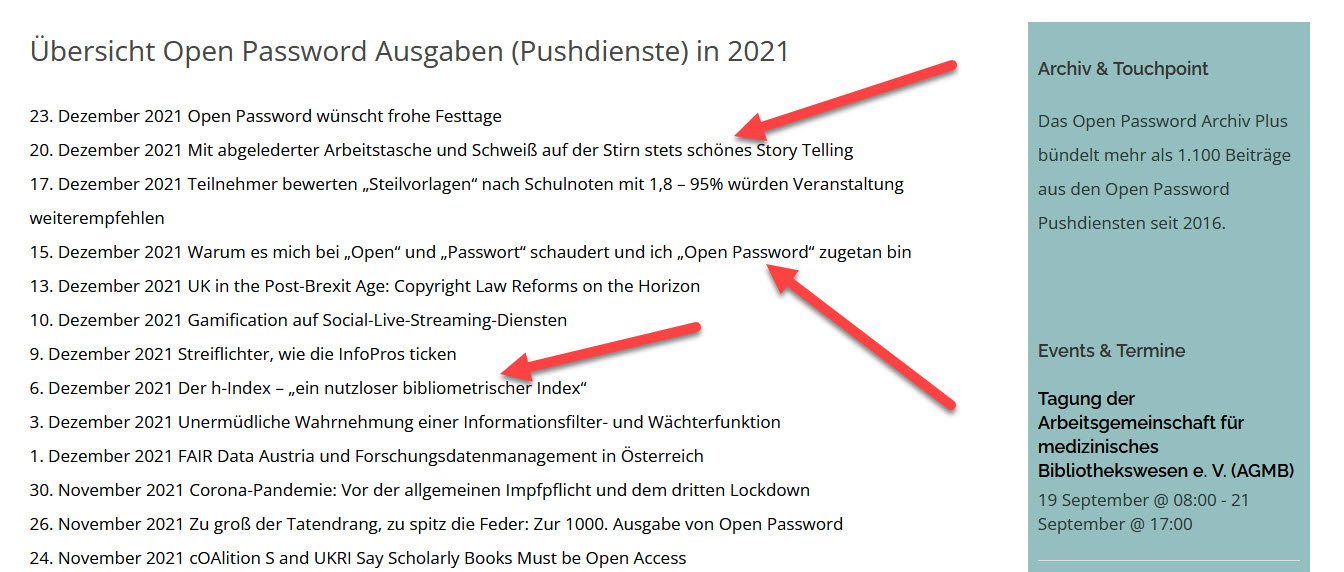

Neue Ausgaben von Open Password erscheinen viermal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe