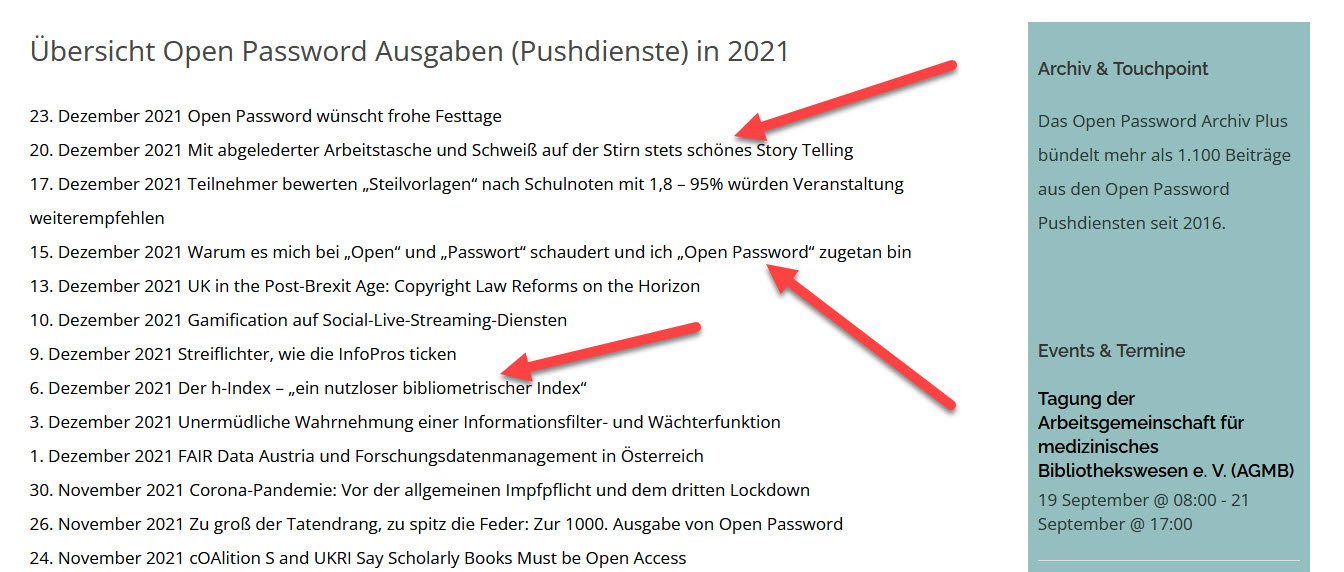

Open Password – Montag, den 14. Juni 2021

# 934

Outsell – Demandbase – Modular Cloud Offering – LinkedIn – Dun & Bradstreet – ZoomInfo – Inside View – DemandMatrix – Engagio – ABX Cloud – Advertising Cloud – Sales Intelligence Cloud – Data Cloud – Company, Contact, and Personal Information – Bombora – 6sense – Customer Data Platform – MarTech – Salesforce – Adobe – Microsoft – Marketo – Modular Approach – Frauen-Blogs – Ranking – Claudia Tödtmann – WiWo-Management-Blog – Faktenkontor – Freizeit, Mode, Lifestyle- Josie loeves – Sarah Eichhorn – Christliches Forum – Felizitas Küble – Stefanie Fiebrig – Foodblog – Michaela Lühr – Springer Nature – LYRASIS – UN-Nachhaltigkeitsziele

Titelgeschichte: Key Demandbase Acquisitions Power

New Modular Cloud Offering

Die erfolgreichsten Bloggerinnen: Karriere schlägt Kochen

III.

Springer Nature: Open Access für Forschung

nach UN-Nachhaltigkeitszielen

IV.

Oxford University Press: Das Ende von Print

Outsell´s June Contribution

Key Demandbase Acquisitions Power

New Modular Cloud Offering

By Randy Giusto, VP & Lead Analyst

Randy Giusto

The deal creates a modular cloud offering with firmographic, demographic, technographic, and intent data at its base. This instantly makes Demandbase a key B2B data provider, next to LinkedIn, Dun & Bradstreet, and ZoomInfo, and positions it for future growth.

__________________________________________________________________________________

What to Know and Why It Matters

__________________________________________________________________________________

On May 4, 2021, Demandbase announced its acquisition of InsideView and DemandMatrix, creating a modular, cloud-based, B2B go-to-market suite that spans account-based experiences (ABX), advertising, sales intelligence, and B2B data. The move positions the company for future growth and comes after Demandbase’s 2020 acquisition of Engagio and its technology, which the company rolled into its ABX offering.

This new offering includes ABX Cloud and Advertising Cloud from Demandbase, and Sales Intelligence Cloud from InsideView. It also includes a new Data Cloud with intent data from Demandbase, company and contact data and data services from InsideView, and technographic data from DemandMatrix.

InsideView will become the brand and technology under the Sales Intelligence Cloud and Data Cloud while DemandMatrix becomes the technographics engine. Both companies’ CEOs will become general managers of their businesses in the new Demandbase organization. Terms of the all-stock deal were not revealed.

__________________________________________________________________________________

Analyst Rating: Positive

__________________________________________________________________________________

This deal, which came together within four months, gives all three companies higher multiples together than they had apart and creates a more solid path to a future IPO. It also consolidates share in the Company, Contact, and Personal Information space, with Demandbase rising to number eight. More importantly, the combined firm consolidates share behind LinkedIn, Dun & Bradstreet, and ZoomInfo.

Demandbase brings its strengths in website visit and account identification, ABM, intent data, and B2B advertising to the new organization. InsideView brings strengths in sales intelligence, B2B data, and data services, DemandMatrix brings expertise in technographics to the deal. Demandbase spent a lot of time and effort trying to develop its own technographics but, in the end, it became easier to buy than to build.

The new company’s modular G2M approach creates multiple entry points, so customers don’t have to lock themselves into a single platform, pay for features they won’t immediately need, or toss away existing tools and data relationships. They can move to whatever cloud they need next over time.

Through this modular approach, marketers can segment their spending across their ABM accounts and personalize their website experiences. They can see website visits and actual ad performance with intent signals, determine what’s working and what’s not, and course-correct their marketing efforts. They can then tie in sales intelligence to measure sales interactions and track account-level engagement with those same accounts; they can also attribute revenue back, essentially monitoring and measuring the buyer journey.

__________________________________________________________________________________

Winners and Losers

__________________________________________________________________________________

Demandbase creates a wider market opportunity for itself through this deal and gets a data platform it can build upon. Both InsideView and DemandMatrix come with their own licensing partners that compete with Demandbase, like Bombora in intent data and 6sense in ABM, which may cut off their API feeds at some point if that competition intensifies.

D&B and ZoomInfo will watch how this deal develops and monitor the traction that Demandbase gets. For now, neither owns a DSP, with most today purpose-built for B2C advertising (not B2B) and owned by either AdTech or MarTech companies. Still, the ability to segment B2B audiences, buy media placements, and watch it all play out across accounts is a powerful value proposition.

The missing piece here is a customer data platform. Demandbase doesn’t seem eager to get into CDPs or master data management (MDM), as most of its customers just want to manage their data in their Salesforce, Marketo, or Dynamics systems of record. Competitively, this leaves D&B with its B2B CDP and MDM offerings unless ZoomInfo decides to test both waters over time. D&B competes more directly with ZoomInfo with its new D&B Rev.Up platform, but will also go against Demandbase through its new D&B Rev.Up ABX module. It will want to keep Demandbase in its rearview mirror.

Another area to watch is the convergence between the Company, Contact, and Personal Information space and big MarTech. Demandbase doesn’t compete directly with Salesforce, which offers a CDP, or Adobe, which just rolled out its Real Time CDP, B2B Edition. However, D&B will now indirectly compete with both. Big MarTech vendors remain data-agnostic, but as they add more B2B workflow tools and capabilities, they start to overlap with B2B sales and marketing intelligence vendors.

__________________________________________________________________________________

What’s Next

__________________________________________________________________________________

The three companies making up the new Demandbase are connected through investors and partners, and the company needs to leverage these relationships for future growth. Salesforce invested in Demandbase and became an important partner for InsideView when it retired its Data.com business. DemandMatrix has a strong relationship with Microsoft, which also serves as its customer. InsideView has a robust partnership with Microsoft through Dynamics 360. Adobe is also an investor in Demandbase, and the latter’s CMO/CPO was a founding member of Marketo.

From a B2B perspective, there’s room for expansion now within Microsoft shops for ABX Cloud and Advertising Cloud, in Adobe environments for Sales Intelligence and Data Clouds, and in Salesforce users for Data Cloud.

The sales and marketing teams across all three companies will remain separate for the time being, but they will need to come together at some point to market and sell the whole solution, not just the parts. The company will also need to accelerate integrations between the underlying data, normalizing Demandbase, InsideView, and DemandMatrix data across the Data Cloud. It will also need to stitch together first- and third-party data across the three entities to make better sense of this data and work on identity resolution.

__________________________________________________________________________________

Essential Actions

__________________________________________________________________________________

This deal shows just how fast a multi-company and technology roll-up to increase scale can happen today. Information industry participants looking to create a similar opportunity ahead need to consider the following actions.

Provide Clarity Instead of Walled Gardens. The pandemic opened the eyes of CEOs, CFOs, and CMOs as their work shifted to 100% online. The move allowed them to see more of what was going on (and what wasn’t) with customers. It enabled them to measure more, identify gaps, and then plan ways to fill them. Customers today don’t have the time to rip out big investments in sales and marketing technology or sign up for extensive IT work to get their data houses in order — marketing budgets remain tight even as the economy improves. Customers need solutions that work with what they have, not new walled gardens that lock them into features they won’t use immediately. Consider a modular approach that provides stepping stones for customers to move to when they’re ready.

Look for White Spaces Between Partners. When considering a series of acquisitions, existing partnerships can often provide opportunity but may also create conflict. Map out prospects’ connections and identify which ones are partners but also customers. Assign not only a risk factor to each company considered but also an opportunity score. Forecast how various combinations of the companies might help fill in gaps from a customer and TAM perspective.

Die erfolgreichsten Bloggerinnen

Karriere schlägt Kochen

(Faktenkontor) Hohe Schlagzahl, gut vernetzt, auffallend: Keine Frau in Deutschland bloggt erfolgreicher als Wirtschaftswochen-Redakteurin Claudia Tödtmann. Mit ihrem WiWo-Management-Blog führt zum ersten Mal ein Weblog aus dem Themenbereich „Karriere“ das Ranking der einflussreichsten deutschsprachigen Blogs von Frauen im Blogger-Relevanzindex an. Das Analyse-Tool der Hamburger Kommunikationsberatung Faktenkontor bewertet fortlaufend die Performance von 2.000 Blogs nach Sichtbarkeit, Verlinkung, Social-Media-Performance, Aktivität und Interaktion mit seiner Community. Bei drei vorhergehenden Auswertungen seit Ende 2017 nahmen jeweils Blogs aus den Bereichen „Kochen“ und „Freizeit / Mode / Lifestyle“ den Platz an der Spitze der erfolgreichsten Blogs von Frauen ein.

Dennoch stellen beide Themenbereiche spielen in der weiblichen Seite der Blogosphäre weiterhin eine gewichtige Rolle: Mit 27 beschäftigt sich mehr als jeder zweite der Top-50 der erfolgreichsten Blogs von Frauen mit Themen aus dem Bereich „Freizeit / Mode / Lifestyle“, angeführt von „Josie loves“ auf Platz sieben. Die erfahrene Josie-Bloggerin Sarah Eichhorn schreibt hier bereits seit mehr als zehn Jahren über Fashion, Beauty und Reisen. Rund ums Kochen dreht sich alles bei zwölf der Top-Bloggerinnen. Bestplatziert ist hier „Herzelieb“.

Der „Foodblog aus dem hohen Norden“ von Michaela Lühr springt von Platz neun auf die Drei. Mit religiösen Themen beschäftigt sich nur ein einziger Top-50-Blog -dafür aber besonders erfolgreich: Das „Christliche Forum“ unter Felizitas Küble setzt die Kirche zwischen Küche und Konzernen auf Platz zwei. Ebenfalls nur einmal vertreten, aber ganz vorn dabei: dasThemenfeld Sport. Der Berliner Fußball-Blog von Stefanie Fiebrig auf Platz vier schafft es zum dritten Mal in Folge unter die führenden fünf Blogs von Frauen. https://www.faktenkontor.de/blogger-relevanzindex/.

Springer Nature

OPEN Access für Forschung

nach UN-Nachhaltigkeitszielen

(Springer) Springer Nature hat mit LYRASIS, einem US-amerikanischen gemeinnützigen Verbund von Bibliotheken, Archiven und Museen, seinen ersten Sponsoringvertrag für Open-Access-Bücher unterzeichnet. Die soeben geschlossene Vereinbarung sieht die Veröffentlichung von Büchern zu Klimawandel, Gleichbehandlung, Frieden und Gerechtigkeit vor. Mit der Veröffentlichung als Open Access-Titel wird sichergestellt, dass neueste Forschungsergebnisse zu ausgewählten UN-Nachhaltigkeitszielen (SDGs) frei verfügbar sind.

Springer Nature hat ein umfassendes Verlagsprogramm zu den UN-Nachhaltigkeitszielen, in dem relevantes Wissen zu den dringendsten Herausforderungen der Welt veröffentlicht wird. Seit dem Start der sogenannten SDGs im Jahr 2015 hat Springer Nature mehr als 300.000 wichtige Artikel und Buchkapitel veröffentlicht, die mehr als 750 Millionen Mal heruntergeladen wurden. Als führender Open-Access-Verlag (OA) hat Springer 2011 begonnen, Bücher auch Open-Access zu verlegen. Das Open-Access-Buchportfolio umfasst mittlerweile über 1.400 Titel aus allen wissenschaftlichen Disziplinen mit mehr als 170 Millionen heruntergeladenen Kapiteln weltweit. Nähere Untersuchungen haben gezeigt, dass Open-Access-Bücher zehnmal häufiger heruntergeladen und 2,4-mal häufiger zitiert werden. Dadurch lassen sich geografisch 61 Prozent mehr Länder erreichen als mit herkömmlichen Büchern. Diese neue Sponsoring-Partnerschaft wird dazu beitragen, wissenschaftliche Erkenntnisse zu drängenden Fragestellungen noch besser sichtbar zu machen, sie in Umlauf zu bringen und so zu bewältigen.

Die neuen Open-Access-Buchtitel werden bei Springer Nature unter den Marken Springer und Palgrave Macmillan unter einer CC BY 4.0-Lizenz veröffentlicht. Leser können global frei auf die Buchinhalte über die Plattform SpringerLink zugreifen.

Oxford University Press

Das Ende von Print

(Outsell) Oxford University’s right to print books was first recognised in 1586, in a decree from the Star Chamber. But the centuries-old printing history of Oxford University Press will end this summer, after the publishing house announced the last vestige of its printing arm was closing. The closure of Oxuniprint will result in the loss of 20 jobs.

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

Neue Ausgaben von Open Password erscheinen viermal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe