Open Password – Dienstag,

den 6. März 2018

#330

Provider´s Corner – LexisNexis – Dow Jones – Factiva – Thomson Reuters – Minesoft – Anthea Stratigos – Outsell – David Worlock – Internationale Anbieter – Digitale Transformation – Gartner – McGraw Hill – Informa – UBM – Acxiom – Marktdominanz – Mehrwertdienste – Aktionäre – Geschäftsführungen – Wissenschaftlich-technische Informationen – Citation Explorer – PatBase

Unsere neue Rubrik

Provider´s Corner

Die internationalen Anbieter

Aktuelle Umwälzungen in der Informationsbranche

Nicht gut vorbereitet

auf die digitale Transformation

Lieber Password-Leser,

es gibt Debatten in unserer Branche, und Open Password ist ein gutes Beispiel dafür. Aber manche Gruppen erheben ihre Stimmen lauter als andere. Open Password vertritt seit längerem die Ansicht, dass die Informationsanbieter zu den Themen, die uns alle bewegen, eine Menge zu sagen hätten, ihre öffentliche Stimme jedoch kaum zu hören sei. Wir haben das unsere getan, um dies zu ändern, und veröffentlichen seit längerem Beiträge von Autoren, die LexisNexis nahestehen (oder machen auf branchenrelevante Beiträge, die bei LexisNexis erschienen sind, aufmerksam). Dem hat sich seit kurzem Dow Jones mit Factiva hinzugesellt, und mit ProQuest, der wir Autoren wie Mary Ellen Bates verdanken, laufen aktuell weitere vielversprechende Gespräche. Keinesfalls zu vergessen Minesoft, mit dem uns eine jahrzehntelange publizistische Partnerschaft verbindet (siehe auch die „Sponsored Post“ von Minesoft zum Schluss dieser Ausgabe). Hier fällt auf, dass die angelsächsischen Anbieter nach unseren Erfahrungen weiter zu sein scheinen als die heimischen Provider, die Marketingpower branchenrelevanter Beiträge zu erkennen. Aber wir geben selbstverständlich auch bei den deutschen Informationsanbietern nicht auf.

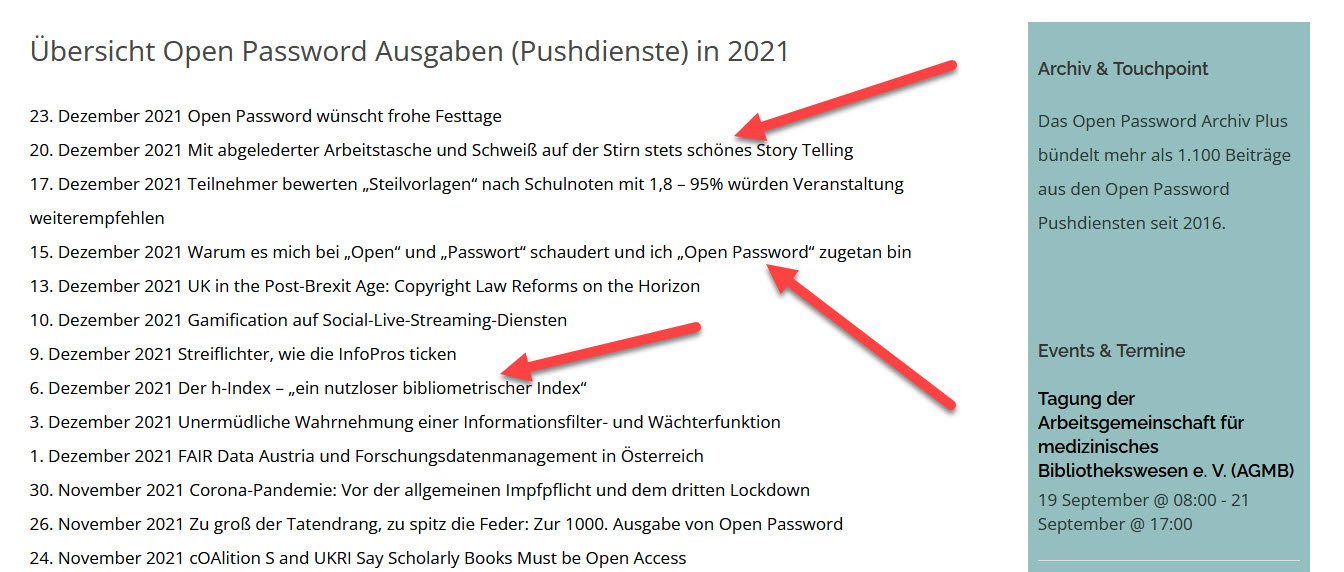

Es ist uns also wichtig, die Informationsanbieter ins Gespräch zu bringen und im Gespräch zu halten. Diesem geben wir künftig Ausdruck, indem wir die Beiträge der Anbieter und Beiträge, die die Strategien und Sichtweisen der Anbieter thematisieren, in einer neuen Rubrik

„Provider´s Corner“

zusammenfassen.Wir eröffnen unsere Rubrik mit einem Beitrag von Anthea Stratigos, deren Branchenanalysen wir seit den 90er Jahren veröffentlicht haben. Frau Stratigos leitet Beratungsunternehmen Outsell (London), mit dem wir in einer jahrzehntelangen teilweise engen publizistischen Partnerschaft verbunden sind. Siehe auch die Beiträge von David Worlock. Frau Stratigos benennt in dankenswerter Klarheit die neuesten Umwälzungen auf den internationalen Märkten, darunter den zweiten Ausverkauf von Thomson Reuters (diesmal des Finanzinformationsbereiches) sowie weitere Mega-Deals und CEO-Entlassungen, und geht danach auf die Gründe ein. Darunter fallen die ungenügenden Vorbereitungen für die digitale Transformation auch in der Informationsbranche und das sehr weitgehende Unverständnis von Aufsichtsräten und (Mit-)Inhabern über die steigenden Kosten und erforderlichen Investitionen der digitalen Transformation.

Im Vergleich zu den internationalen Märkten scheinen wir derzeit in einem Schonraum zu leben. Oder ist das die Ruhe vor dem Sturm?

Herzlichst Ihr

Willi Bredemeier

Die internationalen Anbieter (2)

5 Lessons from D&B, Thomson Reuters, Informa, Gartner, and

Other Industry Stalwarts

By Anthea Stratigos, Co-Founder and CEO of Outsell Inc. (London)

One can´t wake up these days without some major announcement shaking and rattling the industry to its core.The industry’s largest companies have been on my mind a lot lately, and it’s impossible to ignore the reshaping of our industry’s contours right before our very eyes. Five days into 2017, Gartner announced its mega deal with CEB. In Q4, McGraw-Hill Education unceremoniously showed its CEO the door. Seemingly five days into this year, boom-boom-boom, Informa is buying UBM. Thomson Reuters is spinning out 55% of its largest division — the division that has largely defined what’s left of the firm after it sold education and health and science to PE over the years. Dun & Bradstreet (D&B) has announced a CEO change after its earnings reports just a few days ago. Acxiom, after disappointing financial results and guidance, reorganized from three to two divisions last week, deciding enough was enough.

What’s going on and what can we take away?

The Outsell email ethers were alive and well this past week as we analyzed all this news. Let me distill our analytic banter into five key takeaways

- Horizontal Markets + Dominance Matters: Gartner with CEB and Informa with UBM — one seemingly a pure-play and one still diversified — are both achieving decisive dominance with their moves. Gartner & CEB are now far and away the market share leader in its sector. With UBM, Informa will be one too in global events, which can fuel other parts of the portfolio. IT Decision support permeates every function and every size company. Events are also horizontal in that they serve many markets across many verticals. Having large horizontal markets and market share dominance is important.

- Value Added Services Are Key: Having a horizontal market and dominance is great, but delivering value-added services into those markets is critical. D&B serving marketers and risk across industries is also, in essence, serving a “horizontal market,” so is Acxiom. But services and data in those spaces are commoditizing or under intense competition. There’s downward pressure on the D&B’s numbers and the notion of credit risk will one day be embedded in workflow solutions or completed by the likes of Watson. Investing in the future and up the value-chain is critical. Gartner is nearly at the top of its pyramid and events are quintessentially built from value-add — the notion of bringing people to people, F2F, doesn’t get much higher-end.

- Transformation Takes Time and It’s Expensive: Like building a house, digital transformation always takes longer and costs more. Big behemoths move slowly. There is a reason big, established companies are called dinosaurs, legacy, and other things with not-so-nice connotations. Moving the Queen Mary on a dime is not an easy feat and neither is digital transformation, which requires a complete re-think of the business, the ability to take one’s self out competitively, or completely reinvent the business while spending the big bucks required to do so, often in the eye of public markets. It’s hard, unforgiving work, especially in light of two things we see all too often in this industry, which leads to my last two takeaways.

- Owners and Boards Often Have Unrealistic Expectations: I have spent years talking to PE firms, in particular, or board members of large companies who are so often impatient with their ask. It is hard to transform companies while delivering steady profits. By definition digital work requires additional spend. Spend that becomes a second cost structure while the first cost structure supports the incumbent business. It is nearly impossible to make the transformation without impact on margins. Worse, growth expectations are often not steeped in reality. We have said for years that most of our industry grows in single digits because our revenue streams are tied to enterprise budgets, and they simply do not grow at the rates shareholders expect.To achieve 10% growth in most of our industry’s sectors requires inorganic growth, a full throttle focus on market share gains or both. Financial investors and boards often simply don’t get this. Many of these markets are mature. They are not growing. Good CEOs are going by the way side because their investors’ expectations are too often unrealistic in either volume or time-scales or both. Schisms occur, factions are formed. We need only witness the coverage of TRs recent issues playing out in the public eye.

Not too long ago, I said to one CEO that working for PE can be a bloodsport. One false move and you’re out. I’ve seen that happen so much. It takes a certain CEO to put themselves through that particular environment, particularly at the largest companies out there. TR didn’t deliver the transformational growth its owners wanted. In comes Blackstone, and if history is an indicator, it will not be pretty

- Cash Cows or Golden Geese need to be fed and nurtured: There’s a reason investors love our industry’s businesses. For the most part, they have been largely profitable with the stability of recurring revenues. What a combination, and what’s not to like? But when they get used to the cash, bad habits form, and it gets harder and harder to nurture the goose. Especially when that goose needs a shot of adrenaline, new investment, or digital transformation in vertically oriented, structurally changing markets in particular. Education is a hard place to be. Financial Services equally so. Credit and marketing services? Not so nice. But the textbook channels of yesteryear are largely gone and so too is the era of high fees for the desktop in a now shrinking financial market. For the better part of two decades, D&B’s results were driven from financial engineering show returns, while necessary investment for the long term was nearly gutted. Thomson delivered results ruthlessly and then got big and bloated under the merger with Reuters. But while the market changed, owner and board expectations remained the same. To be sure, shareholders deserve a return, and they deserve results, but it will be rare for them to receive the unbridled margins they’ve become used to without the investment and margin impact that goes with taking care of the cash cow. It will simply stop giving, It is nearly impossible for these firms to grow as fast as owners were used to or want, or spin out the profits of yesteryear.

Perhaps there is no greater place to see this than in STM publishing. Away from the public eye, the dynamics at the board level and in the institution play out so similarly. The publishing arms or database arms have long been the cash cow of so many of these organizations. They prop up profits. They subsidize membership or some aspect of the parent while the organization basks in the beauty of flush margins — lots of cash and publishing operations dripping with profit. But journal publishing is going through change as well: open access has yet to fully impact the space, pressures abound from funders, and here too we see boards reluctant to face the reality that these parts of the operation need investment and require some relief on margin in order for them and their parent to survive long term.

It’s a challenging time in the industry right now. It’s not a place for the weak or the meek. It’s becoming ruthless — more so than I’ve ever seen. Our industry would perform better if we’d be a little more tolerant and a bit more realistic of the perils in the corner office because good executives are finding themselves thrown overboard at seemingly record speed. Perhaps there is a silver lining to all this. As one of my colleagues said:

“… XYZ was in circumstances where the staff did not believe it (the transformation) could be done in any sensible timeframe, and the investors demanded that it should be done without diminution of revenues or returns. He will be a happier man outside of that impossible place!”

Perhaps good things happen to good CEOs after all. They’ll pursue philanthropy, go lead startups, become execs in residence, or sit on boards where they can, we hope, instill more sanity into expectations that are too often simply unsound. While any CEO can execute better, they’re better off if they can do so under the rubric of a bit more patience. Leading today is a tightrope act, placing one in constant peril, relief from which comes only after being on the other side or being shown the door.

Sponsored Post

by Minesoft

Enhancing Citation Explorer module

in flagship product PatBase

It is no secret that patent data yields a rich source of competitive intelligence. A significant volume of technical and scientific information (estimates range from 70 to 80%) is only to be found in patent documents. It won’t be published anywhere else!

Having access to a powerful and comprehensive patent search and analysis platform, like Minesoft’s PatBase, is therefore crucial to exploit patent data. For example, being able to analyse patent citations is a great source of competitive & business intelligence, to see who is involved in inventing the critical technology and how the knowledge in the sector is building up – and where. For this, you need a high quality, extensive global database of patents.

Due to the volume and complexity of patent citations, it is a difficult area to efficiently navigate. Citation Explorer is provided as an interactive module within PatBase which makes it much easier to locate, browse and review the complex web of patent citations on a single invention or patent document basis. Citations can be viewed side-by-side, visualised on a timeline or tree and relevant statistics revealed.

Incorporating the latest customer feedback has led to Minesoft further enhancing Citation Explorer. A new methodology to effectively track backward and forward citations for a family of interest makes life easier. Citations can be displayed by various criteria, allowing users to get an easy overview, cross-reference related citations and discover their origins.

In addition, the Citation Tree, a means to follow and traverse citation paths from patent to patent, now shows forward and backward citations simultaneously. As a result, it is easier to extrapolate and draw conclusions. Users can quickly identify which patents are being cited by or citing the invention of interest. Hovering over the publication number lets you quickly scan the title, assignee and excerpt of the abstract.

Exploring forward citations provides an excellent source of competitive business intelligence. You can quickly identify players working in a similar technology area, new competitors entering a similar field, potential licensing opportunities and keep an eye on potential infringers in the sea of data.

Citation Explorer is a comprehensive global patent citation database, ideal for unearthing new players or technologies in your area. Even better – it is included in all PatBase Subscriptions at no extra cost.

Contact us today for a demonstration and free two-week trial at info@minesoft.com, or call us on +44 (0)20 8404 0651.

Anzeige

FAQ + Hilfe