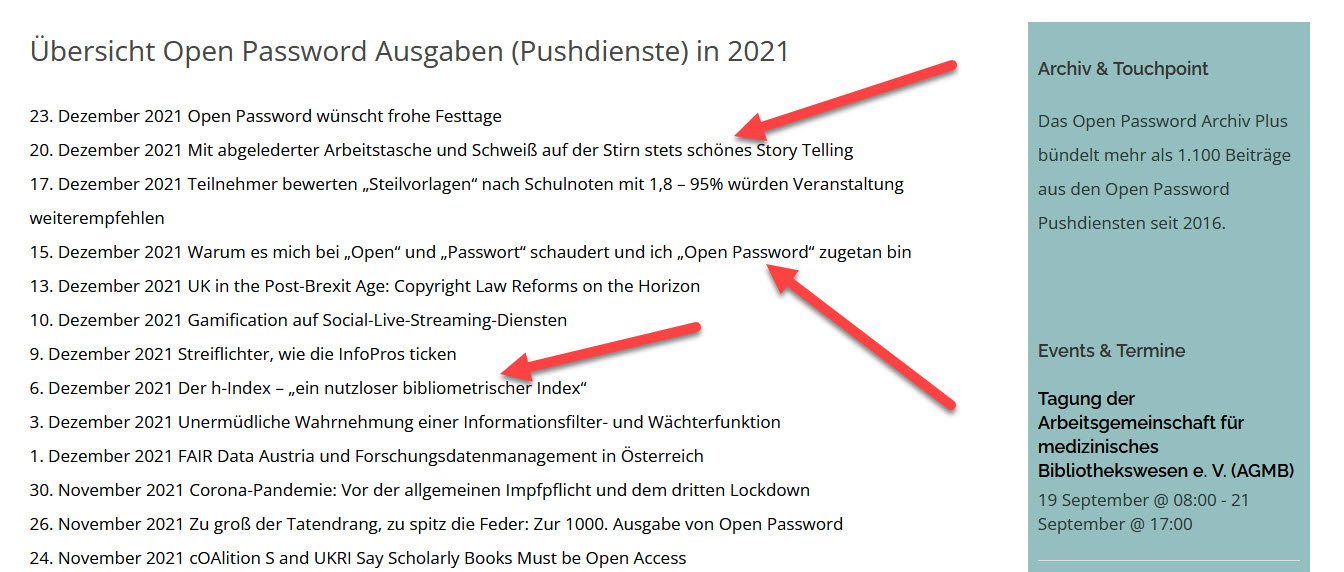

Open Password – Freitag, den 24. Juni 2022

# 1093

Outsell – Global Standards Publishing – Tatiana Khayrullina – Standards Publishing Market – Standards Market Size – Standards Market Size Growth Forecast – Standards Market Revenues by Region – Market Composition – Standards Revenue by Organization Type – Top 10 Standards Providers – Performance by Category: Aggregators – S&P Engineering Solutions – Techstreet – SAI Global – Aggregators Standards Revenue bei Provider – Interlek – ASME – IHS Market´s Product Design – Performance by Category: National Standards Bodies – Copyright Clearance Center – IEEE – Collaborative Coopetition – ASTM – Compass

Hommage an das Buch (XVIII)

Eine Initiative von Open Password

und dem Simon Verlag für Bibliothekswissen

Mit Herzblut, Leidenschaft und tiefen Kenntnissen über Bücher geschrieben, „die uns bewegten“

Nun, da das Buch durch geringe Aufmerksamkeitsspannen, mangelnde Leselust und elektronische Formate bedroht ist, wird es Zeit für eine Hommage an das Buch. Open Password und der Simon Verlag für Bibliothekswissen haben sich zu dem Projekt, „Bücher, die uns bewegten“ zusammengetan und 41 Autoren gewonnen, die mit Herzblut, Leidenschaft und tiefen Kenntnissen berichten, wie sie von einem bestimmten Buch geprägt wurden.

In der 18. Folge unserer Hommage an das Buch wirft Roland Jerzewski in einem Brief an die Verlegerin Elisabeth Simon und an den Herausgeber Willi Bredemeier einen Blick auf das entstandene Gesamtwerk und empfindet es wohl als gelungen. Jerzewski hat auch als Literaturwissenschaftler seinen Enthusiasmus für die Literatur nicht aufgegeben und bleibt auf „der Lauer nach einem Lektüre-Moment, der „wie ein Pfeil im Herzen des Tages zittert“ (Benjamin).

Bücher, die uns bewegten

Eine quer durch alle Generationen

im wahrsten Sinne des Wortes reife Leistung!

Liebe Elisabeth, lieber Herr Bredemeier,

aus persönlichen Gründen kam ich bislang noch nicht dazu, eine Rückmeldung meiner Gesamtlektüre „unseres“ Sammelbandes „Bücher, die uns bewegten“, herausgegeben von Ihnen, lieber Herr Bredemeier, und kuratiert von Dir, liebe Elisabeth, zu übermitteln. Nach Erscheinen des Bandes hatte ich mich – hier und da schmökernd – eingelesen, aber meine österliche Voll-Lektüre ging dann doch tiefer.

Der Band versammelt ganz kurze, kürzere und etwas längere persönliche Stellungnahmen unterschiedlichster Rezipient:innen eines Buches oder mehrerer Lektüren und ist schon allein von seiner Form und Zusammenstellung her gut lesbar! Und dann hat natürlich jeder seine „Spezies“. Unsere eigenen Beiträge – die der Bredemeiers, Simons und Demay-Jerzewskis – lasse ich einmal beiseite, was natürlich nichts über deren Qualität und meine persönliche Berührtheit aussagt. Die folgenden Erwähnungen sind naturgemäß persönlich gefiltert.

Andrea Gereckes Kurztext über „LTI“ von Victor Klemperer ist ein motivierender Lektüretipp, ebenso Katharina Loonus‘ „Siddharta“ von Hermann Hesse als Kontrapunkt zum „Steppenwolf“. Interessant erzählt Yannick Loonus von Ernest Hemingway und seinem Epochenbuch „Wem die Stunde schlägt“; da bleibt kaum Raum für Distanz! Erdmute Lapps langer Beitrag zu Boris Pasternaks „Doktor Zivago“ ist einerseits durchaus lehrreich, gleichermaßen aber doch recht selbstbespiegelnd: Der Roman, seine Entstehung, die Wege zur Veröffentlichung inklusive Übersetzungen wirkt eher wie eine Folie des eigenen Bildungs- und Laufbahnprofils der Rezensentin. Hingegen ist Helga Schwarz‘ ebenfalls etwas längerer Beitrag „The Lost Man…“ lehrreich, anschaulich, nachhaltig und unprätentiös: chapeau! Lebensgeschichtliches der Rezensent:innen hinsichtlich ihrer Lektüreerfahrung mit Hartmann von Aues „Erec“ (Christina Marinides) und Goethes „Faust“ (Sebastian Milkereit) ist durchaus lesenswert.

Kleine Randbemerkung: Wie man den gegenüber der seinerzeit politisch dominierenden Adelsschicht genial widerständigen prototypischen Vertreter des (Bildungs)Bürgertums Johann Wolfgang Goethe („Prometheus“!!!) mittlerweile fast allenthalben erneut mit seinem später verliehenen Verdienstadelstitel vermählt und somit unschädlich macht, bleibt mir ein Rätsel und geht mir gegen den Strich!

Ein insgesamt bemerkenswert lesenswerter und nachwirkender Sammelband zu „unseren“ Leseerlebnissen und Leseerfahrungen quer durch alle Generationen; eine im wahrsten Sinne des Wortes reife Leistung!

Dass Sie, lieber Herr Bredemeier, meinen kleinen Essay in Open Passwort eingestellt haben, empfinde ich dann auch als liebenswerte „Adelung“!

Mit ganz herzlichen Grüßen Dein und Ihr Roland Jerzewski

Outsell´s June Contribution

Global Standards Publishing – Segment View 2022

By Tatiana Khayrullina, Consulting Partner

Part II

Tatiana Khayrullina

_____________________________________________________

Market Size and Forecast

_____________________________________________________

Outsell estimates that the market for the sale of standards was $1.63 billion in 2021 (Figure 1). This represents 11% of Outsell’s Scientific and Technical Information and Solutions sector ($14.36 billion in 2021). Based on reported actual revenue, we have adjusted the size of the market in 2020 down to $1.52 billion, resulting in a growth rate of 6.6% from 2020 to 2021. A recurring comment to Outsell was that 2021 was a “surprisingly good” year, with nine organizations — including Techstreet, AFNOR, and SAE International — reporting growth of at least 8% (see Appendix 1 for exact figures).

Figure 1: Standards Market Size, 2019-2021 ($millions)

Source: Outsell, Inc.

Outsell expects to see standards revenue grow at a CAGR of 5.1% at current exchange rates from 2021 through 2025 as standards publishers continue to leverage the market drivers we described above. We forecast a total market size of $1.9 billion in 2025 (Figure 2).

Figure 2: Standards Market Size Growth Forecast, 2021-2025 ($millions)

Figure 3: Standards Market Revenues by Region, 2021

Table 1: Annual Percentage Changes in US Dollar Exchange Rates for Selected

Major Currencies

Source: Outsell, Inc.

The regional shares of the market did not fluctuate in 2021 beyond fractions of percentage points. The US accounts for nearly half the global market due to the strong revenues of ASME, Techstreet, IEEE, S&P Engineering Solutions, and ASTM. In the Asia Pacific region, the regional share declined by 0.5 percentage points due to a decline in SAI Global revenues in 2021.

____________________________________________________

Market Composition and Competitive Review

_____________________________________________________

This section highlights the revenue breakdown across the four types of organizations

operating within the global standards publishing sector. It also identifies the largest

players operating in this space and their revenues, growth rates, and market shares.

_____________________________________________________

Market Composition

_____________________________________________________

Figure 4 shows Outsell’s revenue estimates for the four types of organizations identified in our market analysis. Aggregators collect 38.0% of revenues from the sale of standards, with the rest split between NSBs (35.3%), SDOs (24.6%), and ISOs (2.1%). Compared to the results of 2020, the share of SDOs declined by 1.8 percentage points, while that of NSBs increased by 1.7 percentage points and the share of aggregators grew by 0.1 percentage points.

Figure 4: Standards Revenue by Organization Type, 2021

Source: Outsell, Inc.

We have consistently noted that there is some overlap in revenues for standards licensed for resale through partner organizations and aggregators due to the uniquely multilayered and interlinked character of the market. This is most significant where SDOs and NSBs license and resell other organizations’ standards rather than developing their own. It also occurs where NSBs expand into regions traditionally served by aggregators or local resellers.

This overlap between aggregators and standards organizations means that there is also some overlap in revenues reported by each of the four provider categories. Outsell estimates that approximately 60% of the revenues collected by aggregators are later recognized by SDOs and NSBs as royalty revenue. This suggests that the total spend by end-users on standards content is closer to $1.3 billion, with aggregator take-home revenue $247 million of that revised total. In other words, although aggregators channel around 38% of total revenues collected by standards providers and resellers, their net revenue is closer to 20% of all end-user spend on standards content.

_____________________________________________________

Competitive Landscape

_____________________________________________________

The most prominent standards vendors remain the top players from all market segments: leading commercial aggregators, NSBs with large domestic markets and strong international sales, and SDOs serving substantial industry sectors. Table 2 shows the top 10 standards providers in terms of standards revenue and their market share of the global total of collected standards revenue.

The top 10 organizations account for around 59% of the market. In US dollar terms, these organizations saw a combined revenue increase of 5.6% in 2021, below the overall market growth of 6.6% in US dollars, due to the declines in revenues of SAI Global and ASME. Viewed individually, their growth varied widely in 2021, with SAI Global and ASME showing a decline of 3.5% and 15.6%, respectively, while Techstreet and AFNOR reported growth rates of 15% and 13%, again respectively

Table 2: Top 10 Standards Providers, 2021

Source: Outsell, Inc.

_____________________________________________________

Performance by Category: Aggregators

_____________________________________________________

The aggregators segment grew by 6.3% from 2020 to 2021, slightly below the overall

market performance of 6.6%. As Figure 5 shows, S&P Engineering Solutions (formerly IHS Markit) remains by far the dominant player in this space — it largely retained ist market share, claiming 58.7% of the aggregators market. Techstreet’s market share climbed up to 12.3%, leaving SAI Global 8.9% of the market. S&P Engineering Solutions and Techstreet both saw growth in 2021: S&P Engineering Solutions grew by 6.0% and Techstreet by 15%, the best results the latter has shown in a few years. SAI Global reported a decline of 3.5% in US dollars and 9.9% in its reported currency (it switched to British pounds in 2021 following the acquisition by Intertek).

Figure 5: Aggregators Standards Revenue by Provider, 2021

Source: Outsell, Inc.

The aggregator sector continued to experience turmoil in 2021, with the SAI Global

acquisition by Intertek finalized in September 2021. IHS Markit’s acquisition by S&P was still undergoing regulatory clearance and was completed in February 2022. As a result, the aggregator sector showed mixed results in 2021, with growth rates between 15% and -3.5% in US dollars.

Techstreet emerged as the most established player in the aggregator sector following its acquisition by ASME in late 2020; it was the best positioned to leverage market drivers and serve the demand for standards in the economies emerging from the pandemic. To ensure uninterrupted customer service, it added to its salesforce with a specific focus on the Asia-Pacific region, where it continues to grow. As a legal entity separate from its parent ASME and under new management for most of 2021, it invested in improving systems to build scalability.

Techstreet’s positioning remains focused on getting standards to engineers as seamlessly as possible. It caters to the expert user, emphasizing the delivery of documents rather than their discovery. It offers only standards and does not curate custom collections or offer reformatting of documents on behalf of either publishers or customers. This approach has served it well so far; however, in Outsell’s opinion, underinvesting in discoverability is risky. Less experienced users, including young engineers, equate ease of use with superior discoverability, especially in a remote work environment, with less on-the-job support from experienced team members.

SAI Global Standards was acquired by total assurance provider Intertek as part of a

more significant acquisition of the assurance business of SAI Global. Since assurance is based on management systems standards like ISO 9001, there are synergies that both parties are looking forward to tapping into. SAI Global will have access to Intertek’s North American assurance customers, while Intertek values SAI Global’s presence in ist domestic market of Australia. Besides gaining exposure to Intertek’s assurance customers, SAI Global will be able to support Intertek’s innovative projects as a leading testing and certification provider with a diversified global network of laboratories.

Its 2021 results reflect the internal shifts leading up to and following the acquisition by

Intertek, coupled with increased competitive pressure on the part of Techstreet in

Australia and the launch of its distribution channel by Standards Australia, a key

publisher partner. Against this background, in Outsell’s opinion, gaining exposure to the North American market through the channels associated with Intertek is a welcome shot in the arm for SAI Global. It is especially well-positioned to serve multinationals expanding into the Australian market, bringing Australian regulatory content and standards into its product mix.

IHS Market’s Product Design, formerly part of Consolidated Market Services, has

rebranded as S&P Engineering Solutions following regulatory approval of the February 2022 acquisition. It is one of the few divisions that has been directly transplanted from IHS Markit and has not merged its services with related ones of S&P. Its growth of 6% in 2021 is on par with the market and not reflective of any significant market share wins. With 400 publishers as partners, it remains the largest aggregator, with the most sophisticated platform capable of cross-publisher search and discovery and dynamic linking to references across document families.

At its size and price point, and with a tool portfolio unmatched in the standards publishing market, S&P Engineering Solutions is best suited to serving the largest multinational corporations. However, such organizations are more likely to develop in-house knowledge management and data analytics tools and present a competitive challenge to S&P Engineering Solutions’ full suite of products. In Outsell’s opinion, its opportunities lie with its ability to create publisher-agnostic data feeds for the most innovative consumers of engineering information, including standards. It needs to get the critical mass of standards publishers on board with this idea to realize it in the short term against the increasingly competitive aggregator segment of the standards publishing market.

The competitive landscape of the aggregator sector is nuanced: The largest aggregators compete against each other, with customers re-evaluating their agreements every 12 months, searching for better deals. It is not uncommon for organizations to hold subscriptions to several aggregators at a time, “cherry-picking” the best prices for specific collections and ensuring access to their mission-critical literature.

In addition, since part of the aggregators’ value proposition is the facilitation of access and cross-publisher search, players like Copyright Clearance Center (with a comparable service through its knowledge management platform RightFind) pose a competitive risk when it comes to multinational companies constituting the core of the aggregators’ target audiences. Large multinationals are also likely to have in-house platforms to facilitate workflow and the integration of third-party information in their internal processes, which presents a barrier for aggregators promoting a more sophisticated way to access and consume standards. Finally, large multinational corporations expect increased user data transparency on the subscriptions they invest in. They will leverage the advantages of more granular content to unbundle their subscriptions for financial or operational reasons.

On a smaller scale, aggregators compete against their publisher partners for business from mid-sized and smaller enterprises and aggregation for niche industry verticals that some SDOs are ideally suited to serve, like IEEE in the telecommunications industry. On this front, publishers are supported by vendors keen to satisfy the demand for technology meshing content from multiple sources. XSB, Realta Online, and Global Data Vision all have these capabilities. These developments will fuel competitive tension among the top leading aggregators as they strive to maintain a state of collaborative co-opetition with their publishing partners.

_____________________________________________________

Performance by Category: National Standards Bodies (NSBs)

_____________________________________________________

The NSB sector remains affected by currency fluctuations: It reported a 10.7% growth in 2021 in US dollars due to exchange rates. In national currencies, the average growth rate was 8.3% for this sector, also a robust result and the best in several years.

Figure 6: National Standards Bodies Standards Revenue by Provider, 2021

Source: Outsell, Inc.

As in previous years, NSBs in mature economies continued to generate the most revenue. The top 10 NSBs in revenue terms — six from Europe and one each from the United States (ANSI), China (SAC), Japan (JSA), and Australia (SA) — accounted for 65% of sales in this market subsegment.

Coming off a financially challenging 2020, the NSBs were able to support the post-pandemic rebounds in their domestic economies with a direct benefit to their toplines. These results were largely unexpected, as many budgeted very conservatively in the middle of pandemic uncertainty. However, businesses relaunched projects put on hold in 2020 and took full advantage of subscription services available from NSBs. Most of the growth was generated by the increase in subscriptions, with growth in retail much less significant.

The leading NSBs — BSI, NEN, DIN, and AFNOR — continued to perfect their products launched in late 2020 or early 2021. For all of them, the focus was on data collection and management and the provision of value-added features like redlining and requirements extraction. We have also recorded a common interest in connecting proprietary content with customer assets and integrating standards content with the wider IoT ecosystem of defined digital objects. On that subject, BSI was in the second year of piloting its BSI Identify database of persistent identifiers to improve traceability for the construction industry, with positive adoption results. The construction industry is also the focus of BSI’s work with the Digital Twin (DT) Hub, led by the UK Government, developing community data interoperability with standards.

DIN’s approach with its new platform Nautos is to move beyond the provision of a platform to the provision of knowledge management software that offers collaboration features. It accommodates third-party content and internal documents, all dynamically integrated with DIN standards. Nautos is optimized for XML and can accommodate a range of business models supporting the flexible consumption of standards.

Recognizing the need to share content seamlessly among standards development organizations, several European NSBs — BSI, DIN, NEN, Standards Norway, SIS (Sweden), and DS (Denmark) — are collaborating on the exchange of best practices and improvements to the compatibility of their back offices via shared technology. The objective of this collaboration is to serve broad audiences within their domestic markets, keep standards prices accessible for businesses of all sizes, and create cost-effective data products. In addition, they are participating in initiatives for the CEN community to develop shared digital infrastructure for European standards development organizations. We expect the impact of this collaboration on the competitive dynamics in the standards publishing market to be more apparent in two to three years.

____________________________________________________

Performance by Category: Standards Development Organizations

_____________________________________________________

Figure 7 shows that, in contrast with the results of 2020, the SDO subsegment of the

standards market recorded the weakest returns in 2021 among the categories of market

players, with year-on-year growth of 1.8% in US dollars.

Figure 7: Standards Development Organizations Standards Revenue by Provider, 2021

Source: Outsell, Inc.

This subsegment is prone to ups and downs in annual revenues due to the impact of

flagship publications and the health of the industries with which they collaborate. A case in point is ASME, an outlier in 2020 with 31.7% growth in revenues attributable to the 2019 edition of the BPVC and experiencing a 15.6% drop in revenues in 2021. The cycles are predictable, and standards developers have dealt with them for decades. As subscriptions and recurring revenues become the mainstream, Outsell expects the peaks and valleys in demand to smooth out.

The two strategic areas of investment in 2021 for the leading SDOs continued to be their technology portfolios and the integration of standards in the broader information ecosystem to support the end-user. This included creating learning materials and guidelines and repurposing and redirecting standards content to be used independently of the specific standards that content is based on.

Some of the initiatives launched by larger organizations behind the top SDOs in 2021 are not directly related to the development and distribution of standards. Still, they are intended to nurture their memberships and keep a broader stakeholder audience engaged. SAE International recorded interest in its new Edge Research reports, created to keep the industry informed of new developments that are not yet ready for standardization. This strengthens SAE’s position as a thought leader in the industry and keeps its audience interested, priming potential standards committee members for joining. ASME acquired Metrix Inc., an event and marketing platform, and IEEE launched IEEE Discovery Point for Communications, a platform curating communications-specific engineering solutions and information. These initiatives leverage the organization’s positions as academic publishers and industry associations to put the development and consumption of standards in the context that works best for their target audiences.

In the same vein, ASTM finished its ASTM 2.0 project in 2021, boosting the stability of its Compass platform and enhancing the members’ area and the collaborative features. Stakeholder engagement is at the core of UL’s Modern Standards Program, also launched in 2021. UL seeks to address the perennial issues of standardization lagging behind the pace of technology by modernizing its development process. All these initiatives are steps to ensure that SDOs are on point delivering the volume of standards and related literature required by the industry and on top of the industry’s developments. Outsell expects the production and distribution of standards by leading SDOs to increase, driving revenues.

Coming Soon: The final part of „Global Standards Publishing“ with Advanced Standards Publishing Formats – Meeting User Expectations – Essential Actions – Leading Standards Publishing Bodies Organizations

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

Neue Ausgaben von Open Password erscheinen dreimal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe