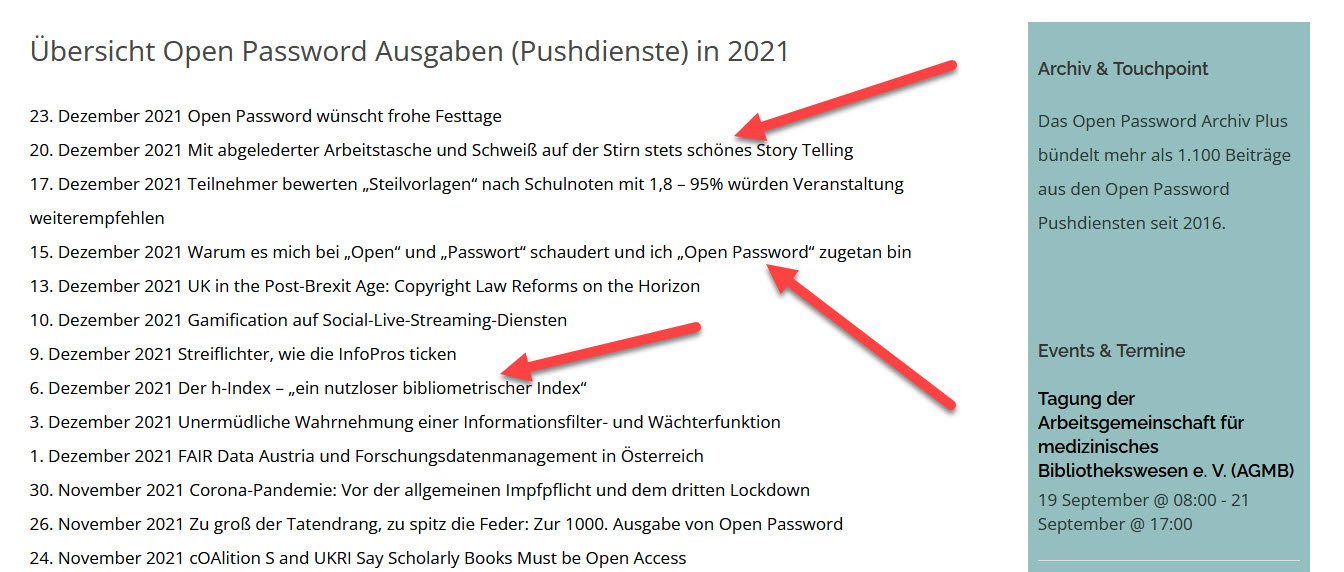

Open Password – Freitag, den

- August 2018

# 425

Credit Information – Data Protection Policy – Asia Business – EU Commission – Joachim C. Bartels – Business Industry Association – Financial Crisis – US Market – China – People’s Bank of China – Consumer credit information market – Credit Reference Center – Alibaba – Tencent – Credit Scoring – Artificial Intelligence – Big Data – Kreditech – Joseph Stieglitz – Ant Financial – Alipay – India – International Financial Company – Risk Management – D&B – Creditsafe – Analytical services – Moody – BvD – S&P Global – Anthea Stratigos – Outsell – Decision Support – Fraud Prevention – Risk Assessment – Machine Laerning – Blockchain – GDPR – Money Laundering – BIIA Conferences – LinkedIn – Cybercrime

Kreditinformationen weltweit

und die Datenschutzpolitik in Europa

Business in Asia: „For those

who can stomach the risk

may eventually reap the benefits“

Scoring as a Key Competitive Element

„The EU Commission Overkill

in Data Protection“

Joachim C. Bartels is Managing Director oft he Business Industry Association. His comments in this interview are his private opinions and do not necessarily reflect the opinion of BIIA or its members.

Als wir unser letztes Interview führten, stand die Welt im Schatten der Finanzkrise. Seitdem hat sich sehr viel und vor allem die politische Großwetterlage verändert. Driften die USA und Europa auch im Geschäftsleben auseinander?

Certainly, a great deal has changed since the financial crisis. The financial systems have recovered and most importantly the US government got most of its bail-out money back. Unfortunately none of the culprits went to jail.

I do not think the business communities of the US and Europe are drifting apart. The US is still the largest consumer market and too important for European exporters to be ignored.

________________________________________________________________________

Business in China: Difficulties and Potentials – Fintech Technology: Scoring and Lending.

________________________________________________________________________

Eine der großen Entwicklungen der letzten Jahre ist der weitere politische und wirtschaftliche Aufstieg Chinas. Haben sich hier die Geschäftsmöglichkeiten für ausländische Unternehmen, speziell der Kreditinformationsanbieter, verbessert?

China exerts total control over the information flows within its country and information flows entering its borders. Same applies for credit information. To operate a commercial or consumer credit information business one has to obtain a license from the regulator, the People’s Bank of China (Central Bank). There are only a few commercial credit information companies licensed, because they were established before the new law controlling the credit information services was introduced. They received their license in retrospect.

The consumer credit information market was off limits until recently. The Credit Reference Center, operated by the People’s Bank of China, was the only supplier of consumer credit information. To date there is little opportunity for a foreign owned consumer credit information company to operate in China. It may change following the relaxation of restrictions for financial services to hold a majority interest in China operation. Since credit and information are intertwined, credit information may follow.

Here is some background: The Credit Reference Center operates similarly to the credit reference centers of the Bank of France and the Bundesbank. Banks report lending activities and performances to the Credit Reference Center and banks can retrieve information for risk assessment purposes. It is a closed system, only banks have access to it. The Credit Reference Center is the largest credit bureau in the world containing information on 800 million data subjects – approximately 300 to 500 million are credit active.

About two years ago the Chinese regulator opened the consumer credit information sector to Chinese companies to give them a head start before opening the sector to foreign companies. Among the 8 companies selected were Alibaba’s Ant Financial, Tencent, and other financial services companies, however, they all failed to obtain a license as of today. Some of them are still operating on a test basis. Up to now only one Chinese company has been granted a license to operate a consumer credit information business (credit bureau). In addition is hold data on 27 million companies.

Können oder müssen wir mittlerweile von China lernen, beispielsweise von den dort bestehenden umfassenden Möglichkeiten des Scoring?

Opportunities or experiments? The question implies that there is a perception that we in the Western world may be able to learn from the Chinese concerning credit scoring? That would certainly be a misconception.

China is a huge consumer market with a high reliance on electronic media, e-commerce electronic payments and online lending systems. In the absence of access to traditional credit histories (The Credit Reference Center is off limits to non-banking institutions), the Chinese online lenders became highly creative in using credit scoring in conjunction with alternative data: mainly use of social media and or data from mobile payment systems.

Credit scoring is a well-defined technology and the general tendency is to perfect decisions systems (higher accuracy of the decision, better insights) particularly in conjunction with Artificial Intelligence (AI). China is no exception and it aims to become a super power in the use of Artificial Intelligence. Credit scoring does not work without reliable and timely data and in many cases people believe that one can use credit scoring for risk assessment effectively without the use of traditional credit histories.

The rise of Fintech technology and the use of alternate data (BIG Data) in conjunction with extreme analytics have suddenly chan ged the way credit is being granted. Fintech companies everywhere have been very creative in providing tools for on-line lending using latest scoring methodology and the use of alternative data by tapping into new data pools such as mobile payment systems and social media data. When Fintech companies decided to go into lending themselves, they believed that they had better scoring models than banks. They even taunted the FICO’s scoring method as being inadequate. Little did they know that in most instances they were moving on treacherous ground accepting too much risk.

Case in point: The German on-line lender Kreditech had taunted the financial services industry that they had superior technology, had no need for credit histories and could provide many unbanked people with access to credit than banks could do. Recently the management of Kreditech was replaced by bankers and the ‘high-tech’ founders are now working in second tier management functions.

In my opinion, Fintechs should stick to their mettle providing online lending technology to lenders and leave the lending to financial experts.

Fintech technology took off in China because of the monolithic attitude of banks in not providing adequate lending to the general public. In the absence of credit data (Credit Reference Center off-limits to non-banks), Fintechs and peer-to-peer lenders found very creative ways to tap into new data sources. The term credit scoring became the underlying theme for such ventures. Much was built on hype rather than substance. In essence many of the online or peer-to-peer lending lead to a credit boom ending up with heavy credit losses, prompting the People’s Bank of China to step in to close down many of such businesses.

The Nobel Laureate Joseph Stiglitz (former Chief Economist of the World Bank) once wrote a long time ago: “Imperfect information makes imperfect markets”. A maxim obviously not followed by many Fintechs.

The most successful Fintechs in China are Alibaba’s Ant Financial and Tencent. They are now leading the pack in online lending because they have an enormous amount of internal consumer data derived from transactions of their respective e-commerce businesses, retail activities and mobile payment systems (for example Alipay has over 500 million users). China and India are the only nations with such potential.

________________________________________________________________________

India and Other Asian Contries – Welcome to Robot Land!

________________________________________________________________________

Wie entwickeln sich die geschäftlichen Möglichkeiten der BIIA-Mitglieder in den anderen Ländern Ostasiens und des pazifischen Raums? Welche besonderen Risiken und Chancen?

Whether China will open up the market for credit information is uncertain. Much will depend on whether western financial services are able to enter the market. Many of our members are on standby.

India opened the market for credit information some time ago and five of our BIIA members are very active there. It took 10 years for the Indian government to open up the market and to allow full control over such businesses.

There are some European niche players who have successfully entered smaller markets in Asia. In many smaller Asian markets the credit infrastructure (banking, credit bureaus, business registers, court systems) is still underdeveloped.

For those who can stomach the risk (time and money) may eventually be able to reap the benefits.

The International Finance Company (IFC-World Bank Group) is still very active to open credit information markets in remote central Asian countries. The IFC is very active in advising central banks to set up the legal basis for information sharing between the financial services sector setting the stage for the private sector in establishing credit information services. Most of the credit bureaus which had been established in Asia are now members of BIIA.

… und in den USA?

The US is still one of the most sophisticated information markets, especially in consumer credit information with three credit bureaus leading the pack. Analytics, artificial intelligence, machine learning, fraud prevention and identity services being in high demand. It is no longer credit reporting, it is called risk management services.

Consumer and small business lending has become an automated process, the loan officer is being phased out, thus welcome to robot land. The commercial credit information market is quite fragmented with D&B and Experian holding the high ground while smaller players try to survive under the price umbrella of the larger players. Surprise, surprise, a relative newcomer, called Creditsafe, has entered the market unperturbed carving out a sizable niche.

Not to be outdone, the rating agencies have recently invested substantial sums of money in new technology (mainly AI), to gain considerable insights on businesses and their environment. Bond rating is no longer their only domain. Their analytical services are fast growing and are extended to provide valuable insights into the credit standing of non-listed companies and those who usually have no access to capital markets. That does not bode well for traditional commercial credit information companies. Case in point: Moody’s spent over US$ 3 billion to acquire private company data supplier Bureau van Dijk (BvD). The Moody/BvD global data base contains data of 280 million private companies surpassing market leader D&B by 60 million. S&P Global paid US$ 500 million for a leading artificial intelligence (AI) start-up and is moving into the same direction

______________________________________________________________________

The Intransparency of Asian and European Credit Information Markets.

________________________________________________________________________

Konnten aus Ihrer Sicht die europäischen Anbieter, beispielsweise Creditreform, im letzten Jahrzehnt ihre Positionen halten?

Let me provide you with some general observations without mentioning names. The credit information market in Europe and Asia is not transparent. Many non-listed companies do not provide information about their performance. It is however apparent that the traditional commercial credit information companies are no longer growing (with the exception of Creditsafe).

The cedit insurance business, as a customer and competitor, is no longer growing either.

Anthea Stratigos (CEO of Outsell) wrote not too long ago” “Many of these markets are mature. They are not growing. To achieve 10% growth in most of our industry’s sectors requires inorganic growth, a full throttle focus on market share gains or both.”

The consumer credit information companies are just doing that, but not the commercial credit information providers. Commercial credit information companies may not survive medium term unless they invest heavily in new technologies (analytics and AI) and acquire market share.

________________________________________________________________________

The Combination of Analytics and Artificial Intelligence – Lurking in the Wings are Blockchain Concepts.

________________________________________________________________________

Haben sich die Analyse- und Scoring-Möglichkeiten im letzten Jahrzehnt stark verbessert? Große Chancen für Künstliche Intelligenz?

Analytics (decision support – scoring) have become a key competitive element in credit information / risk assessment services for our industry. The combination of analytics and AI will be the future lead technology to tackle a number of key issues:

- Combating cyber crime o Financial fraud o Identity theft

- Securing financial transaction

- Fraud prevention – fraud is still rampant with criminals stealing billions

- Reducing risk and cost of risk assessment – Gaining insights on risk characteristics and the risk environment of a business/or private borrower – Risk shifts over time thus tracking risk parameters has become a key feature of risk management

- Cost reduction is a key element (banks are shedding jobs in the Tens of thousands).

- Analytics, Artificial Intelligence, Machine Learning, Identity management etc. are services in high demand and will be in high demand for some time.

BIIA is tracking company announcements concerning acquisitions, partnerships and internal product development, within the business information industry. We have observed, during the past two years, that many information companies are using acquisitions and or partnerships as a fast track method to acquire these new skill sets (rather than developing them in-house).

Lurking in the wings are Blockchain concepts. Perhaps over time Blockchain (distributive ledger technology may not only change our industry, but also those of our clients as well. To date not many concepts have entered the Beta test stage. Thus there is still too much hype and little substance. Nevertheless the technology cannot be ignored and BIIA is monitoring potential applications.

________________________________________________________________________

The EU as the World’s Policeman for Data Protection.

________________________________________________________________________

Sagen Sie doch mal etwas zum Wahnsinn der europäischen Datenschutzpolitik!

Perhaps one can describe it as an “EU Commission Overkill”

- Shocking: Everybody had to be compliant by May 25th, 2018. According to a survey by Reuters about 23 national jurisdictions are not ready to perform their regulatory duties. Who will fine the respective regulators?

- The EU GDPR initiative is already being perceived as an aspiration by the EU to become the world’s policeman for data protection.

- Consent in lending or open credit activities is an ill placed concept. It does not protect the financial services sector and the economic environment. It does not help the borrower either. Lack of information leads to financial exclusion.

I support measures designed to:

- Protecting the data held on data subjects (businesses or individuals).

- Restrict the use of data within the context of a transaction. Any other data on a data subject not relevant to a transaction should not be collected and stored.

- Improve the transparency of credit transactions in the interest of protecting the health of the financial services community and economic growth – Beneficial owners of businesses and those who hold proxy powers need to be disclosed

- Support anti-money laundering measures requiring transparency (know your customer)

- These are key requirements designed to protect national economies and the financial system – consent or to withdraw (opt out) should not be permitted.

______________________________________________________________________

BIIA prosperiert.

_______________________________________________________________________

BIIA is in good health?

BIIA (launched in 2005) was created to assist members on industry advocacy and to be a window for legal and technical developments.

Within two years BIIA became a global association providing important insights on business information developments. Today BIIA has 75 members.

- The last three BIIA conferences were a sellout. The key topics centered on key technology developments impacting our industry and clients.

- Unique visitors to the BIIA website are 3,000 to 4,000 per month extracting over 20,000 pages of information. The largest readership is in Asia with 39%, followed by the USA with 37% and Europe with 24%. Within Europe the UK, Germany and Italy represent the largest readership.

- We are monitoring industry developments on a daily basis. Our database has reached over 9,500 articles for the use of our information users, regulators, academia and the general public. Specific articles (approx. 25% of our content) is password protected and for the use of members only. Thus during the past 12 years BIIA has become one of the largest source on business and credit information.

- BIIA Network on LinkedIn has over 3.200 members, together with approximately 1,000 information professionals employed by our members, is a network comprising of over 4,000 members

- BIIA’s Board of Directors represents a pool of professional competence.

- BIIA represents the interests of its membership by participating in international and regional committees that focus on information services such as the World Bank International Committee on Credit Reporting (ICCR) and the B20 Taskforce on Financing SMEs in Global Value Chains

The association also represents the interest of its membership by being actively involved in regional initiatives that seek to develop the information that is available to support growth in region such as the Financial Infrastructure Development Network (FIDN) established as part of the work of the APEC / ABAC financial infrastructure development forums.

________________________________________________________________________

Opportunities and Perspectives in Coming Years.

________________________________________________________________________

Ein paar Worte zu den Chancen und Perspektiven der kommenden Jahre?

This is a tall order to describe what will happen in the next couple of years! I started in my career in business information when our industry was using paper based products. Planning horizons were 10 years, today we don’t even know what will happen next year.

- Technology is changing too fast for many industry players to keep up with – If companies do not have the resources to either develop new skills in-house, or to acquire them, or to enter into partnerships, they will be left on the roadside.

- Our industry is involved in a catch-up state of war with cybercrime

- Will companies have the resources to defend themselves against cybercrime and at the same time to be able to invest in new product development? – Assume that any data base can be hacked, thus the next hack is just around the corner

- Defending yourself against cybercrime will tie down too many resources (financial and skills) which may not be available for product development and growth. It may retard growth.

- There is a lot of hype about artificial intelligence (AI) being a potential solution to such problems? However Cyber criminals have access to the same technology.

- Cynically I venture to say it may be better to hire cyber criminals to fend off other criminals and to provide vital skills to better monetize the value of information. Cyber criminals are masters in monetizing data.

These are the immediate perspectives of the year. Unless governments (and UN) step up to the plate to impose sanctions on states who harbor cyber criminals there will be no chance for our industry and our clients in having any success in combating cybercrime. Once this has been achieved we may be able to divert our attention to new business!

Private observations of Joachim C Bartels – Joachimcbartels@gmail.com

Anzeige

FAQ + Hilfe