Open Password – Freitag,

den 17. April 2020

# 739

Conora – COVID19 – Data, Information and Analytics Industry – Ned May – Outsell – BSB Media and Business Information – Scholarly Communication – Informa – Home Office – Advertising – Marketing Research – Research Subscriptions – Quality Research – Company, Contact, and Personal Information – STM Information – Open Access – Credit, Financial, and Risk & Compliance – Legal & Regulatory Solutions – Court Technology – Pharma Information & Solutions – Heathcare Solutions – Social Distancing – Telemedicine – Education & Training Solutions – School Closures – Virtual Learning – Free Access – Subscription Business – Normalcy – Financial Disruption – Weltweiter COVID-19-Barometer – Kantar – Finanzielle Sorgen – Gesundheitliche Gefährdung – Wirtschaftliche Entwicklung – Nachrichtenkonsum – Vertrauenswürdige Quellen – China – UK – Brasilien – Regierungswebsites – Gestaltung des Alltages – Unternehmen und Corona

Conora

COVID-19’s Impact on the Data, Information,

and Analytics Industry

By Ned May, Outsell, VP Analytic Operations

With global reactions to COVID-19’s potential impact spreading possibly faster than the virus itself, Outsell analysts paused to gather our thoughts on its impact and what it means to operating leaders and their boards and teams.

___________________________________________________________________________

What to Know and Why It Matters

___________________________________________________________________________

The most important issue facing everyone today is not the long-term health of the data, information, and analytics industry — it is the immediate health of our loved ones. That said, Outsell is observing a broad state of panic unfold across nearly all aspects of our lives, and in times of crisis, we believe in the importance of rational analysis and veracity of reactions from those in the best positions to provide insight.

Just as epidemiologists are essential to understanding the impact of COVID-19 on health and we encourage everyone to seek understanding from them, what follows are our best views on the pandemic’s near and longer-term impact on our own industry in 2020. Each of our segment experts provided input to this analysis, which is organized by the major segments we cover. In the broadest terms, structural change that was already underway will accelerate. The impact on underlying markets is mixed. Some, such as events, will witness dramatic downturns and a likely upheaval of the landscape of providers. Others, such as Education and Legal, will see pockets of strong growth.

B2B Media and Business Information

Impact: Contraction (~$4.3 billion decline in B2B events revenue and $450 million decline across B2B print)

The events business is quickly becoming B2B media’s “cruise industry,” and the impact has been immediate. Companies are scrambling to postpone shows, but finding room in the second half of this year will be challenging. At some point, the calendar will run out, and they’ll be too close to next year’s shows to postpone. This holds for the scholarly communications sector as well, which is now also postponing major shows and events.

Some companies will shift their event experiences online, but for big players, the sheer number of event cancelations and the supply chains around them in the weeks ahead will weigh on their teams’ ability to quickly go virtual. Outside of the B2B Media and Business Information space, company sponsored events like Adobe Summit, Salesforce’s Dreamforce, Google I/O, and Facebook F8 will lend themselves well to virtual audiences because tech companies have the technological infrastructure to pull them off.

Informa, with events at 65% of its mix, has so far postponed or canceled 130 shows, with an impact of £450 million. Others, like Emerald Expositions, Clarion Events, and Haymarket Media, will see significant revenue disruption, and the impact will increase because the virus has yet to peak in many countries.

On the media side of these businesses, the impact is less pronounced. The shift to working from home will drive website traffic higher because employees need to stay in touch with their industries through their trusted media sources. Advertisers will shift more ad dollars from events and print to digital as B2B audiences move almost exclusively online. The nature of who is advertising will shift as well because categories like travel may dry up near-term while others such as health and wellness explode.

B2B media companies with significant print assets will face substantial print revenue erosion. The reading of print materials in public places like on airplanes and doctor’s offices will suffer greatly this year, decimating what was left of the B2B print media industry.

Marketing Research

Impact: Contraction (~$4 billion decline in a $43.5 billion market)

COVID-19’s impact on the marketing research industry will be immediately felt in 2020 but not evenly across the board. Those with a high proportion of revenue from discretionary custom research will experience a sharp decline near-term. However, many custom research providers lock in annual or even longer contracts that insulate them well from economic or societal crises such as this one.

Customers need to feel the full force of the market’s meltdown first on their Q2 and Q3 revenue and earnings. This will result in belt-tightening down the road during the next round of research contract negotiations, most of which may not occur until Q4 2020 and into early 2021.

Conversely, syndicated research subscriptions won’t experience much of an impact because those contracts and their revenue recognition are locked in this year. If companies start to slash budgets toward the end of this year, those contracts could become more exposed, but they’re relatively safe for 2020. However, those related to new product launches will delay if those products get pushed.

COVID-19 is having an immediate impact on qualitative research efforts such as focus groups, which will stop functioning during the crisis. Qualitative interviews will proceed, though at a slower pace, as business professionals move to digital environments and do these by phone or video when they’re not dealing with disruption to their businesses. Focus groups could be replicated by Zoom or WebEx, but the industry will need to move swiftly.

Company, Contact, and Personal Information

Impact: Minimal (~$100 million decline in a $14 billion market)

Even in times of crisis, companies need good data. Office closures will disrupt the ebb and flow of these businesses momentarily and the cadence of their deal closure rate over the next few months. These businesses are almost entirely online, so they don’t have large offline parts to protect. The impact of workers moving to work from home scenarios will also not affect their operations much in terms of the load required of their client service teams.

With a large majority of services now subscription-based, the Company, Contact and Personal Information market will weather the COVID-19 storm better than other market segments such as B2B Media. Providers may experience a slowing of sales momentum in the near term as their customers and prospects get disrupted by office closures. Many providers might delay some upcoming product announcements simply because their customers will remain distracted over the next few months.

Science, Technical and Medical Information

Impact: Contraction (~$650 million decline in a $27 billion market)

The immediate impact for publishers will stem from a disruption in workflows and submissions due to office closures and reduced workdays, meeting and event cancellations, disruption experienced by universities, and reduced demand from China. Associations, smaller publishers operating on tight budgets, and OA publishers relying on transactional revenues will be affected the most.

That said, in the long term, COVID-19 may prove to be the black swan event for STM when it comes to open access. There has been a surge in interest in open access publications from the general public looking for expert opinions. In addition, researchers have been actively posting their OA findings, attempting to advance the discovery of a vaccine and share best practices for containment. These activities have also been supported by major publishers, providing further evidence for the cause of open science.

As such, researchers are likely to fuel the political will of funders and regulators to accelerate the OA mandate, pushing the market into the „Beyond the Tipping Point scenario of an advanced implementation of open access“ we previously described. According to that scenario, we predict annual growth of 20% in overall OA articles and net margins slashed to negative amounts by 2023, and the journal market effectively losing up to 10% of its value. As the impact is setting in, we expect 2020 subscription revenues to be down 5%.

Credit, Financial, and Risk & Compliance

Impact: Minimal (~$100 million decline in a $108 billion market)

While this period of heightened uncertainty dramatically increases the need for more insight into credit, financial, and risk and compliance activities, the funds needed to procure such additional solutions will likely dry up in the near term. As such, companies will need to operate with what they have. This will contribute to flat market growth in these segments, given the potential increase in demand for these solutions, while financial firms and companies tighten their solution budgets.

SMBs, both providers and customers, will be the most hurt in this pandemic. The basis of SMB information and solution providers is lower cost of ownership. A rise in data sourcing costs means their margins are stretched thin as it is. SMBs such as small financial firms and retail banks will potentially close shop (due to client panic and early investment redemption), and there will be a drop in mortgage originations due to lost jobs, despite borrowing rates now at historic lows. This will result in a likely drop in the demand for such information and solutions, which applies to financial, credit, and risk and compliance information and solutions.

Legal & Regulatory Solutions

Impact: Growth (~$960 million growth in a $25.8 billion market)

The immediate effect in the legal services market will be a temporary halt of M&A deals amid market uncertainty. This will impact the legal services sector, where the work involved in large corporate transactions is a vital revenue source, although this could be short-term if the COVID-19 pandemic comes under control by mid-summer. A longer period of uncertainty will force law firms to cut costs, including spending on legal solutions. However, annual and multi-year subscriptions will insulate legal solution providers for the next 12-18 months, by which time the economy may have come through to the other side.

Longer-term, COVID-19 will also drive further adoption of cloud-based solutions and more innovative court technology, and it is likely to lead to the introduction of new regulations, legislation, and compliance requirements to reduce the effects of future outbreaks. Overall, Outsell expects that impacts from the COVID-19 pandemic will directly add $960 million, or 3.7%, to the Legal & Regulatory solutions market in 2020, on top of existing expected growth. Four subsegments particularly stand to be affected by the COVID-19 pandemic: Legal Practice Management Software, Court Technology & Online Dispute Resolution Systems, Legal Information for Consumers, and Continuing Legal Education.

As an example of one of these, courts are the frontline of the justice system and are most exposed to COVID-19. Several governments have already announced the closure of their courts for nonessential functions. Ahead of the outbreak, the court tech subsegment was already growing at 12% per year, after two decades of underinvestment. Outsell expects that the pandemic will be the paradigm shift that finally drives mainstream adoption of online court technology.

Pharma Information & Solutions

Impact: Growth ($1.6 billion growth in a $16 billion market)

Pharma will be one of the biggest beneficiaries as diagnostic tests and vaccine candidates are rushed to development. For example, the European Commission has offered up to €80 million to the German biotech firm CureVac AG to support vaccine discovery. In addition, German company BioNTech announced a $135 million partnership with Shanghaibased Fosun Pharmaceutical Group to codevelop a COVID-19 vaccine in China, then announced a partnership with Pfizer to develop a vaccine outside of China that’s expected to be in phase I clinical trials by late April.

Other vaccine candidates are now in development by companies around the world, including Inovio Pharmaceuticals, Moderna, Oxford University, Imperial College London, and Queensland University in Australia. Overall, diagnostic testing and drug discovery around COVID19 will have a positive impact of up to 10%.

Healthcare Information

Impact: Growth ($4.5 billion growth in a $114 billion market)

Health information providers will see an increase in demand as healthcare systems realize they need quality information tools in the case of a pandemic, even if it’s a rare occurrence. One of the biggest beneficiaries of the “social distancing” phenomenon is telemedicine, as patients are told to call providers rather than show up at emergency rooms and as demand for remote psychological care explodes. In the US, for example, telehealth services have been expanded for Medicare beneficiaries, including allowing physicians to use their personal phones.

The health information industry will experience an uptick of approximately 3-5%, bringing the segment to approximately $16 billion. Already financially challenged healthcare providers, however, will see a negative impact of up to 20% as they struggle to keep up with demand while forgoing profitable procedures.

Education & Training Solutions

Impact: Growth ($8 billion growth in an $87 billion market)

The most immediate impact of COVID-19 on education has been the closure of schools, colleges, and universities. All K-12 schools in Italy are closed and unlikely to open until mid-April at the earliest, schools and universities in China are also closed, and so are schools in many other nations, while many higher education institutions worldwide have rolled out virtual delivery for all courses.

This sudden shift toward virtual learning at scale took many institutions by surprise. Although a third of higher education students in the US take one or more online courses, virtual learning is not yet in a position to be easily scaled because of the need for synchronous access to individual platforms at specific times, which could cause system crashes. This is particularly true in the K-12 market, although occasional snow days have acted as a trial run for longer periods of school closures in limited areas. Additionally, most educators, particularly in K-12, have little or no experience delivering online learning.

This forced move to virtual learning marks a paradigm shift for providers of digital content resources and tools that facilitate online classes, and we expect it to lead to increased demand long-term. In the short term, however, it is crucial that providers aren’t seen to be taking advantage. Several have opened up their solutions for free access, including Twinkl in the UK (free downloadable resources for parents forced into homeschooling), JoVE (temporary free access to Science Education videos through June 15th for STEM teaching) and Annual Reviews (temporary removal of access controls to content).

___________________________________________________________________________

Essential Actions

___________________________________________________________________________

Certain markets will face impacts well beyond what can reasonably be sustained in the short term, and it is unclear what stimulus packages will appear to ease challenges across each. Governments are discussing such plans, and we can only speculate about what will transpire. For example, we envision an impact on the global travel industry in the realm of $50 billion or more, but this is if nothing is done. For now, here are the steps we advise everyone to take to alleviate some of the challenges ahead.

For those with significant subscription businesses, don’t panic. While uncertainty is likely to continue to rise in the near term, a long-term view indicates that the industry overall is relatively stable. Resources will certainly need to shift as some areas of demand disappear while new ones emerge, but with a few exceptions, the changes will not likely be severe or long-term.

Understand that online communities differ from physical ones. For those with events business, look aggressively to find new venues for digital engagement now, but don’t set these up to mirror the physical world. Face-to-face meetings are different online, with distinct attention spans, visual cues, and general energy levels. Expect interactions to unfold and maintain themselves in different ways.

Be prepared for normalcy to return. While they might be novel for a while, virtual cocktails won’t take hold long-term. Similarly, when the travel bans get lifted, face-to-face physical events will likely return rapidly due to pent-up demand. Those prepared for this will get a boost that offsets today’s challenging click.

Conserve cash. There will be financial disruption beyond what we’ve seen. The longer this goes on, the more challenging it will be for certain sectors to recuperate. It’s essential to manage liquidity and contain costs alongside revenue shortfalls. In a recession, even a short one, cash is king.

Scrutinize the Business. Emergencies tend to bring out questions about why things are done a certain way and what’s really driving value. This is the time to scrutinize aspects of the business and optimize them for not only current conditions but the long haul.

Do the right thing now and worry about monetizing it later. As we are seeing with open science and in EdTech platforms, players across the industry can play a valuable role in society’s collective transformation to a new normal. Seize on that role by demonstrating capabilities to the broadest set of users without regard to near-term gains.

Weltweiter COVID-19-Barometer

Finanzielle Sorgen werden wichtiger genommen

als die gesundheitliche Gefährdung

Von Unternehmen wird Übernahme

gesellschaftlicher Verantwortung erwartet

Junge Altersgruppen krempeln

ihr bisheriges Leben um

Globales COVID-19-Barometer: Mit fortschreitender Pandemie überwiegt die finanzielle Unsicherheit die gesundheitlichen Bedenken. Der Nachrichtenkonsum steigt und die Menschen gestalten ihren Alltag achtsamer

Die aktuelle Analyse des COVID-19-Barometers, der globalen Verbraucherstudie von Kantar, untersucht, wie die Menschen im Verlauf der Pandemie reagieren und sich an die „neue Normalität“ anpassen. Zentrale Ergebnisse der zweiten Welle der Befragung von mehr als 30.000 Verbrauchern in über 50 Ländern sind:

__________________________________________________________________________________

Die finanziellen Sorgen werden aktuell am wichtigsten genommen.

__________________________________________________________________________________

- Mehr als die Hälfte der Menschen weltweit (52 Prozent) gibt an, dass ihr tägliches Leben von der aktuellen Situation beeinflusst wird – gegenüber 39 Prozent in der ersten Befragungs-Welle.

- Überall auf der Welt nimmt die allgemeine Besorgnis mit dem Fortschreiten der Pandemie zu. Besonders deutlich wird dieser Anstieg in Großbritannien (Steigerung um 23 Prozentpunkte auf 82 Prozent) und in den USA (Steigerung um 21 Prozentpunkte auf 79 Prozent).

- Finanzielle Sorgen überwiegen die persönlichen gesundheitlichen Bedenken. 68 Prozent der Menschen sagen, dass die Situation eine proaktivere Finanzplanung erfordert (gegenüber 62 Prozent in Welle 1), und 60 Prozent sind besorgt über die Fähigkeit der Wirtschaft, sich zu erholen (53 Prozent in Welle 1). 50 Prozent der Menschen sind besorgt, krank zu werden, im Vergleich zu 45 Prozent in der ersten Welle der Studie.

- 78 Prozent der 18-34-Jährigen geben an, dass ihr Haushaltseinkommen vom Coronavirus betroffen ist oder sein wird, verglichen mit 71 Prozent insgesamt.

__________________________________________________________________________________

Der Nachrichtenkonsum ist gestiegen – die Menschen versuchen, informiert zu bleiben.

__________________________________________________________________________________

- Für mehr als einem Drittel der Befragten weltweit (34 Prozent) ist es derzeit vorrangig, vorbereitet zu sein und gut informiert zu bleiben.

- Nationale Medienkanäle wie landesweite Fernsehsender und Zeitungen werden nach wie vor als die vertrauenswürdigste Informationsquelle angesehen. 54 Prozent der Befragten halten sie für eine vertrauenswürdige Quelle (gegenüber 52 Prozent in der ersten Welle).

- Die von Kantar erhobenen Daten zur Messung der Zuschauerzahlen verzeichneten einen signifikanten Anstieg auf der ganzen Welt:

- In China hat sich die Sendezeit für Nachrichtensendungen in den ersten drei Monaten des Jahres von neun Stunden (im Jahr 2019) auf 18,5 Stunden im Jahr 2020 mehr als verdoppelt.

- In 2020 waren in Großbritannien 17 der 20 meistgesehenen Sendungen BBC News.

- In Brasilien ist der Anteil der Zeit, in der Nachrichten gesehen werden, bis zum März um ein Drittel gestiegen.

- Das Vertrauen in Regierungs-Websites ist auf 54 Prozent gestiegen, gegenüber 48 Prozent während der ersten Welle der Untersuchung. Das lässt den Schluss zu, dass sich die Menschen mit zunehmender Schwere der Pandemie vermehrt an ihre Regierung wenden, wenn es um Informationen und Unterstützung geht.

__________________________________________________________________________________

Die am stärksten Betroffenen sehen die Situation als Gelegenheit für einen Neustart.

__________________________________________________________________________________

- Junge Erwachsene spüren eher die finanziellen Auswirkungen des Coronavirus und erleben die größten Veränderungen in ihrem täglichen Leben. Viele entscheiden sich für eine gesündere Lebensweise. Die Menschen versuchen Ihren Alltag achtsamer zu gestalten:

- 59% der 18-34-Jährigen sagen, dass sie sich gesünder ernähren.

- 57% nutzen die Situation als Gelegenheit, um mehr zu schlafen.

- 48% trainieren regelmäßiger.

- 44% konzentrieren sich auf die persönliche Entwicklung.

- 25% entscheiden sich für die Meditation.

- Ältere Altersgruppen (55+) versuchen, trotz den Einschränkungen ihrer Bewegungsfreiheit möglichst viel Sonnenlicht zu bekommen.

__________________________________________________________________________________

Verbraucher erwarten von Unternehmen zunehmend „mehr“.

__________________________________________________________________________________

- Die Ergebnisse aus der ersten Welle der COVID-19-Barometer-Umfrage zeigen, dass die Menschen von den Unternehmen erwarten, dem Wohlergehen ihrer Mitarbeiter Vorrang einzuräumen und ihren Beitrag zur Unterstützung der Gesellschaft in der Pandemie zu leisten. Die Verantwortung der Unternehmen gegenüber der Öffentlichkeit ist noch wichtiger geworden. Die Menschen erwarten von den Unternehmen mehr praktische Hilfe einschließlich dem Spenden nützlicher Gegenstände und der Unterstützung der Regierung.

- 47 Prozent (41 Prozent in der ersten Welle) der Menschen erwarten, dass Unternehmen Krankenhäuser in der Krise unterstützen, während 39 Prozent (35 Prozent in der ersten Welle) sagen, dass Unternehmen die Regierungen stärker unterstützen sollten.

- 31 Prozent der Menschen wollen, dass Marken ihnen im Alltag helfen. Das deutet darauf hin, dass man sich im Leben nach der Pandemie daran erinnern wird, wie Marken sich jetzt verhalten.

- Nur acht Prozent der Verbraucher sind der Meinung, dass Unternehmen mit der Werbung aufhören sollten, wobei viele behaupten, dass sie eine willkommene Ablenkung darstellt, die sie an normalere Zeiten erinnert.

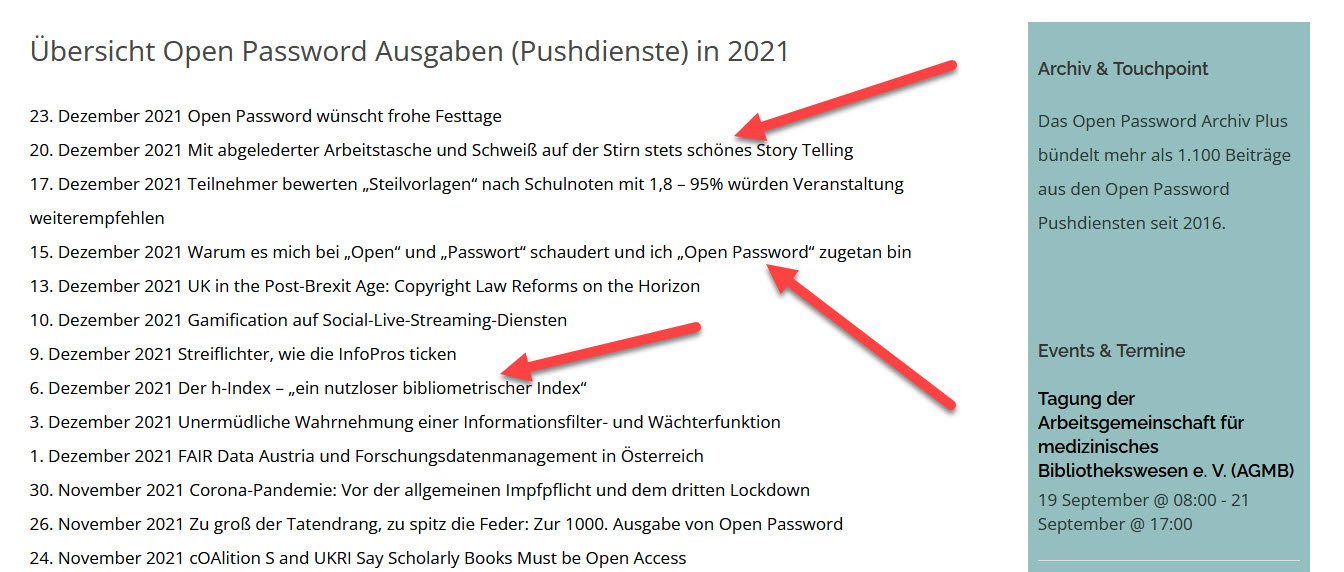

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

Neue Ausgaben von Open Password erscheinen viermal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe