Open Password – Donnerstag,

den 16. Juli 2020

# 788

Outsell – Alternative Data Brokers – Financial Services – Will Jan – COVID-19 – Financial Markets – Brokering Data in Financial Services – Insights – Commision Fee – Geospatial Data – Social Media Data – Transactional Data – Logistics Data – Statistical Data – Census Data – Alt Data – Core Financial Data – Bloomberg – Refinitiv – S&P Global – FactSet – Market Drivers – Market Inhibitors – Freight Information – Machine Learning – Natural Language Processing – GDPR – SEC – Data Cleanliness – Data Scientists – eco – Datensicherheit – Online-Banking – Staatliche Service-Angebote – Shopping-Portale – E-Mail-Anbieter – Zeitungen – Zeitschriften – Soziale Medien – Annette Strauch – Forschungsdatenmanagement – KIT – Claudia Kramer – RDMO – re3data – NFDI – FAIR – Jens Kloppmann – Charlotte Kastner – easydb

Outsell´s Contribution for July

Market View: Alternative Data Brokers

in Financial Services

Market Drivers and Inhibitors

By Will Jan, VP & Lead Analyst

___________________________________________________________________________

Why This Segment

___________________________________________________________________________

COVID-19-induced volatility in the financial markets is driving investors and traders to seek all data that could provide direction at the front line of the pandemic. This report offers insight into opportunities for companies to create new revenue streams by brokering data into financial services.

___________________________________________________________________________

Market Definition and Methodology

___________________________________________________________________________

This area of coverage falls under Outsell’s Financial Information & Solutions segment and is comprised of alt data brokers in financial services. To be clear, while many of these brokers position themselves as alt data providers or platforms, they are, indeed, data brokers. This means they do not create their own data or information in support of financial research but rather help third-party data suppliers refine their content for monetization in financial research, then broker this content to the financial community in return for a commission.

That said, the data suppliers (data owners and originators) could effectively be companies in any industry, since all companies produce some type of data, either as part of their offerings or as byproducts of their operations (data exhaust). Were it not for alt data brokers, these companies would likely remain unaware of the tremendous value (insight) that their data and information may hold for traders and investors in financial services. As such, the alt data broker market has grown exponentially to help companies monetize their otherwise useless data.

From a business model perspective, the alt data brokers in this market generate/create no data or information themselves, deriving their revenues from brokerage fees that they charge to the data owners/suppliers. The data is then offered through the broker’s platform, from where the data is either subscribed to or licensed in a recurring model (e.g., for continued research) or purchased transactionally (e.g., a dataset for a project). The brokers then charge a commission fee, usually ranging from 30% to 50% of the total deal price, while the data owners retain the rest. The fee is closer to 30% if the data requires minimal cleansing and formatting for use by financial services and can range up to 50% if the data requires significant cleansing and formatting before use by financial services.

While the types of alt data used in financial services vary greatly, the following categories have become the most common:

- Geospatial Data: This content includes satellite imagery that provides financial professionals visuals on activities on the ground or at sea that may impact investments or overall market direction.

- Social Media Data: This information speaks largely to the large-scale social sentiments of consumers or businesses or the small-scale behavior of the most influential people (e.g., celebrities or politicians) who can sway the market.

- Transactional Data: This content details point-of-sale (POS) or other deal information as collected through retail channels, e-commerce, consumer/business banking, and electronic payments, which could act as a leading indicator of consumer confidence and company profits.

- Logistics Data: This includes information on freight movements that enables visibility into the inputs and outputs of companies and countries, effectively providing a real-time pulse on the health of the economy.

- Statistical Data: This content describes mostly census data as collected by governments and organizations/associations, which enables the input and output of a company or country to be measured against known denominators.

Because investors and traders could potentially derive signals (indications to buy, sell, or hold) from any type of data — including textual, contextual (via the creation of metadata), audio, and visual — the market for yet-to-be-discovered data continues to grow. A key remit of the alt data broker is to assess how such data could be of value to financial services.

Alt data is not a replacement for core financial data as commonly supplied by the financial research desktops today, such as company filings, reference data, earnings information, indices, pricing, asset- or company-specific news, or price-to-earnings ratios. In fact, all the major financial desktop providers, like Bloomberg, Refinitiv, S&P Global, and FactSet, have already created portals that offer alt data to their users. As such, alt data analytics must be viewed (at least for now) as a supplement to traditional financial research tools (as a form of research enhancement) and not a replacement.

Outsell’s methodology starts with its robust database of over 9,000 global media and information companies, which are assigned to the appropriate segments in which they operate. Outsell uses all publicly available information and its own insight and research with the companies themselves to size each player in the space. Outsell sizes public companies primarily on their reported results, though it also applies analysis to further segment and align their revenues according to Outsell’s industry segmentation. Outsell uses the best available information on private companies, augmented by its own primary proprietary research, to assess platform characteristics and revenue performance.

This study combines primary on-the-record vendor research and secondary desk research by Outsell and an earnings assessment of the top pure-play alt data brokers, by revenue within the data categories in which they operate. It further includes information derived from Outsell’s daily contact and interviews with these firms’ CEOs, CDOs, CPOs, and CTOs as well as Outsell’s deep knowledge gained from our unique, ongoing market analysis history spanning 25+ years.

Will Jan

___________________________________________________________________________

Market Drivers and Inhibitors

___________________________________________________________________________

Five key market trends serve as catalysts for the developments in this market. Each trend is driven by current opportunities and challenges in financial services. Together, these five trends are prompting alt data brokers to become more specific about the financial firms they serve. Most investment firms are asset-specific, so it is much easier to go deeper into corresponding datasets that serve specific assets than to cast a wide net on datasets that could serve an entire trading or investment community. The result is a highly focused group of market participants whose brokerage-based revenue increased to $538.5 million in 2019, up 9.5% from 2018.

Core Financial Data Is No Longer Enough to Competitively Differentiate. As traditional financial research desktops and core financial data feeds continue to become more pervasive, the competitive differentiation among financial firms in their ability to grow their clients’ money becomes normalized. There is still differentiation through the skills and intuitions of the different traders and investors, but the resources they use to drive their final decisions have been level-set. As such, the need for new or yet-to-be-discovered alt data sets will be the source of new competitive differentiation.

The challenge for alt data brokers is identifying the right datasets to source. Some financial firms will dictate which data they need based on requests from their data scientists and portfolio managers. Others will only dictate the intelligence that they desire while unsure which datasets will offer the necessary insight: This is where alt data brokers have to put in more work to decide which datasets will satisfy client needs.

For example, if a hedge fund is looking to evaluate the foot traffic in and out of a particular retail store, an alt data broker would need to decide if the firm could benefit from foot traffic counter data — which counts every person entering or exiting the store, including non-paying children — or a satellite image of the store parking lot, where each car indicates an adult driver who is likely the spender at the store. Lastly, not all providers of products and/or services are willing to sell their data, so the broker’s job is not always easy.

Yesterday’s Alt Data Is Becoming Today’s Core Financial Data. Using ocean freight information — cargo ship movements and hull depth below sea surface to assess payload — to monitor commodity movements and the import/export activities of countries would have been considered alt data for traders and investors a decade ago. This is now standard on most financial research desktops, with real-time graphical overlays with current financial asset/market movements, so freight information has essentially evolved to be core financial data. Because core financial data is no longer enough to competitively differentiate, the desire for a financial firm to seek out more alt data to create better decisions than its competitors (to attract more clients with the promise of greater returns) elevates.

The challenge here is the increasing customer value-add offered by the major financial desktop research providers. These desktop solutions have evolved from being core financial information providers, to offering asset-specific data feeds, to becoming platform providers of alternative data. They have done all this while enabling AI, machine learning (ML), and natural language processing (NLP) to augment their customer decision-making support. Thus, these financial desktop platforms have effectively become alt data brokers themselves — though possessing a different revenue share model — due to their customers already paying hefty desktop licensing fees looking for alt data to be part of the benefit.

Compliance to Keep Alt Data Use from Going Out of Control. The use of alt data continues to be loosely regulated. Despite data protection regulations like the EU’s GDPR and other global privacy acts, consumer information remains a key source of alt data (e.g., social sentiments, consumer transactions, and consumer statistics). Even if such data is anonymized and taken in aggregate, the degree to which it can be used for investment or trading decisions is still being debated.

Alt data brokers will be challenged by regulators tightening legislation around data sourcing, reuse, and monetization. For two decades, securities regulators have focused on global derivatives of the Regulation Fair Disclosure, also commonly referred to as Regulation FD or Reg FD, which was promulgated by the US Securities and Exchange Commission (SEC). The rule mandates that all publicly traded companies must disclose material information to all investors at the same time. In the data economy, the regulatory focus is now on the type of data being disclosed. GDPR and other global privacy acts represent just the tip of the iceberg in posing this challenge to all data brokers.

The Use of AI, ML, NLP, and Predictive Analytics Is Growing Due to Alt Data Availability. While the volume of core financial news, information, and data is steadily growing, the volume of alternative data is growing even faster. The increases in total information and the pace of its generation and delivery are prompting financial firms to seek help from machines. Today’s data identification, sourcing, aggregation, and analysis in support of investment research are at the limits of human capability, which is becoming a key catalyst for AI, ML, and NLP in investment and trading support, creating the basis for investment discovery.

The challenge for alt data brokers remains data cleanliness and formatting for proper machine and/or financial workflow consumption. The greater the spectrum of alt data being sourced, the greater the likelihood of alt data brokers having to deal with a plethora of content that is inaccurate, false, or in a format that cannot be fed into available analytics platforms, including existing research desktops.

Alt Data Use Is Prompting Demand for Data Scientists. Generating signals to create effective trading or investment strategies requires being able to identify relationships (associations, correlations, and causations) among data sets. These data clusters now combine core financial data with alt data, which makes traditional core data analytics less useful. The need for more complex analytics has prompted a desire for data scientists among financial institutions.

The challenge for alt data brokers is onboarding qualified data scientists, the most renowned of whom have already been contracted or staffed by the biggest names in quant-driven hedge funds. This leaves many people who are self-proclaimed data scientists and really essentially glorified database administrators.

Next: Market Size and Market Share

eco-Umfrage

Vertrauen in Datensicherheit

bei Online-Banking am größten

Insgesamt haben Deutsche wenig Vertrauen in die Datensicherheit auf Online-Plattformen. Trotzdem übernehmen die Nutzer noch zu wenig Eigenverantwortung durch eigene Sicherheitsmaßnahmen. Das höchste Vertrauen mit rund 60 Prozent attestieren die Befragten mit Abstand Onlinebanking-Anbietern.

Den Online-Services des Staates wie beispielsweise dem Online-Ausweis traut lediglich gut jeder Vierte (26 Prozent) zu, verantwortungsvoll mit den eigenen Daten umzugehen. Das ergab eine repräsentative Meinungsumfrage des Markt- und Meinungsforschungsinstituts Civey im Auftrag des eco – Verbands der Internetwirtschaft e. V.

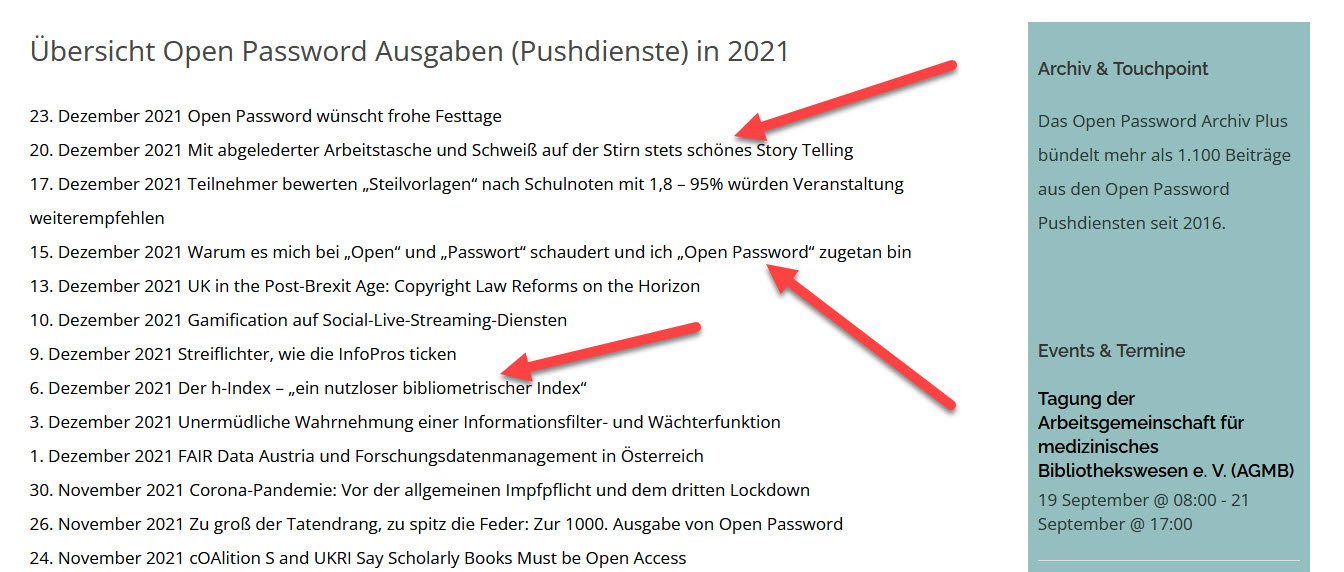

Siehe Abbildung.

Forschungsdatenmanagement

Wie „verantwortliche“ Forschung bei guter wissenschaftlicher Praxis gelingen kann

Von Annette Strauch, UB Hildesheim

Die ONLINE Veranstaltung „Digital Summer School 2020“ zum Forschungsdatenmanagement der Stiftung Universität Hildesheim richtete sich an die Forscher aller Fachbereiche und Institute der Stiftung Universität Hildesheim. Über 150 interessierte Forschende sowie Personen aus der FDM-Community (Bibliotheken, Rechenzentren, Datenschutzbeauftragte, usw.) nahmen via BigBlueButton daran teil.

Wie können wir die Nutzbarkeit von Forschungsdaten verbessern, um die Wissenschaft nachhaltig voranzubringen? ‘Good Practices’ und ‘Lessons Learned’ aus dem KIT wurden vorgestellt. Während die Nationale Forschungsdateninfrastruktur (NFDI) aufgebaut wird, damit Forschungsdaten wissenschaftlich breit nutzbare Datenschätze mit gesellschaftlichem Mehrwert werden können, arbeiten die Konsortien an der fachspezifischen Pflege zentraler Daten- und Wissensbestände ( Normdaten, Taxonomien oder Thesauri) und ihrer Homogenisierung zur Anbindung an Daten zentraler Repositorien.

Dr. Claudia Kramer, Karlsruher Institut für Technologie, berichtete in “Research Data Management am KIT” wie ein Team aus IT-Spezialisten, Bibliothekaren, Wissenschaftlern und anderen Fachleuten im Serviceteam RDM zusammenarbeiten und Forschende in allen Stufen des Forschungsprozesses beim FAIRen Datenmanagement unterstützen. Zu den Angeboten zählen das Tool Research Data Management Organizer RDMO, das Verzeichnis für Repositorien re3data und die Informationsplattform forschungsdaten.info. Das Serviceteam ist neben der Unterstützung lokaler Projekte am KIT auch Partner beim Aufbau von Strukturen des FDM im Land (E-Science-Initiative, bundesweit (NFDI) und EOSC im globalen Kontext. Dabei geht es immer um die Entwicklung von ‚Uses Cases‘ und Etablierung von Best-Practice-Beispielen, wie „verantwortliche“ Forschung im Kontext der guten wissenschaftlichen Praxis gelingen kann.

Jens Kloppmann und Charlotte Kastner stellten ‚easydb‘ vor. Die Software ist ein flexibles Web-Framework, um beliebige Objekt-, Metadaten- und Medienrepositorien aufzubauen und Forschungsdaten zu verwalten. ‚easydb‘ wird an vielen Universitätsbibliotheken als zentraler Dienst angeboten, um verschiedene Datenstrukturen in einer oder in mehreren Instanzen abzubilden.

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

Neue Ausgaben von Open Password erscheinen viermal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe