Open Password – Freitag, den 14. Januar 2022

# 1014

Outsell – 2022–2021 – Pandemic – Cleenup – Propriety Data – Removing Walls – Ned May – Dricing by Need – Driving by Strategic Choice – Vaccines – Variants and Waves – Beyond Ambiguity – Informa – Intelligence Division – Academic Division – LSEG – Refinitiv – Merger S&P and IHS Markit – Desk Research and Alternative Data – ProQuest – Clarivate – Wiley – Hindawi – NPD – PE – Dow Jones – Machine Intelligence – IDG – Eqifax – AWS Data Exchange – Snowflake Data Marketplace – UK Research and Innovation – Elisabeth Freeman – University of Cambridge – Octopus – ESG – Bloomberg – NetZero Pathfinder – Google – Facebook – French News Publishers – Twitter – AP – Reuters – Fact-checking Partnerships – Reliability of Information – Regulation – Content Containers – Textbook Market – Componentizing Content – Multiverse – Talent Crisis – Great Resignation – Talent Shortage – Automation – Morningstar – Robotic Content – Deep Mind – Isomophic Labs – Salesforce – Narrative Science – Work-from-Home /Work-from-Anywhere Shift – Ulrich Kämper – Zoom – Technik-Information aus Patenten – DGI-Stammtisch – DGI-Seminare – FIZ Karlsruhe – Forschungsdatenrepository -RADAR – Lokale Implementierung

- Titel

Outsell: 2021 Events and What They Mean for 2022 – From Driving by Need to Driving by Strategy? – ESG as the Latest Golden Child

II.

Ulrich Kämper

Chance für Newcomer mit abgelaufenen Patenten

III.

DGI

Virtueller Stammtisch und Online-Seminare

IV.

FIZ Karlsruhe

Forschungsdatenrepository RADAR als lokale Implementierung verfügbar

Outsell´s January Contribution (1)

2021 Events and What They Mean for 2022

After Corona: Cleenup will Take Many Years and

May Require a New Approach

Short Theses

By Ned May, SVP Analytic Operations

Ned May

- Amid much pandemic-related confusion, we keep waiting for the government to make its moves und wonder when we´ll face evonomic fallout.

- Providers that hunkered down in 2020 now realize that cleenup will take many years and may require a new approach.

- Outsell identified 810 deals across our industry since the start oft he year – a 45% increase over 2020.

- While some companies are putting up walls around their proprietary data, others see equal opportunity in removing walls.

- Knowing how to best identify, source, and channels individuals into our workplaces will remain a critical need.

- Industry providers must make hard choices about focus. For those on the outside looking in, industry alignment means opportunity.

Outsell´s January Contribution (2)

2021 Events and What They Mean for 2022

From Driving by Need to Driving by Strategy?

ESG as the Latest Golden Child

Full Text

By Ned May, SVP Analytic Operations

As 2021 comes to a close, we find ourselves wondering what just happened to the year.

In many ways, it felt like a compressed extension of 2020, the year when all heck broke

loose. Confusion over timelines is our new norm. Has the pandemic really been with us

for nearly two years? And was its impact truly worse this year than last?

Is it really true that vaccines have only been around at any scale for a little over six months? How many variants and waves have we had? Amid this confusion, we keep waiting for the government to make its moves and wonder when we’ll face economic fallout. We keep telling ourselves the very real signs of inflation we see today are simply a mirage.

_____________________________________________________

Key Announcements

_____________________________________________________

With all this in mind, we press on and make sense out of the non-sense so we can keep

Moving Beyond Ambiguity — Outsell’s 2022 meta-theme. At times like this, we find

no better way of understanding our world than looking back across the multitude of

announcements that data and information solutions providers made in 2021 to read the

tea leaves and what they portend. Here are the most important announcements of 2021

and why they matter.

____________________________________________________

The Pandemic’s Fallout Took Hold

_____________________________________________________

Across those information markets most directly impacted by the pandemic — think

travel, events, and retail — the ramifications of COVID-19 began to have long-term

effects. Providers that hunkered down in 2020 to weather the storm now realize that

cleanup will take many years, and the approach necessary might be different than the

one taken under more favorable skies.

We see this in Informa’s announcement that it would spin off properties across its

Informa Intelligence division. The decision to divest that division might have come as a

surprise to some — after all, it was the events business within its B2B Markets division that

bore the brunt of a pandemic-fueled collapse. Yet, if we’ve learned anything from the COVID-19 impact, it’s to stop thinking in straight lines. Needing to sell off some assets to shore up the house, Informa had little choice but to go this route. The margins in its Academic division are simply too strong to let go, and selling B2B Markets without a recovery in events would amount to a fire sale.

The data and information providers making these hard choices must look at their own operating environments and decide if their new focus — driven by need more than

strategic choice — will require additional changes. And for those on the outside looking

in, such realignment creates opportunity. Given the thirst for all things data, we anticipate that some elements of Intelligence will arouse real interest and, likely, some will fall to fierce competitors. Informa is not alone in this. Across our industry, other data and information providers are starting to do the same — opening opportunities for expansion — assuming strategic buyers can afford them at the time.

This leads directly into our next essential area.

_____________________________________________________

The M&A Market Remained White Hot

_____________________________________________________

Outsell identified 810 deals across our industry since the start of the year — a 45%

increase over 2020, a figure with many implications. Acquisitions like LSEG’s purchase

of Refinitiv make us wonder: How big is too big? We’ll be watching to see at what point

these behemoths become too bulky to move and suffer from a lack of agility. Refinitiv,

with a reputation as “the largest FinTech company,” may be hard-pressed to maintain its

ability to innovate. Will other deals of this size be the same? Ultimately, it will come

down to how the firms involved manage the integration.

In parallel, the rationale for these deals is often strong as our industry realigns how it

creates and delivers value. Take, for instance, the merger of S&P and IHS Markit, which points to the opportunity in combining complementary offerings in a way that extends the value of both (in this case, merging the power of desktop research with the wealth of alternative data). We anticipate more of this type of M&A between analytics

platforms and data providers to corner particular markets with unique insights.

Another example of this trend is found in the acquisition of ProQuest by Clarivate, which

positions it as a leading player in the provision of both curated content resources and

enterprise software, so it can serve the entire research value chain from early-stage

research onward. So, too, was Wiley’s acquisition of Hindawi to propel its OA growth.

NPD’s acquisition by PE shows the fierce competition for great data-driven assets and

how rare the dying breed of a founder-led business of significant size is in the market.

Like IDG, JD Power, and a few more before it, most others take the “hare” route, relying

on multiple funding rounds with low or no profits and ridiculous valuations. Perhaps

Bloomberg and Holtzbrinck are the last assets standing. We’ll watch FiscalNote and a

few of the new breed to see whether old-fashioned financials have the last laugh.

_____________________________________________________

Opportunities Abounded for Picking Up Tuck-Ins

_____________________________________________________

Amid the realignment, assets get spun off for both greater focus and to address

regulatory concerns. Given the volume of rollups and combinations underway, this

means a plethora of small spin-offs are happening today, allowing others in the industry

to up their games at a lower cost. For instance, take how Dow Jones has stayed in the

game by picking up key divestitures from S&P and IHS Markit, like OPIS and

PetroChem. We expect similar actions circling in 2022 around Informa’s spin-outs.

_____________________________________________________

The Prominence of All Things Data Continued to Rise

_____________________________________________________

Strategically, Clarivate’s realignment is all about becoming a data business, focusing on

how data is interrogated and put into the workflow through machine intelligence rather

than human research. We also saw this in the moves by B2B Media provider IDG: The

company made a series of moves to put up walls around its proprietary data. The move

signaled that B2B data was not going to be left to ZoomInfo, Bombora, and the other

tech platforms out there. Big media was invested in keeping their data in their own

walled gardens and, as such, this was the biggest announcement in the B2B media

space this year.

Demonstrating that the value of data can be commercialized in many ways, we saw the

likes of Demandbase acquiring InsideView and Demand Matrix to do a data, workflow,

and services rollup to take on D&B and ZoomInfo. The new company’s modular go-to-

market cloud approach creates multiple entry points, so customers don’t have to lock

themselves into a single platform, pay for features they won’t immediately need, or toss

away existing tools and data relationships. In other words, some across the industry see equal opportunity in removing walls. Providers need to look closely at their market dynamics to see which approach — closed or open — will yield the greatest value for their firms.

_____________________________________________________

Partnerships Got Creative

_____________________________________________________

As the pandemic created a host of new needs and market opportunities, we saw arise what might have first appeared as strange bedfellows. Take, for example, Equifax partnering with AWS Data Exchange and Snowflake Data Marketplace to make its unregulated data available in new ways. Why would a well-established provider of data with a long history of serving clients start directly utilizing a generic data marketplace? The firm saw how its data could yield a new level of insight into consumer financial behavior for users — enhancing customer targeting, decision-making, and risk mitigation — and decided it could not get there by itself. Providers across the data and information industry must look for similar arrangements to expose their underlying data assets in new and unique ways.

_____________________________________________________

The Government Found Itself Funding ReInvention

_____________________________________________________

When the government thinks a sector need be reinvented, we have reached a low point,

yet we saw this occur multiple times. For instance, consider the announcement that the

British government research funding body UK Research and Innovation (UKRI) had

awarded a grant of £650,000 to Dr. Elizabeth Freeman at the University of Cambridge

to develop Octopus, a system for publishing research articles as a searchable record of

academic results. The commercial sector is seen by many as inadequate to the challenges of technology or communication, and markets are increasingly taking direction from non-commercial participants. This is happening in sectors like standards as well.

_____________________________________________________

ESG Became the Latest Golden Child

_____________________________________________________

If prior years were about making bold statements about what was being done in AI or, to

a lesser degree, blockchain, ESG became the new number one marketing hype in

2021. Fortunately for the earth, some of this hype was real.

An example was Bloomberg’s move to spearhead net zero in financial services.

Bloomberg launched its NetZero Pathfinders platform to help companies play their part

in supporting climate change. This was a major step in advancing ESG solutions

beyond reporting on the corporate impacts on the environment and toward how

companies can save it.

We saw other providers boost ESG capabilities as well; the ones that do this in

meaningful ways will benefit in the coming years. Meanwhile, for those of us watching,

we expect the ability to discern true advancements within ESG to be a bit more

challenging near term as the hype continues to rise and the market experiences an

inevitable shake-out.

_____________________________________________________

Big Tech Came in from the Cold (Sort Of)

_____________________________________________________

Google and Facebook’s copyright deal with French news publishers to pay for their news content perhaps signaled a change among the big tech firms. Could this be the start of a new direction, where aggregators pay publishers for reusing their content online? Can we expect other countries to follow?

For its part, Twitter partnered with AP and Reuters to address misinformation on its

platform. Fact-checking partnerships such as this is also critically important, as this

helps improve the reliability of the information consumed by millions of users daily. Yet,

in the grand scheme of things, these moves remain minor ones for a group of

companies that have brought many advances but also wreaked havoc in a myriad of

ways. Is this a sign of change or a small token to appease? We worry that it’s the latter

unless outside pressures remain, and we continue to believe that regulation has a place

with these behemoths.

_____________________________________________________

The Death of Content Containers Continued to Spread

_____________________________________________________

Long under pressure, the idea that content containers could withstand digital

transformation continued to break down, even in those markets that had been relatively

immune. We saw this in the education market, with Argos Education’s new Sojourner

platform acting as a marketplace, providing the opportunity for any provider of

educational learning objects to sell these resources on an object-by-object basis. This

moves the textbook market into a position much like the journals market in that journals

and textbooks are breaking down as containers, with real value coming from individual

articles and data (for journals) and from learning objects (for textbooks).

Componentizing content remains an imperative.

_____________________________________________________

A Crisis in Talent Spurred New Approaches

_____________________________________________________

In early 2021, Multiverse raised a $44 million Series B round (the largest venture round

ever for a UK EdTech company) and followed that up later in the year with a $130

million Series C round. The funding highlights the burgeoning opportunity to solve the talent crisis in new ways. Knowing how to best identify, source, and channel individuals into our workplaces will remain a critical need in the coming year as the pandemic-fueled Great Resignation continues to impact the industry. We expect to see startups emerge that solve this talent shortage in novel ways. In the interim, we expect greater reliance on acqui-hires: M&A driven solely by the desire to bring in talented teams.

_____________________________________________________

And the Bots Kept Marching On…

_____________________________________________________

One relief point for the talent crisis is the automation that’s well underway. Take, for

example, Morningstar’s deployment of bots to create fund research. Morningstar has

been using robots to create analyst ratings on thousands of small funds; now the

financial information provider is scaling up its robotic content authoring to create actual

fund research.

Or consider Google’s spin-off of DeepMind into a standalone company: Isomorphic

Labs. Deep Mind made the news in 2020 with its powerful AI-driven technology for

protein folding, which is already impacting research techniques and practices in the life

sciences. Perhaps most ambitious was the Salesforce acquisition of Narrative Science,

an automated authoring platform that will be bundled with its data visualization tool

Tableau. The stated rationale was to drive AI-generated insights; we wonder how long

it’ll be before these bots start to close sales.

_____________________________________________________

Implications for 2022

_____________________________________________________

With all these changes, we don’t expect the pace of activity to slow in 2022. Amid the

accelerated pace of digital transformation caused by the pandemic, 2021 saw dramatic

changes that will only fuel more of the same. The great work-from-home / work-from-

anywhere shift continues to drive changes in how we organize, produce, and monetize. The

talent crisis continues to grow as wealth levels rise and tolerances shrink — and this will likely drive a greater portion of the workforce out for good. And those changing mindsets are elevating ESG to higher focus.

When will M&A cool? We doubt it will be next year. With trillions of dollars in dry powder

still out there, we only anticipate the market froth accelerating in 2022. It simply has to

get spent (er, “invested”) even if rational models seem in lower supply. But if interest

rates rise — and they likely will — we’ll see companies overextended where the silly

money was in play.

Which brings us to the one item we are certain about: We love the work we do in

supporting all of you. Here’s to a joyful, healthy, and prosperous 2022!

Ulrich Kämper

Chance für Newcomer

mit abgelaufenen Patenten

Sehr geehrter Herr Bredemeier,

Zur Erinnerung, am kommenden Dienstag 18.01. um 11:00 findet mein nächster Zoom-Vortrag „Technik-Information aus Patenten – kostenlose Recherchen in amtlichen Patentdatenbanken“ statt.

Gelegentlich wird als Gegenargument für Technik-Information aus abgelaufenen Patenten das Alter der Information vorgetragen. Es gibt aber viele Beispiele dafür, dass Erfindungen nur deshalb nicht zum Tragen kamen, weil die verfügbaren Materialien nicht den Anforderungen entsprachen. Oft war auch der Markt nicht reif.

In vielen dieser Fälle haben Newcomer Technologien in abgelaufenen Patenten entdeckt und weiterentwickelt. De facto laufen Patente übrigens im Durchschnitt bereits nach 12-13 Jahren ab.

Ignorieren Sie die Gebührenangabe, der 30-minütige Vortrag ist für Sie kostenfrei. Angemeldete Teilnehmer erhalten den Zugangs-Link und die Meeting-ID am Vortag per E-mail.

Schöne Grüße

Dipl.-Chem. Ulrich Kämper

Zum Event: https://www.xing.com/events/technik-information-patenten-kostenlose-recherche-amtlichen-patentdatenbanken-3678777?cce=em61f5ab16.%3AbX7Zw9a8a139jXC9_rgvAD

DGI

- Februar 2022, online, ab 18:00 Uhr

Wir laden Sie ganz herzlich zu unserem virtuellen DGI-Stammtisch ein – wie gewohnt am zweiten Dienstag im Monat. Die Themen sind wie immer breit gestreut – rund um Informationswissenschaft, -praxis und -politik, Alternative Facts, Wissensmanagement, Internet, Suchmaschinen und vieles mehr – da wird uns so schnell nicht langweilig werden. Weitere Auskünfte und Reservierungen erfolgen bitte unter borchardt@dgi-info.de. Wir freuen uns auf Sie und eine gelungene Fortsetzung des DGI-Stammtisches!

Februar und März

- Februar, 9:30 – 13:00 Schreibwerkstatt universal – Von der Idee zum Medium

- Februar, 9:30 – 13:00 Schreibwerkstatt – Websites: Ein- und Aufstieg beim Texten

22.+ 23. Februar, 9:30 – 13:00 Kommunikation für Information Professionals

- Februar, 9:30 – 13:00 Rhetorik und Präsentationstechniken

- Februar, 9:30 – 14:30 DSVGO – Datenschutz in der Praxis

1.+ 2. März, 9:30 – 13:00 Metadaten gegen das Informationschaos

- März, 9:30 – 13:00 Klassifikationen, Thesauri, Taxonomien und Ontologien

- März, 8:00 – 17:00 Dokumentenmanagement

- März, 9:30 – 13:00 Schreibwerkstatt – Blogs

- März, 9:30 – 13:00 Schreibwerkstatt – Facebook

- März, 9:30 – 13:00 Schreibwerkstatt – Instagram

- März, 9:30 – 13:00 Schreibwerkstatt – Storytelling

- März, 9:30 – 13:00 Schreibwerkstatt – Essays

- März, 9:30 – 13:00 Social Media und Recherche – Einführung

FIZ Karlsruhe

Forschungsdatenrepository RADAR

als lokale Implementierung verfügbar

Bibliotheken und Rechenzentren an Universitäten und Forschungseinrichtungen unterstützen Wissenschaftler entlang des gesamten, zunehmend digitalen Forschungszyklus. Sie gestalten den digitalen Wandel an ihren Institutionen mit und stellen dafür notwendige Infrastrukturdienste bereit. Institutionelle Forschungsdatenrepositorys sind ein zunehmend wichtiger Baustein, um Forschungsdaten der eigenen Einrichtung effektiv zu verwalten und um sie transparent und nachhaltig öffentlich verfügbar zu machen. Dafür stehen vielfältige Lösungen zur Auswahl. Sie reichen von der Eigenentwicklung eines Repositorys bis hin zum Betrieb in der Cloud durch einen externen Dienstleister.

Die Universität Konstanz mit ihrem Kommunikations-, Informations-, und Medienzentrum (KIM) hat sich für die Repository-Lösung RADAR Local entschieden. Hierbei übernimmt FIZ Karlsruhe – Leibniz-Institut für Informationsinfrastruktur den technischen Betrieb der etablierten Repository-Software RADAR auf der IT-Infrastruktur der Exzellenzuniversität. Das Repository steht den Konstanzer Wissenschaftlern für die Publikation ihrer Forschungsdaten seit Dezember 2021 unter dem Namen „KonDATA“ unter lokaler Domain und mit eigener Startseite im Design der Universität zur Verfügung.

Maßgeblich für die Entscheidung des KIM waren die generische Einsetzbarkeit der RADAR-Software, ihre Benutzungsfreundlichkeit, die weitgehende Barrierefreiheit und die flexible Anpassbarkeit des Repository-Dienstes an lokale Vorgaben. Von besonderer Bedeutung ist der Aspekt der Nachhaltigkeit. Neben dem Betrieb der lokalen RADAR-Instanz durch FIZ Karlsruhe sind auch die Softwarepflege und deren funktionale Weiterentwicklung durch das Leibniz-Institut gesichert.

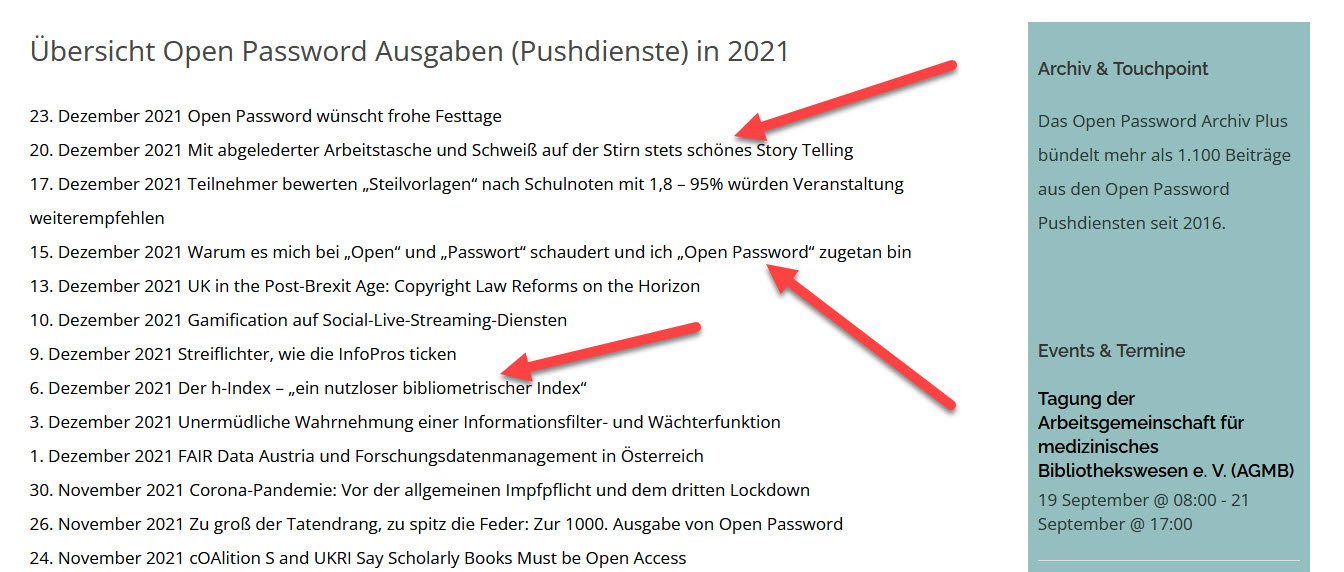

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

Neue Ausgaben von Open Password erscheinen dreimal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe