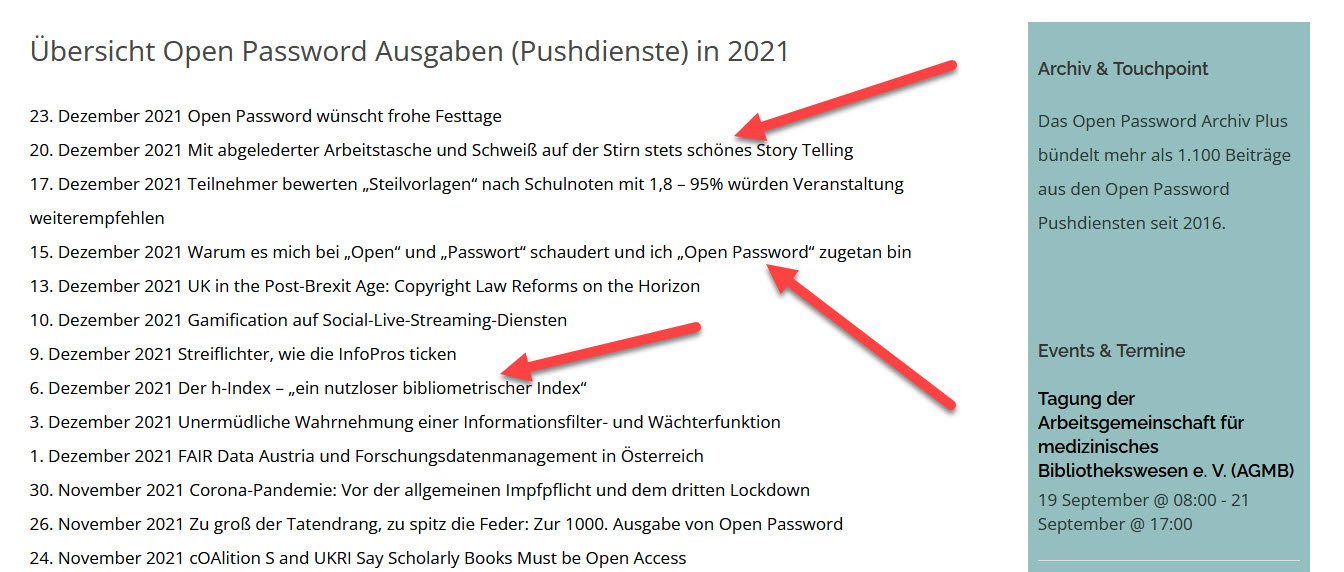

Open Password – Donnerstag,

den 15. August 2019

# 610

Anthea Stratigos – Facebook – Privacy – Data Security – EU – Google vs. Oracle – APIs – Harvard Law School – Open Access – Elsevier – University of California – Plan S – Salesforce – Google – Publicis – Accenture – Dun & Bradstreet – Discover.org – Slack – vLex – Justis Publishing – IHS Markets – Informa Tech – Dow Jones – Education – Trade War – Transparency – Information Services – WattTime – Satellite Imagery – Belt and Road Initiative – China – Paris Accord – LexisNexis – Consent – GDPR – International Regulation – FTC – Amazon – Apple – Equifax – Russian Meddling – – BITKOM – Podcasts – UNIQA Ventures – Elevator Ventures Beteiligungs GmbH – Kampany – Web of Science – Emerald Publishing – Deep Green Initiative – Open Access – Snapchat – Bloomberg Government – Google – Frauen-Websites

A Comprehensive View of First Half Events

in the International Arena

In this World of Transparency and Fines

Things can Still Go too Far

Information Providers and Services

Under Attack

Missing: International Regulation

By Anthea Stratigos, CEO Outsell, the international Partner of Open Password

With regulators looming, and government bravado and feather-fluffing as the backdrop, structural change continues apace.

______________________________________________________________________

Important Details

______________________________________________________________________

Three times a year, we take stock of the big picture for executives and investors operating in our industry. This, our mid-year analysis, establishes the tone for the remainder of the year. A couple of key items rose to the top in the first half of 2019, and they paint a picture of more change on the horizon.

Digital giant regulatory clouds are forming over big tech. Facebook just got threatened with a $5 billion fine, and Google and Amazon are also in the crosshairs. Privacy and data security are traveling beyond GDPR and the EU, migrating into China and California. Equifax also began settling its major breach. People are saying enough: Privacy and security have gone mainstream as regulators outside the EU finally wake up.

A perfect storm for open access and open source data is gathering. The EU adopted a complex new copyright law, and clear signs are pointing to a perfect storm of drivers coming together for open access and open source data. Legislation, again from the EU, is pointing to more access to public data. A pending US Supreme Court case, Google vs. Oracle, could determine whether APIs are open source or subject to copyright; a case on whether annotated state laws can be copyrighted is also underway.

Universities continue to push for access; for example, Harvard Law School is opening up free access to every reported case in the US going back to the 17th century. We see governments increasingly supporting open access, which is a shift from the widely held view over the last 20 years that getting involved with information and data interferes with the private sector. This is not so much the case anymore, as privacy and security offenses have become flagrant, and publishers are seemingly missing every opportunity to improve market education and awareness.

Ongoing structural change continues. If the developments above weren’t enough, one only need look at the evidence of continued structural change underway. Here are a few first-half announcements that drive that point home:

- Elsevier ended negotiations with the University of California in February in a “take no prisoners” approach to 2019 article access. UC joined the ranks of German and Swedish universities that remain cut off from the latest content as negotiations also failed there. Consortia in Norway and Hungary managed to reach deals that may spell a new chapter for open access. In total, the rancor is what we find problematic: Getting into public squabbles with large customers is not great for business or brand. Meanwhile, in response to feedback from researchers and publishers, the deadline for Plan S moved by one year to January 2021. We need sustainable compromise and a focus on the advancement of science. Otherwise, embedded interests of many existing stakeholders will eventually break and go by the wayside.

- Salesforce dropped $15.7 billion on Tableau, showing the continued importance of enterprise software plays to add ever more functionality as they compete with one another. This plays out while future consolidation in marketing and sales stacks unfolds, driven by vendor, agency, and consulting company movements. Google bought Looker for $2.6 billion, and Publicis dropped $4.4 billion on Epsilon to buy a data business. Accenture spent $475 million on creative specialist Droga5 and bought US data intelligence firm Knowledgent. Dun & Bradstreet bought Lattice Engines while DiscoverOrg acquired ZoomInfo.

- Slack went public. The non-traditional route to market that skipped the iBank model was interesting enough on its own. (As was the Clarivate Analytics deal, reflecting a unique route to market. Public markets have not been kind to information companies of late, with the constant yin and yang of public and private equity.) Yet the success of Slack’s non-traditional listing leads us to pay close attention to the future of email. Email has been particularly enduring for all the right reasons, but Slack may be the metaphor for the way content delivery, consumption, and organization shift.

- vLex acquired Justis Publishing. This is a great example of a small, nimble startup building a platform that is now able to ingest content at the rate of larger incumbents. It is a model that others in the information industry need to watch carefully, as open access continues to gain momentum with the help of government support and new regulations around public data, placing the value increasingly on tools rather than content and data itself.

- IHS Market and Informa Tech swapped assets as they work on the age-old challenge of finding the best way to run a multi-format information business. Informa, like most others, has opted for divisions based on formats. Now Informa Tech, a very bold experiment, will demonstrate whether a business with more than $200 million in revenue can find theoretical synergies among its different tech businesses and turn it into a boost to revenue and profit.

- D&B and Dow Jones partnered to join forces and better play to each company’s strengths regarding third-party risk data solutions. This is a testimony to the importance of partnerships and how best to bring respective achievements to solve problems that are not core to either firm. Our prediction for these two entities is that they will one day merge. In some senses, they are natural fits for one another; with one public and the other now PE-owned, there will be an exit someday, and partnerships could lay the groundwork. We’ll see.

Big companies are taking the lead in education. In the education environment, big companies took matters into their own hands, fed up with the lack of progress or outright dysfunction in the institutional category. White Hat Education and School 42 continue to make news, and change is also visible in the corporate learning space as large employers such as Google and Amazon become educators themselves. Amazon’s recent decision to expand its own postsecondary training and credential programs, largely outside traditional higher education, is a warning shot across the bow for colleges and universities.

______________________________________________________________________

Why This Matters

______________________________________________________________________

We have a new UK prime minister and the rancor of another US presidential election looming, alongside trade disputes seemingly everywhere. While all this goes on, transparency in general, the true north of information services at their best, continues to gain steam. It’s ironic that information services in so many sectors are under attack while so many are oriented toward doing good. Information services shed light on that which is otherwise closed, and there are signs of good news that encourage us.

There is more pressure on companies to share where their sources are, what they are doing with data, and how they are contributing to global warming, reducing emissions, or tracking the supply chain. Consumers and the companies across the supply chain that serve them (such as Walmart) want to know where food is coming from, and companies (such as IBM) are offering more solutions to increase transparency.

In energy, at the beginning of May, the non-profit WattTime announced that it intends to use satellite imagery to track air pollution, including carbon emissions, from every power plant in the world — and to make the information public.

China’s Belt and Road Initiative (BRI) already has over 1,400 projects underway, ranging from building new transportation infrastructure to enhancing commerce, prompting a swath of new market participants that need to be validated. Separately, US companies are frantically looking to shift their suppliers out of China as a result of the trade war that is further driving the need for improved supplier visibility. In other areas, the Paris Accord is prompting companies to reevaluate their business practices in the context of climate impact. Together, these events are bringing about the need for better information visibility about companies, persons, and entities.

Sometimes, when the carrot doesn’t work, the stick just might, as indicated by Google’s $50 million breach of GDPR, the Weather Channel app lawsuit earlier this year, and, of course, the $5 billion fine just levied against Facebook. However, even in this world of transparency and fines, things can still go too far. Facial recognition without consent is an example of something that is out of bounds, as is Lexis Nexis expanding its platform through the addition of death because it sparks certain purchase patterns (by those left living).

Information, like technology and the internet, can be used for good or evil. In large part, over the past 20 plus years of serving this industry, nearly everything we’ve seen has been mission-driven and good for both business and those being served. The climate is changing, however, literally and figuratively, and people want to know where their food comes from, the quality of their air and water, and the status of those they invest in. They are waking up, thanks to fake news, big fines, and literal data theft, to understanding that the information they consume can be just as lethal as bad water or air. Worse, the information product that “they themselves have become” was created without their explicit permission, even though they hit “Consent” on the terms and conditions acceptance bar.

Will information services businesses join together to improve the way they are perceived? Is there such a thing as a global campaign, or will we continue to under-market and under-represent ourselves? Where are our associations? Will Facebook’s $5 billion fine stick? Will the US, in an age of nationalistic introspection, continue to let California and the EU regulate its largest, fastest-growing, and newest category — tech? GDPR has been globally applied, yet we have a proliferation of policy and no global coordination about the flows of information that are so necessary.

Widespread reports in early June indicated that the Justice Department and FTC have divided up responsibility for potential anti-trust probes, with Justice leading on Google and Apple, and the FTC tackling Facebook and Amazon, leading to combined falls of more $130 billion in the four stocks. While the prospect of break-up for some or all of them is not nearly as remote as it once was, we see more friction on the horizon, and governments finally waking up to the need for better regulation in this arena. After all, if we’re still regulating broadcast news, for heaven’s sake, why are Amazon, Google, and Facebook (especially) going unfettered?

Indeed, more regulation is on the horizon. Let’s just hope it can be somewhat coordinated. This is the theme that rose to the top this first half, simmering and percolating since the 2016 election. With the Equifax breach, Russian meddling, and general political agita, the world woke up and boiled over, so the regulators have finally begun showing up in spades.

BITKOM

Podcasts immer beliebter –

aber kurz müssen sie sein

News vor Film und Fernsehen

sowie Sport und Comedy

Mehr als ein Viertel (26 Prozent) der Deutschen geben in einer repräsentativen Umfrage von Bitkom an, digitale Radioshows zu hören – im Vergleich zu 2018 eine Steigerung um vier Prozent. Podcasts sind zu einer gewaltigen Medienindustrie gewachsen. „Ob Nachrichten, Krimi oder Beziehungs-Talks – das Podcast-Angebot ist so groß wie nie und wächst beständig“, sagt BITKOM-Experte Sebastian Klöß.

Die beliebtesten Podcast-Themen sind Nachrichten und Politik (45 Prozent) sowie Film und Fernsehen (41 Prozent). Dahinter folgen Sport und Comedy (je 38 Prozent). Ein Drittel hört gerne Musik-Podcasts, weniger beliebt sind Wissenschaft (29 Prozent) und Bildung (28 Prozent).

Sendungen sollten möglichst kurz sein. Für 49 Prozent ist die Ideallänge fünf bis zehn Minuten, für 24 Prozent können es auch zehn bis 15 Minuten sein. Nur sieben Prozent wollen Podcasts hören, die über eine Stunde dauern. 38 Prozent hören Podcasts üblicherweise nicht bis zu deren Ende.

Künstliche Intelligenz, Automatisierung durch Roboter und Blockchain

für „Know Your Customer“.

UNIQA Ventures and Elevator Ventures Beteiligungs GmbH have invested in kompany, the RegTech platform for Global Business Verification and Business KYC, while previous investors, including the European Super Angels Club (ESAC), have increased their stakes. kompany combines Artificial Intelligence (AI), robotic process automation and blockchain technology to deliver next generation Business KYC solutions.

Verlagsübergreifende Transparenz für Peer Review Process. The Web of Science Group has entered into a new partnership with Emerald Publishing, to pilot the industry’s first cross-publisher, scalable and transparent peer review workflow from Publons and ScholarOne across three of Emerald’s leading journals. Transparent peer review shows the complete peer review process from initial review to final decision, and has gained popularity with authors, reviewers and editors alike in recent years.

Deutsche DeepGreen-Initiative tritt in Testphase ein. The DeepGreen initiative in Germany started into an advanced test phase with the publishing partners S. Karger AG, SAGE Publishing, MDPI, Frontiers and De Gruyter, as well as 27 universities from all over German. DeepGreen aims at lowering the barriers for open access publishing by automatically delivering metadata and full text publications from participating publishers to authorized repositories at German universities.

Nach Renaissance von Snapchat eine Milliarde Dollar Investment? Snap said it will raise $1 billion in short-term debt and plans to invest in more media content, augmented reality features, and may also buy other companies. The parent company of the popular disappearing messaging app Snapchat has revived its user growth and stock price after a rough 2018. It introduced mobile gaming within Snapchat and developed its AR features, but faces competition from larger platforms like Facebook and TikTok.

Start von Bloomberg Government: State. Bloomberg Government announced the launch of Bloomberg Government: State, an integrated state-focused news, directory, legislative and regulatory tracking service for government affairs professionals who need to keep on top of developments in all 50 states and Washington, D.C. Bloomberg Government: State features the reporting of a dedicated team of journalists on the ground from coast to coast covering policy areas and proprietary Bloomberg technology that aggregates state and local news from over 35,000 sources.

Google rankt Frauen-Websites niedriger. tn3.de führt dies auf Besonderheiten der deutschen Sprache zurück.

Anzeige

FAQ + Hilfe