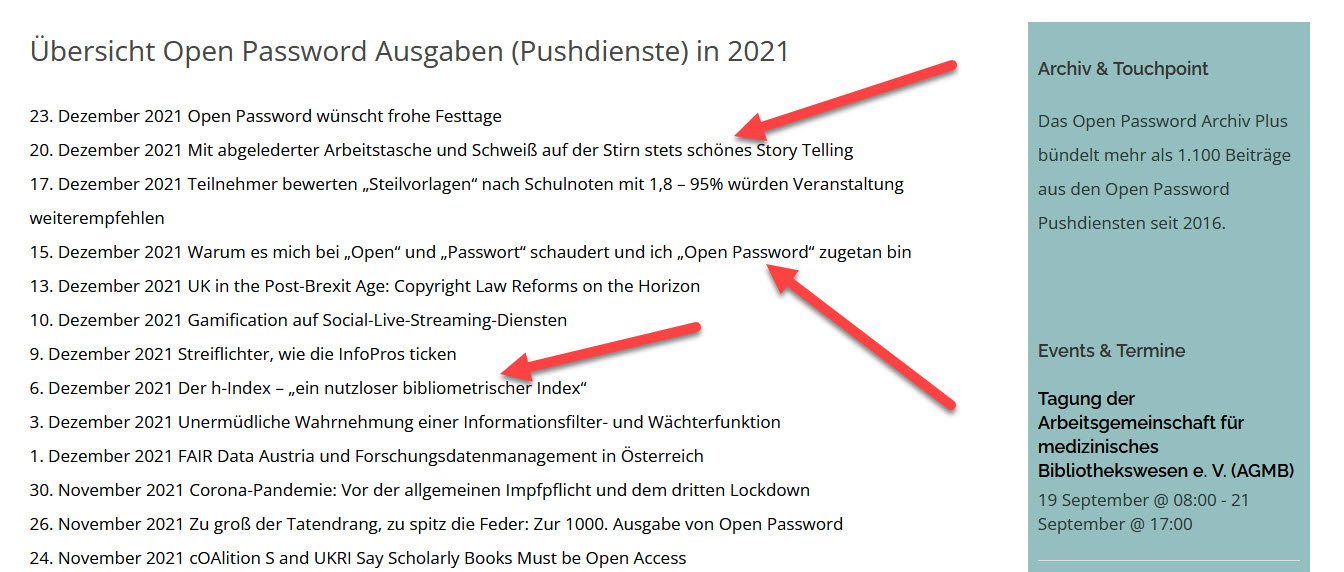

Open Password – Montag, den 11. April 2022

# 1053

Outsell – Herausforderungen aus Kundensicht – Inflation – Talent Hiring and Retention – Return to the Office – Union Action – Rising Fuel Costs – Securing New Business – Larger Customers – Outside Agencies

Outsell – RELX – Thomson Reuters – Wolters Kluwer – Inflation – Russia´s Invasion of Ukraine – COVID-19 – Risk Division – Financial Crime Compliance – TruNarrative – Elsevier – Reuters News – Transition Program – TR Ventures Fund – Vanguard Software – XCM – CGE Risk Management – Print Publications and Events – Westlaw Edge 2.0 – HighQ – Financial Compliance Solutions – Financial Sanctions Against Russia – Atul Dubey – Provide Quick Updates in a Fast Changing World – Reassess Startup Valuations – Investors – Disruption

Science of Synthesis – Thieme – Mareike Bauner – Jan Dehmelt – Tag der Bibliotheken in Berlin und Brandenburg – Ramin Yahyapour – GWGD – Annette Strauch-Davey

I.

Outsell (1):

Die wichtigsten Herausforderungen aus Sicht der Kunden: Inflation, Return to the Office, Fuel Costs

II.

Outsell (2):

RELX, Thomson Reuters, and Wolters Kluwer Post Full-Year Results – The Information Industry is Largely Bouncing Back – Concerns Over Inflation and Russia´s Invasion of Ukraine – By Hugh Logue, Director & Lead Analyst

III.

Thieme:

Science of Synthesis, Release 4.2

IV.

Tag der Bibliotheken in Berlin und Brandenburg:

Kompetenz und Leidenschaft

V.

Forschungsdatenmanagement Hildesheim:

High Performance Computing

Outsell*

Die wichtigsten Herausforderungen aus Sicht der Kunden: Inflation, Return to the Office, Fuel Costs

(Outsell) A number of societal trends are on our clients’ minds, including inflation, issues with talent hiring and retention, and the return to the office. Some of these are combining to spur union action in the information sector, such as demonstrations and walkouts. Rising fuel costs are also causing some to rethink their back-to-office plans due to the impact on commuting expenses.

Clients are talking to us specifically about securing new business. They are curious about how others approach lead scoring and nurturing services and how to create packages that will be appealing to new customers. They are also working on optimizing their offerings for larger customers that may work with outside agencies and other third parties to execute their marketing programs.

* Outsell ist der internationale Partner von Open Password

Outsell´s April Contribution*

RELX, Thomson Reuters, and Wolters Kluwer

Post Full-Year Results

The Information Industry is Largely Bouncing Back

Concerns Over Inflation

and Russia´s Invasion of Ukraine

By Hugh Logue, Director & Lead Analyst

Hugh Logue

The full-year 2021 results from these three large firms show that the information industry has largely bounced back. However, starting the year coming from a lower base after the pandemic may make this a one-off.

____________________________________________________

What to Know and Why It Matters

____________________________________________________

RELX, Thomson Reuters, and Wolters Kluwer, the three largest publicly listed

diversified data and information providers, recently released their 2021 annual reports. The three providers reported faster-than-expected recovery from the pandemic.

RELX saw its overall revenues increase by 8% to £7.2 billion in constant currencies or 7% without currency adjustment. Adjusted operating profits were £1.9 billion, up 24%. Following COVID-19 restrictions on events that resulted in sharp declines in 2020, RELX’s Exhibitions division’s revenue grew by 55% in 2021 in constant currencies. Beyond Exhibitions, RELX’s Risk division performed well, with 9% growth in revenue. At the other end, its Scientific, Technical & Medical and Legal divisions grew by 4% and 2% respectively in constant currencies, which while lower than the Risk division, were still above the results from recent years.

Overall, RELX is migrating its information solutions towards decision tools with higher

value-add: it is adding broader data sets, embedding more sophisticated analytics, and leveraging more powerful technology. As part of this effort, in 2021, RELX’s Risk

division continued its expansion into financial crime compliance with the acquisition of

TruNarrative, a cloud-based platform that provides financial crime analytics. In RELX’s Scientific, Technical & Medical division, primary research accounts for around half of revenues, and in 2021, Elsevier launched 105 new journals, bringing Elsevier’s total portfolio to over 2,700 journals.

Thomson Reuters’ revenues increased by 5% to $6.3 billion in constant currencies (6% without currency adjustment), driven by 6% growth in recurring revenues, which

comprised 80% of total revenues. However, operating profit decreased 73%, primarily because the prior year included significant gains from the sale of an investment and an amendment to a pension plan. Additionally, higher revenues were more than offset by higher costs. Thomson Reuters’ Legal Professionals division increased revenues by 6% in constant currencies (7% without currency adjustment), and its Tax & Accounting Professionals and Corporates divisions grew by 9% and 5%, respectively, in constant currencies. The Global Print division declined 3% in constant currencies, while Reuters News grew by 7%.

Thomson Reuters is in the middle of a two-year transition program to change from a

holding company into an operating company and from a content provider into a content-driven technology company. In 2021, this included $217 million in run-rate operating expense savings, which exceeded its $200 million in planned savings. Thomson Reuters made no acquisitions in 2021 but launched TR Ventures Fund, which plans to invest up to $100 million in investments to support companies that are building innovations for professionals.

Wolters Kluwer saw its overall revenues increase by 6% to €4.8 billion in constant

currencies (4% without currency adjustment). Recurring revenues (80% of total

revenues) were up 6% and non-recurring were also up 6%. Digital and services

revenues grew 7%, while expert solutions grew 6% organically. Adjusted operating

profits were €1.2 billion, up 11% in constant currencies. Wolters Kluwer’s Health division grew by 7% in constant currencies, Tax & Accounting grew 7%, and Governance, Risk & Compliance went up 10%, while Legal & Regulatory declined 1%.

Wolters Kluwer is known among professionals in several markets for its deep vertical

specialist knowledge solutions, and in recent years, it has doubled down on expert

solutions. It has grown its expert solutions from 49% of total revenues in 2018 to 55% of total revenues in 2021, primarily through organic growth. Wolters Kluwer also divested legacy assets that needed investment, such as its legal-information-based businesses in Spain and France. At the same time, it acquired innovative solutions such as its Tax & Accounting division’s acquisitions of Vanguard Software and XCM Solutions and ist Legal & Regulatory division’s acquisition of CGE Risk Management Solutions.

_____________________________________________________

Analyst Rating: Positive

_____________________________________________________

The 2021 performance of RELX, Thomson Reuters, and Wolters Kluwer is a positive

sign, especially when one takes into account the fact that the prior-year comparisons for 2020 include two months of strong pre-pandemic activity. There were fears that the positive first-half results were driven by the release of temporary pent-up demand, but the full-year positive results show a recovery in professional services, and the pre-pandemic investment in cloud-based solutions helped to support customers during the pandemic.

_____________________________________________________

Winners and Losers

_____________________________________________________

These results show the best growth rates RELX, Thomson Reuters, and Wolters Kluwer have seen in over five years. That said, coming off 2020, there was a lower base to grow from, especially after restrictions in the US and Europe were eased for much of 2021. The publicly listed companies are under pressure from investors, as better returns can be achieved elsewhere — such as US and European real estate, which surged in 2021.

Providers that are more reliant on print publications and events, such as Lefebvre

Sarrut, will be the biggest losers compared to those that had invested significantly in

innovation — especially in data analytics, AI, and expertise automation. However, one reason these companies were more reliant on print was their SMB customers’

reluctance to switch to more innovative solutions. In the longer term, the pandemic has driven the change that will make it easier for them to grow.

_____________________________________________________

What’s Next

_____________________________________________________

Thomson Reuters needs to demonstrate that it is on the right path of evolution and able to transform its product roadmap to a holistic offering. As an example, we’ll be paying close attention to its Legal Division, which is planning a major release of Westlaw Edge 2.0 in the second half of 2022. It will be a key moment for Thomson Reuters to demonstrate that it has fully integrated and added value to its acquisition of HighQ in 2019 and plugged gaps in its product portfolio that represent areas served by its smaller competitors.

A significant proportion of RELX’s revenues are linked to direct or indirect spending and actions from governments, for example, spending on courts and justice and scientific research. Outsell will be watching its Scientific, Technical & Medical division closely as countries come out of the worst of the COVID-19 pandemic, likely resulting in budget cuts to scientific and healthcare research. On the other hand, RELX’s Risk division is likely to see increased demand for its financial compliance solutions in 2022 following the introduction of global financial sanctions against Russia.

There is an inconsistent geographic split of Wolters Kluwer’s revenues across its

divisions. For example, 75% of its Health division and 88% of its Governance, Risk &

Compliance revenues come from North America, while only 24% of its Legal &

Regulatory division’s revenues are from that region. Outsell will be watching its Legal & Regulatory division after Wolters Kluwer recently made some divestments in Europe and appointed Atul Dubey to succeed Dean Sonderegger as Head of Legal &

Regulatory US. The divestment of European legal assets will immediately increase the proportion of the Legal division’s overall revenue coming from North America, but the appointment is also significant as Dubey comes to the position from his role as Wolters Kluwer’s overall Chief Strategy Officer, indicating that the company could be preparing for bigger strategic changes to its Legal & Regulatory US division.

_____________________________________________________

Essential Actions

_____________________________________________________

At the end of 2021, most providers expected that 2022 would be the year that they

could finally make new investments, hire new staff, and drive growth in their businesses. However, those expectations were tempered by concerns over inflation and Russia’s invasion of Ukraine. While the ability to deal with huge uncertainty is now an essential skill for business leaders, they still need to protect and grow their businesses and avoid disruption. With this in mind, Outsell recommends the following actions:

Provide Quick Updates in a Fast-Changing World. Information providers need to anticipate areas that are quickly changing, such as displaced workers, supply chain disruption, and sanction compliance, and map these to their customers’ needs in the coming year. As with the pandemic, there will be unexpected knock-on effects in a range of industries, especially those reliant on commodities such as grain, steel, gas, and oil. This will create a need for information, data, and tools to enable companies to make far quicker decisions than usual.

Reassess Startup Valuations. Professional services are going through a major technology shift that was only been accelerated by the pandemic. On the whole, the large players in the market are keeping up with the pace of change, but they are not ahead of it. In this climate, large information providers trying to keep up with the technological pace of change cannot afford to go for over a year without making innovative acquisitions, or they could quite suddenly lose market share to more disruptive players.

The largest players are too afraid of investors’ reactions if they acquire companies at

the high valuations that are now becoming standard. However, large information

providers are not properly considering the risks to their businesses from disruption and losing market share long-term.

*Outsell is the international Partner of Open Password.

Thieme

Science of Synthesis, Release 4.2

Dear Sir,

Science of Synthesis, Thieme’s definitive online resource on reliable synthetic methods in organic chemistry, now provides the international chemistry community with a new reference volume on electrochemistry, a research field currently undergoing a remarkable renaissance. The latest release 4.24 also includes several knowledge updates as well as a revamped page with teaching resources and improved links for viewing and download options.

Best regards, Mareike Bauner und Jan Dehmelt, Thieme Communications, Stuttgart

Tag der Bibliotheken

in Berlin und Brandenburg

Kompetenz und Leidenschaft

Lieber Kollege,

unter dem Motto „Kompetenz und Leidenschaft“ möchten wir Sie herzlich zum

Tag der Bibliotheken in Berlin und Brandenburg einladen:

* Ort: Brandenburg an der Havel, Johanniskirche und Gotisches Haus

* Zeit: 1. Oktober 2022, 10:30 Uhr

Neben einem interessanten Programm besteht die Möglichkeit Erfahrungen zu

teilen, von Kolleg:innen zu lernen, sich zu vernetzen und gemeinsam

einen Ausblick auf Bibliotheken und Informationseinrichtungen nach der

Pandemie zu wagen.

Über das Programm der Eröffnungsveranstaltung sowie der Vorträge und

Workshops informieren wir zeitnah auf

https://bibliotheksverband-brandenburg.de/t3b .

Über Meldungen von Freiwilligen zur Unterstützung am T3B und Anregungen

freuen wir uns.

Mit herzlichen Grüßen

das Organisationsteam

Der Tag der Bibliotheken in Berlin und Brandenburg wird von den regionalen

Verbänden und Arbeitskreisen im Bibliotheks- und Informationswesen

organisiert: Arbeitsgemeinschaft Schulbibliotheken Berlin-Brandenburg – BAK – Berliner Arbeitskreis Information – BIB Berlin – BIB Brandenburg – dbv Berlin – dbv Brandenburg – OPL-Arbeitskreis Berlin-Brandenburg – VDB

Forschungsdatenmanagement Hildesheim

High Performance Computing

Liebe Alle,

in der 7. Veranstaltungsreihe „Coffee Lectures FDM“ im Sommersemester 2022 geht es nach Ostern am 20. April 2022 mit High Performance Computing (HPC) weiter.

Das Hochleistungsrechnen gilt als Schlüsseltechnologie für wissenschaftlichen und technischen Fortschritt, und da außerdem das Speichern von Forschungsdaten immer wichtiger geworden ist, gehört nun HPC natürlich unbedingt als Thema in eine unserer Coffee Lectures zum Forschungsdatenmanagement. 😉 Wir interessieren uns dabei für extrem anspruchsvolle Rechenanwendungen, deren Berechnung wegen Komplexität oder Umfang auf normalen Rechnern nicht mehr umsetzbar sind. Dabei spielen nicht zuletzt auch intelligente Sicherheitskonzepte eine sehr wichtige Rolle.

Die Veranstaltung wird über das Tool BBB übertragen: https://www.uni-hildesheim.de/veranstaltungen/veranstaltungskalender/ oder direkt über diesen Link: https://bbb.uni-hildesheim.de/b/ann-i2r-z5l-fc8

Mittwoch, 20. April 2022 um 12:30 Uhr Thema: High Performance Computing und FDM (Forschungsdatenmanagement) – Referent: Prof. Dr. Ramin Yahyapour (Geschäftsführer der GWGD, IT in der Wissenschaft)

Mit herzlichen Grüßen aus Niedersachsen und bis spätestens am 20.,

Annette Strauch-Davey

Open Password

Forum und Nachrichten

für die Informationsbranche

im deutschsprachigen Raum

Neue Ausgaben von Open Password erscheinen dreimal in der Woche.

Wer den E-Mai-Service kostenfrei abonnieren möchte – bitte unter www.password-online.de eintragen.

Die aktuelle Ausgabe von Open Password ist unmittelbar nach ihrem Erscheinen im Web abzurufen. www.password-online.de/archiv. Das gilt auch für alle früher erschienenen Ausgaben.

International Co-operation Partner:

Outsell (London)

Business Industry Information Association/BIIA (Hongkong)

Anzeige

FAQ + Hilfe